Parker's first shopping spree

Parker gets her first credit card and proves she knows how to use it.

Our shopping spree started how you might imagine one led by a 9-year-old would — at a candy store appropriately named “It’s Sugar.”

Parker has little interest in clothes. She doesn’t care much about shoes and has no use for makeup and manicures. She craves candy. She can’t say no to sweets. With a chance to spend some of her own money however she wanted, she headed straight for the sugar.

After that, it was a trip to American Girl and The Lego Store.

This was the Thursday before Parker’s first day of fourth grade, the excursion along Chicago’s swanky Magnificent Mile I foreshadowed in August.

Parker’s new credit card had arrived eight months earlier. But after sitting safely in her jewelry box ever since, it was time to pull it out. It was time to finally put her plastic to use. Even with the early delay, Parker’s first credit card purchases came five years sooner than I imagined they would.

My original plan was to get Parker a credit card before her freshman year of high school. I figured it would give her four years of practice using plastic. I assumed that would equip her with ample credit card management skills before graduating and going off into the real world.

But then I listened to the advice of Ro$$ Mac, who I told you about in March. On the same podcast episode that provided a critical conversation for me early in my financial literacy journey, Mac presented a different approach. He talked about adding his children to his credit card as an authorized user.

“My daughter’s 2. My son is 8 months,” Mac said. “When they become 18, guess what? They’ll have 16 and 18 years of bills that have been paid on time on their credit. They’re not going to need me to be a co-signer or a guarantor. They’re not going to need me to guarantee some loan for them because they would have already known that.”

