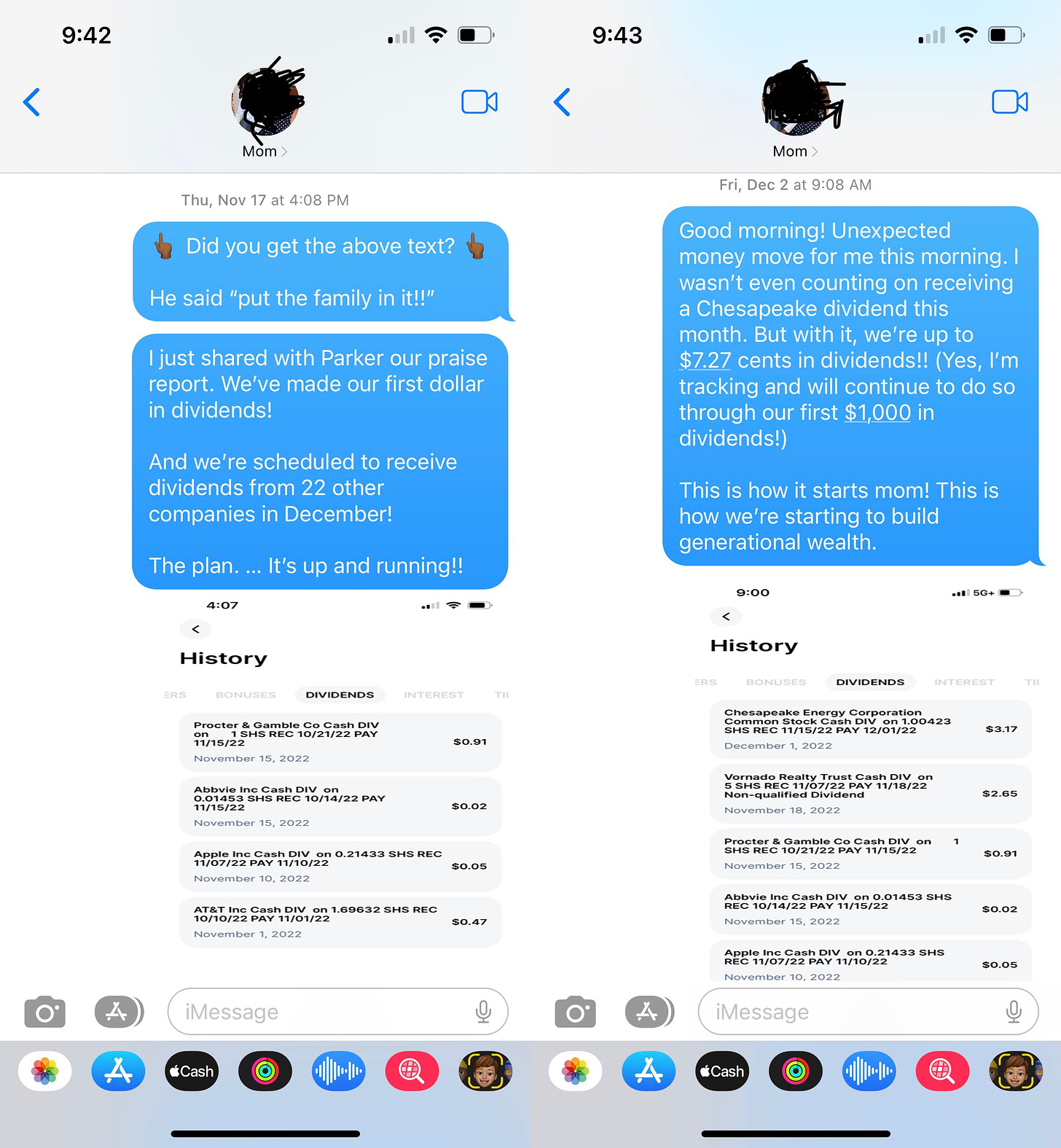

My first dividend was 47 cents.

It came from AT&T, and I received it on Nov. 1, 2022.

As of Wednesday, I’ve collected $299.35 in dividends within my standard brokerage account. Not bad for my first nine months in the stock market.

Parker’s account has amassed $161.94 in dividends. I like that even more.

Before I gained even a basic understanding of the stock market’s capabilities, I could comprehend the concept of dividends. And since successful companies pay a portion of their profits to shareholders, I needed to be in on that action.

My problem was I had no plan in the beginning. Any company that paid a high dividend yield commanded my attention and captured my cash. I didn’t understand the potential risk of investing into a company solely because of a high dividend yield, and I didn’t care. I saw an opportunity to collect free money.

I searched for companies I use, like AT&T, and promptly poured as much money as I could into each when their stock prices seemed reasonable. I started with household names like Apple, Nike, McDonald’s and Walmart. From there, I targeted companies that could be considered recession-proof: Johnson & Johnson, Procter & Gamble and Waste Management.

When my first dividend arrived, I texted my mother a screenshot in excitement. That 47 cents felt like five grand. I was proud of it, and what made the memory sweeter is I didn’t learn of my first dividend landing until a day later — on my birthday. I was sitting on a beach in Jamaica, where my first cruise had docked for the day and I could connect to complimentary Wi-Fi.

“Happy birthday to me!” I texted.

When we made our first dollar from dividends two weeks later, I texted my mother again. And again two days after that when we reached $4.10, and again two weeks after that when we hit $7.27.

“This is how it starts, mom!” I texted. “This is how we’re starting to build generational wealth.”

In those first few months of investing, my stock portfolio contained more than 50 companies. To date, I have received dividends from 34 companies.

I also didn’t grasp that I was spreading my money too thin and, in too many instances, overlapping my investments.

At the rate I was going, it would have taken two lifetimes for my dividends to grow into anything substantial. I’ve settled down since the fall.

A conversation with my brother Clifton in November helped me see clearly. He had read about investing in index funds and understood the growth possibilities the investing approach carried, particularly when held against the potential pitfalls of picking individual stocks. But he had yet to become an investor himself. He patiently listened to my early experiences. He enjoyed learning little by little through my trials and errors.

One day he posed a straightforward question, without criticizing or coming off as condescending. He asked why I don’t just invest in index funds. I answered him with a standard response I’ve said often to him through this first year: “I’m learning.”

But by January, I had come around. I knew then I needed to consolidate. I had grown into a believer of buying and holding a total stock market index fund.

Instead of attempting to collect dividends from almost three dozen companies, I decided to pare down my portfolio and trust VTI, the Vanguard Total Stock Market ETF (exchange-traded fund). I’ve trimmed my holdings to 28 companies. VTI now makes up 30 percent of my portfolio. I still have a handful of stocks I’m waiting to sell so I can fold the money from them into the VTI.

I’m anticipating my second dividend payout from the VTI any day now. The first arrived on March 28 and paid $28.68. The impending payout should be about the same, pushing my total dividends over the $400 mark.

But that gain doesn’t account for all the capital I preserved by starting to invest. Who knows how much money I would have blown had I not stumbled into the stock market?

It also doesn’t reflect how much more value I stand to gain over time as an investor instead of going through life solely as a consumer.

I’m learning.