Parker's first job opens a simple path to wealth

With Money Talks expanding, Parker becomes a paid partner in the family business.

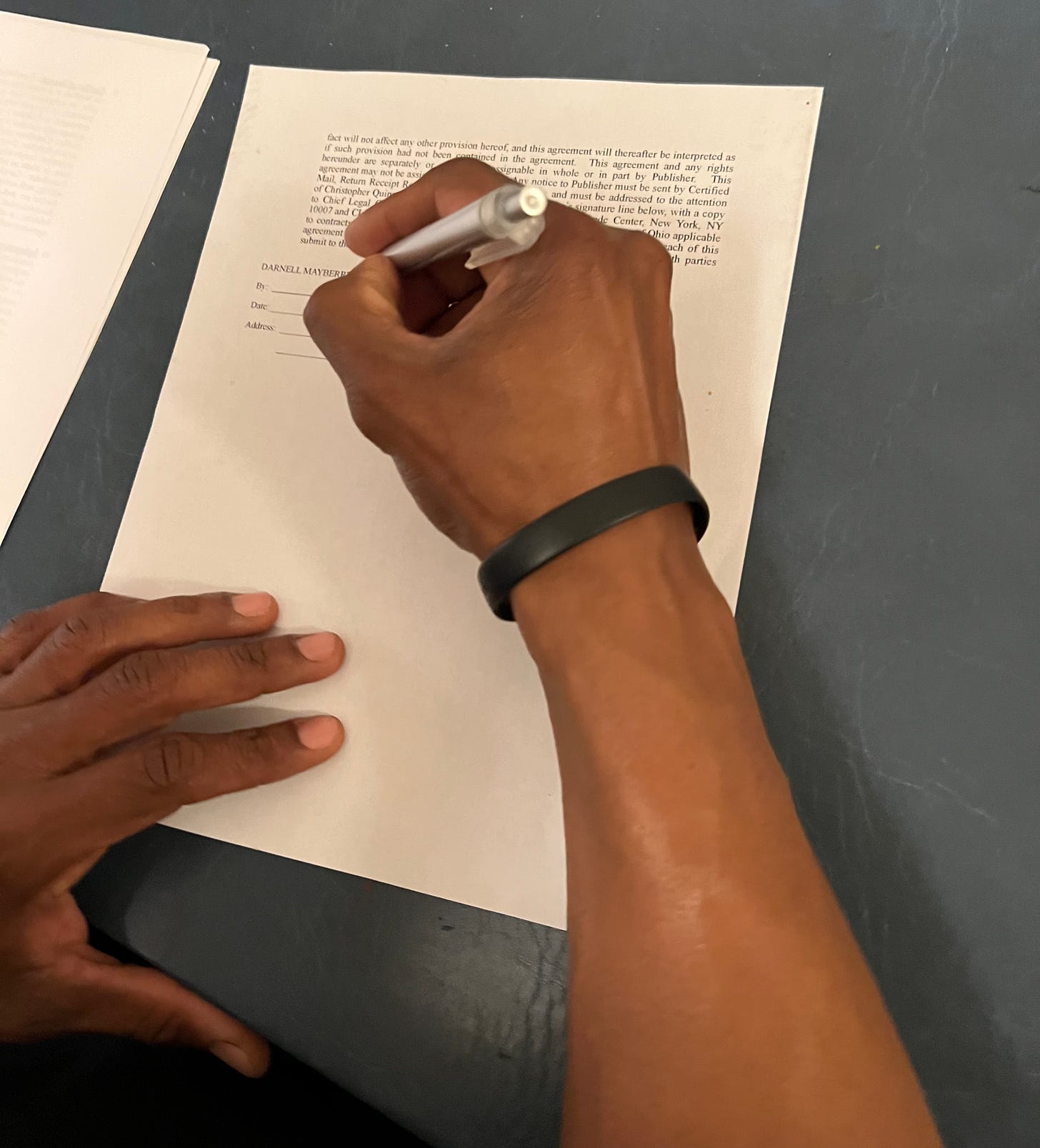

I signed our first contract for Money Talks just before 4:30 p.m. on a Friday. To celebrate, I researched Roth IRA’s for Parker.