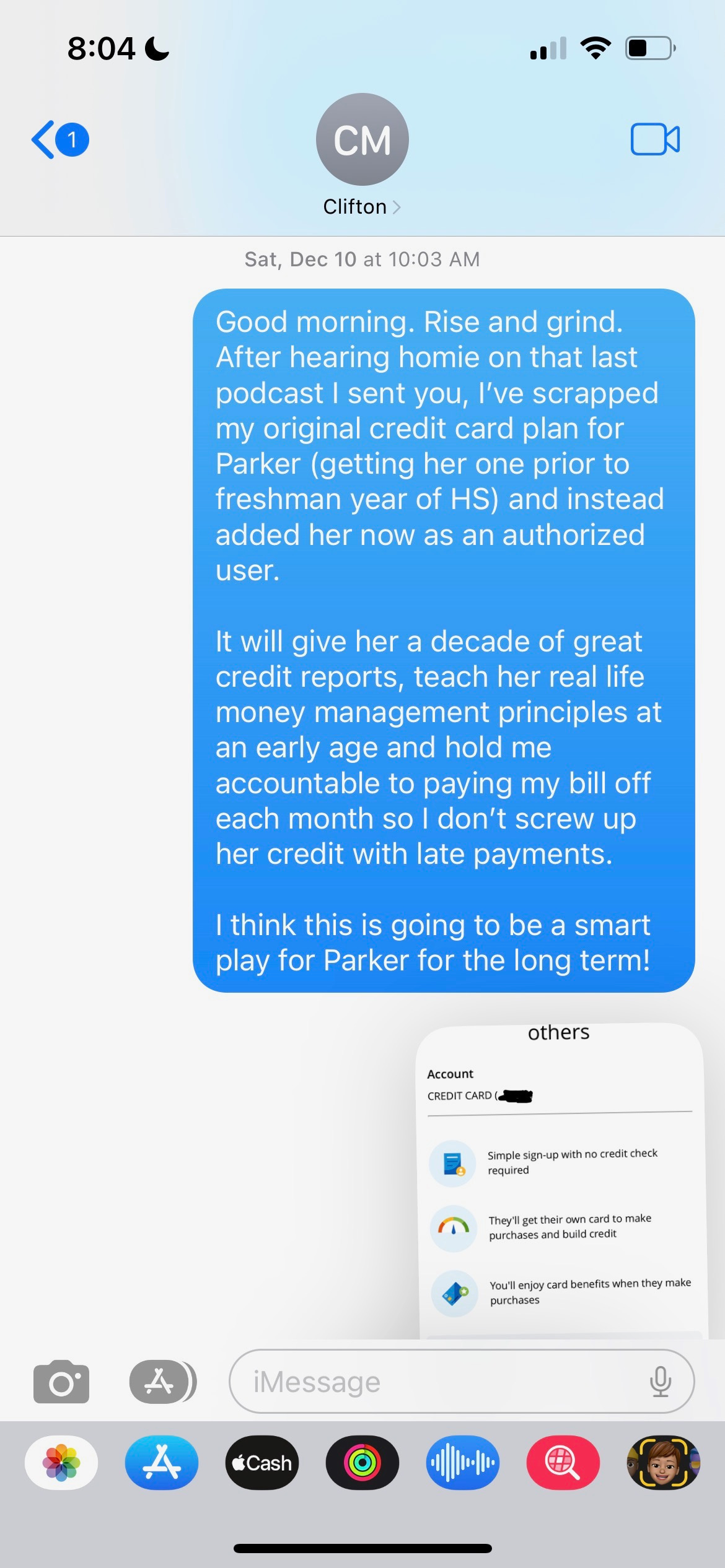

It was a method that made sense to me. I didn’t need to wait another five years to begin teaching Parker lessons she’s capable of comprehending now. And so I scrapped my plan. I shared my new direction with my brother Clifton and my lady friend Triest via text on Dec. 10 last year.

“It will give her a decade of great credit reports,” I wrote, “teach her real life money management principles at an early age and hold me accountable to paying my bill off each month so I don’t screw up her credit with late payments. I think this is going to be a smart play for Parker for the long term!”

I’ve since come across a dissenting argument on the value of adding minors as authorized credit card users. The way I interpreted the counterargument is that the upside in improving a child’s future credit report is limited while the potential downside includes risks such as identity theft.

I would love to fast track Parker’s credit. If her history looks better 10 years from now because I added her as an authorized user on my credit card, great. But I’m more interested in all that she’ll learn over that time from getting real-life experience. With a strong foundation stemming from an early education, Parker should be a savvy credit user.

She already understands credit cards as one of the four primary causes of debt, along with home loans, car loans and student loans. This ensures she doesn’t get her first credit card at 18 and go crazy maxing it out on whatever her heart desires at the moment. This ensures that by then she will have built up her financial responsibility.

“It’s Sugar” might have been the first stop on our shopping spree. But Parker’s first money lesson came at The Lego Store.

The listed price for the Lego Friends Cat Hotel building toy that caught Parker’s eye was $29.99. After tapping her credit card and paying $33.06, Parker asked an important question as we walked away from the register.

“Daddy,” she said, “why did it cost more than the price said it did?”

It took me a second to realize Parker’s confusion stemmed from sales tax. I reminded her it is a topic we had previously learned about from an episode of Million Bazillion. Still, Parker didn’t seem pleased with the process.

Meanwhile, I couldn’t help but to cringe at the ease with which Parker carried out her transaction at the point of sale. I’ve only recently started tapping my credit card and smartphone to pay for goods and services. Parker did it with no problem. And for the first time, I had to think of the method as the primary format Parker will utilize. It robbed her of the pain of paying.

There was no exchange. Parker didn’t have to hand over anything. She just tapped her card and left with a new toy. Everything about the process felt dangerous without a proper education on the potential pitfalls in the rapidly improving digital world.

But I was proud of Parker for not going wild inside “It’s Sugar.” She loaded only a half a pound worth of candy, mostly Gummi Pizza Slices with healthy helpings of jawbreakers and sour gummy worms. At $16.96 per pound, Parker’s subtotal came out to $8.48. This time, Parker didn’t notice the 95 cents sales tax that bumped her total to $9.43.

We strolled leisurely through American Girl, looking at various dolls and playing different games, but didn’t buy anything. We had fun nonetheless exploiting the massive, two-level store.

We broke up the day by splitting a colorful shaved ice and a delicious bag of Garrett Popcorn. My treat.

For her first shopping spree, Parker showed excellent restraint. She was given a credit card and the green light at 9 years old to buy whatever she wanted. She spent only $42.49 and walked away happy with a new toy and a cherished bag of sweets.

She really is my mini-me.

Lego store! That's what I'm talking about...good choice Parker!