I’ve looked forward to this day since April 24.

That was the day I purchased my first Treasury bill. It matures today, returning my invested capital with some extra coin on top. That makes it a winning investment.

Back in April, however, I wasn’t sure what I was taking on when I dedicated funds to a T-bill. The method was foreign to me but increasingly intriguing as interest rates climbed. I couldn’t resist trying to take advantage.

By April, I had graduated from a goofball with money and morphed into a more calculated man. I’d grown serious with my spending and intentional about investing. Each one of my dollars required a purpose.

Locking in my first T-bill merely was an extension of that determination. Looking back, I know now the decision was a no-brainer. I can easily say it’s the most worry-free investment I’ve made.

A Treasury bill is a type of fixed-income security, issued as a U.S. government debt obligation backed by the Treasury Department that matures within one year.

When T-bill rates crossed 5% in the spring, I had to consider the vehicle’s potential.

Thanks to last year’s $20,000 windfall, I was armed with supplemental capital. I parked a portion of that cash in the Vanguard S&P 500 ETF, ticker symbol VOO, and operated it as a savings account. Some remains.

But I withdrew $1,000 from that account and directed it to my freedom fund at the start of April. Three weeks later, I made another money move.

I’d become focused on making the most of the money I made and maximizing its ability to multiply itself through shrewd investments. With more cash than I needed — before I committed to growing a healthy freedom fund — an increasingly valuable T-bill seemed like a safe bet.

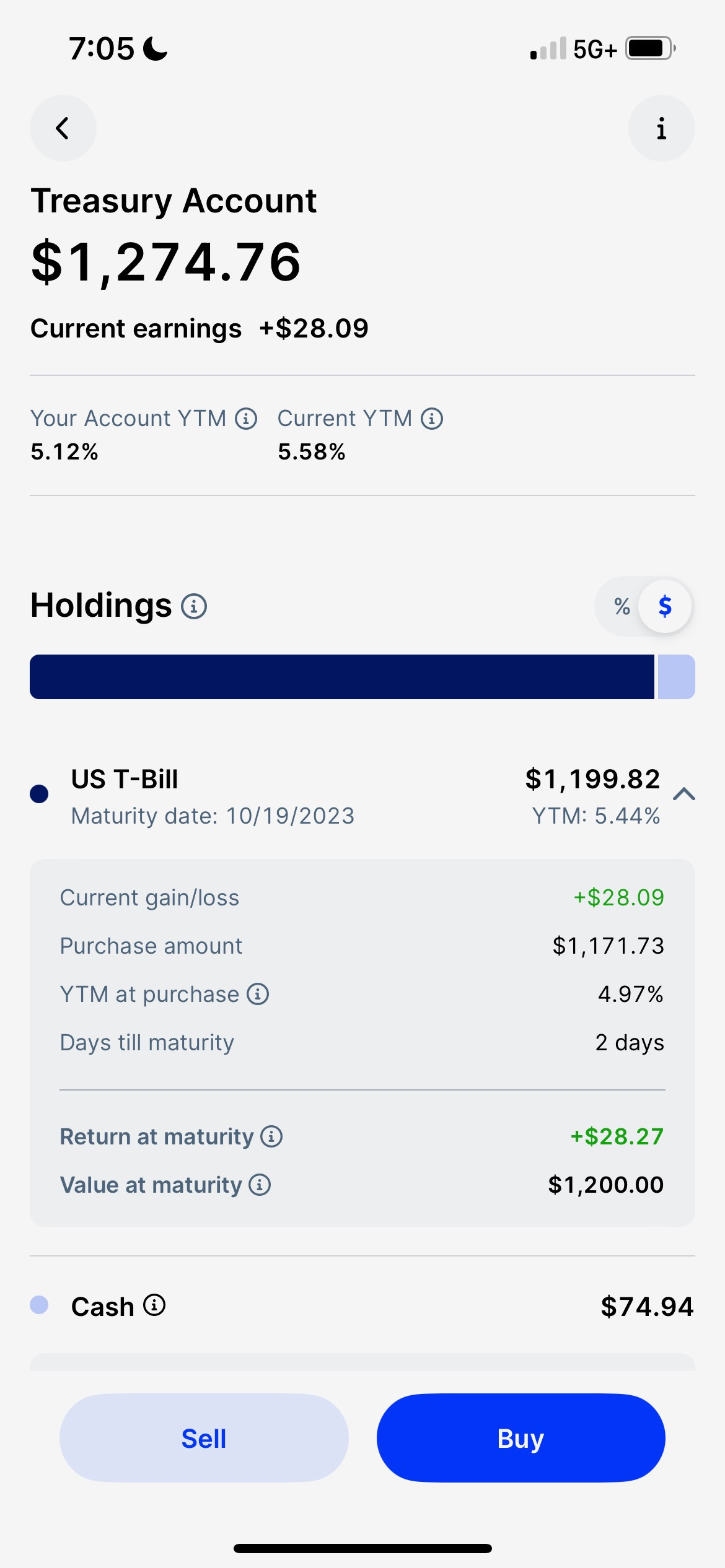

I funneled $1,250 into my brokerage’s treasury account. I’m still trying to figure out why only $1,171.73 was used to secure my T-bill. That means I’ve had $74.94 sitting idly, which doesn’t feel good.

My choice of a 26-week term rather than 52 weeks should tell you how much trepidation still covered me even after embracing the idea. Not only was I unsure about what would happen to my money, but I also didn’t know what would come up and require me to rely on that money. The old me felt like I needed cash accessible just in case. This new version of me is learning to trust my financial processes and outcomes and to shun any semblance of a scarcity mindset.

I locked in a 5.1% rate and knew what the profit would be six months ago. Still, I checked the account daily. I loved seeing our incremental gains. It was a routine reminder that another way wasn’t simply possible but also effective.

Our money generated $28.27 from being invested since the final week of April.

That’s not a bad return. But it wasn’t enough for me to tie up $1,250 for half a year again. It doesn’t take that long to turn $1,250 into $1,278.27.

I can see a scenario where the more discretionary money we have the more T-bills could make sense. Billionaire businessman Warren Buffett prints millions of dollars on a loop with T-bills.

Buffett knows a good bet when he sees one.

Hey Darnell, I've really enjoyed your work. Thought I'd share what I know about T-bills and maybe why your full $1200 wasn't funded. The way T-bills work is that you buy them at a discount, and your return comes via the bill increasing to "par" or the amount paid at maturity, which looks like $1,200 in your case. I hope that makes sense.

I've considered getting into buying individual t bills, but it's so easy to access them in a money market fund like VMFXX or VUSXX that I'm sticking with those. If you use Chase as your brokerage, you can access them with free trades. There are also t bill ETFs to try out like SGOV if not. With either of these options, you take a slight hit in yield, but you gain liquidity.