It was one of the best Friday nights of my life.

The fully executed contract didn’t arrive until 9:47 a.m. the following Monday. But I needed to be ready, with a plan in place before the checks started coming.

Last week, I told you that our agreement with Advance Ohio to run Money Talks at cleveland.com and in The Plain Dealer is a game-changer. More than anything else, this is why.

It gives Parker her first job.

As a partner at Money Talks, Parker will now be paid for her services just like me. Her responsibilities to the company already are vast and rapidly expanding. Now, she’ll be compensated for her intellectual property, turning her thoughts and time into dollars.

Parker is required to read every word of Money Talks. When she loses focus, she must read a column twice. Often, she asks to hear the audio version after reading. It’s not punishment. It’s practice. She’s learning, growing and, sometimes when I least expect it, contributing.

Parker has helped brainstorm ideas, write headlines, take pictures and, of course, served as my partner and the star of the Money Talks podcast. Soon, she will make her writing debut and take on a larger role in proofreading and editing audio. She has much more in her mind that she can’t wait to share with the world.

My first job was at Pizza Hut. I’m proud Parker is starting in the family business. I hope she understands the value of that and replicates this strategy with her children. Don’t wait 15 or 16 years if you can start at 8 or 9. Don’t build another family’s company for crumbs when you can earn more by bringing value to your own.

Because we are now earning income for Money Talks, Parker qualifies for a Roth IRA. It’s an individual retirement account with tax advantages. Any adult can open and manage a custodial account on behalf of a minor earning income. What makes the Roth IRA great is the account’s earnings grow federally tax-free. Withdrawals also are tax-free after 59 1/2, and after the account is at least five years old for certain qualifying events.

I opened Parker’s account in only a few minutes. But with time on her side, it will help her become set for life. Check out this example of the power of compounding from Investopedia.

“A single $1,000 IRA contribution made at age 10, for example, could grow to $11,467 over 50 years, assuming a conservative 5% average annual growth rate. Contribute $50 each month, and the amount might grow to $137,076 (with the initial $1,000 contribution and the same hypothetical growth rate of 5%). Or you could double the contribution to $100 each month, and the account could reach $262,685.”

We’re starting before Parker’s 10th birthday, adding more than an initial lump sum of $1,000, contributing more than $100 each month and anticipating more than 5 percent average annual growth.

The Roth IRA contribution limit for minors is $6,500, the same as adults 49 and younger. I aim to max out Parker’s Roth IRA just like I’m doing with mine.

With our earnings from each column, I will set aside 15.3% for taxes and split evenly the remaining 84.7% between me and Parker. So Parker’s weekly earnings will be $150. That’s $600 a month, or $7,200 a year. She’s allowed to have fun with the remaining $700, and I won’t even warn her to not spend it all in one place.

I’ll earmark my $150 for fixing my foundation, first building my emergency fund before funneling any funds to investment accounts.

But this expansion gives me breathing room. It’s my first true side hustle. I’m learning to make money in the stock market but have a long way to go. I’ve been a working stiff for one company at a time throughout my professional life. That changes today.

I’m capable of more. And I must show Parker a different way.

Thankfully, we now have a profitable family business.

Disclaimer: The information contained on Money Talks is not intended as, and should not be understood or construed as, financial advice. I am not an attorney, accountant or financial advisor. These are my personal experiences, and neither this website, newsletter nor podcast is a substitute for advice from a qualified professional.

Hey Darnell, congrats to Parker on her first job. Just wanted to make sure that you’re taking advantage of all the tax advantages that come with having employing a child. However, you may have to have an S corp to be able take advantage of this. Here’s an article outlining some of the benefits: https://www.blueandco.com/tax-benefits-of-hiring-children-in-the-family-business/