I’m getting pretty good at spending less.

But what’s fascinating is how fast the transformation has taken shape.

Eight months ago, I bought whatever I wanted, whenever I wanted. I didn’t budget. I didn’t track my money. I didn’t have a plan and wasn’t particularly interested in devising one.

Now, I’m intentional about my money. I try to be purposeful with every dollar. It took too long for me to understand a basic principle. The less I spend, the more money I have. Before I could truly regain control of my finances, I first had to get my spending in check.

I’m happy to report I’ve done it. My transformation is far from complete. I still fight ample temptation. But a noticeable shift has occurred. Now, the less I spend, the more I want to spend less.

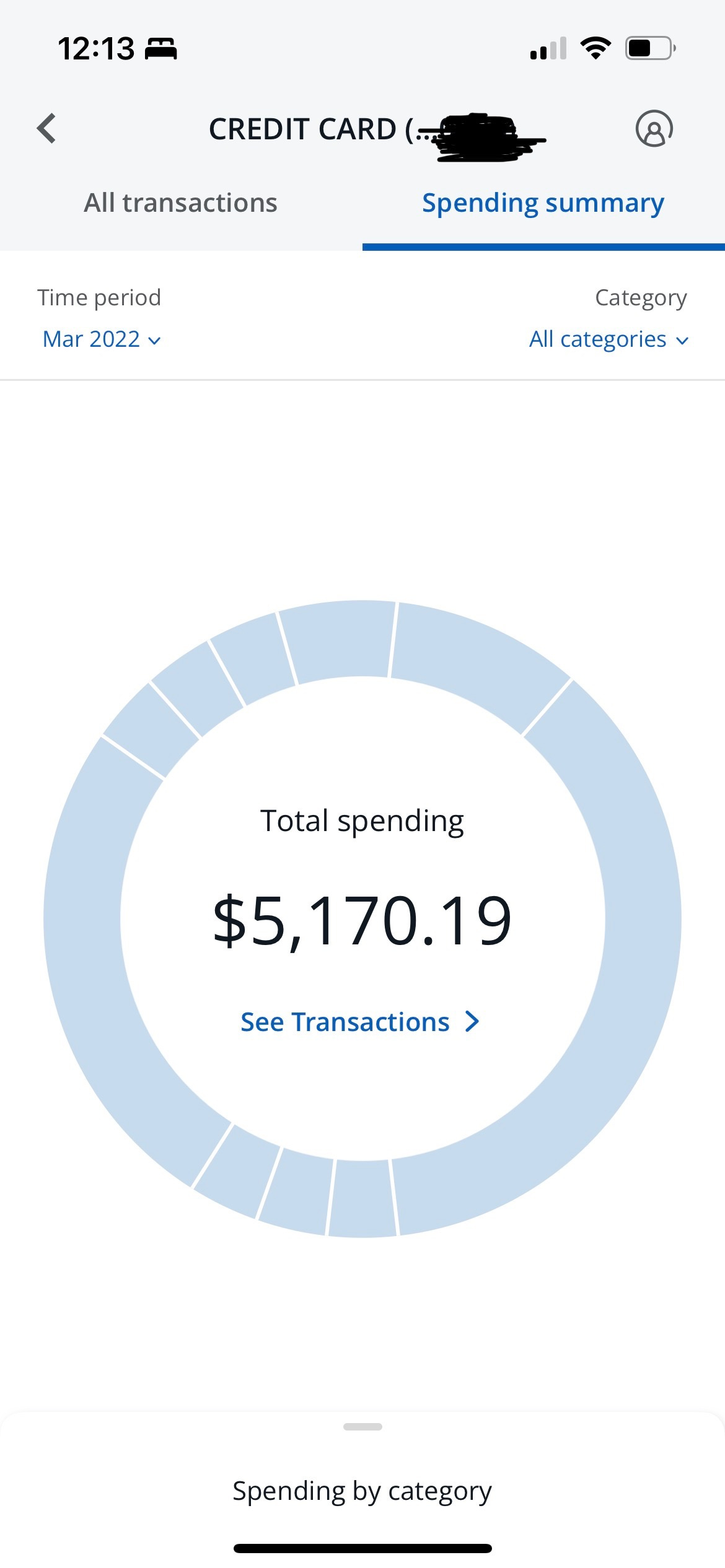

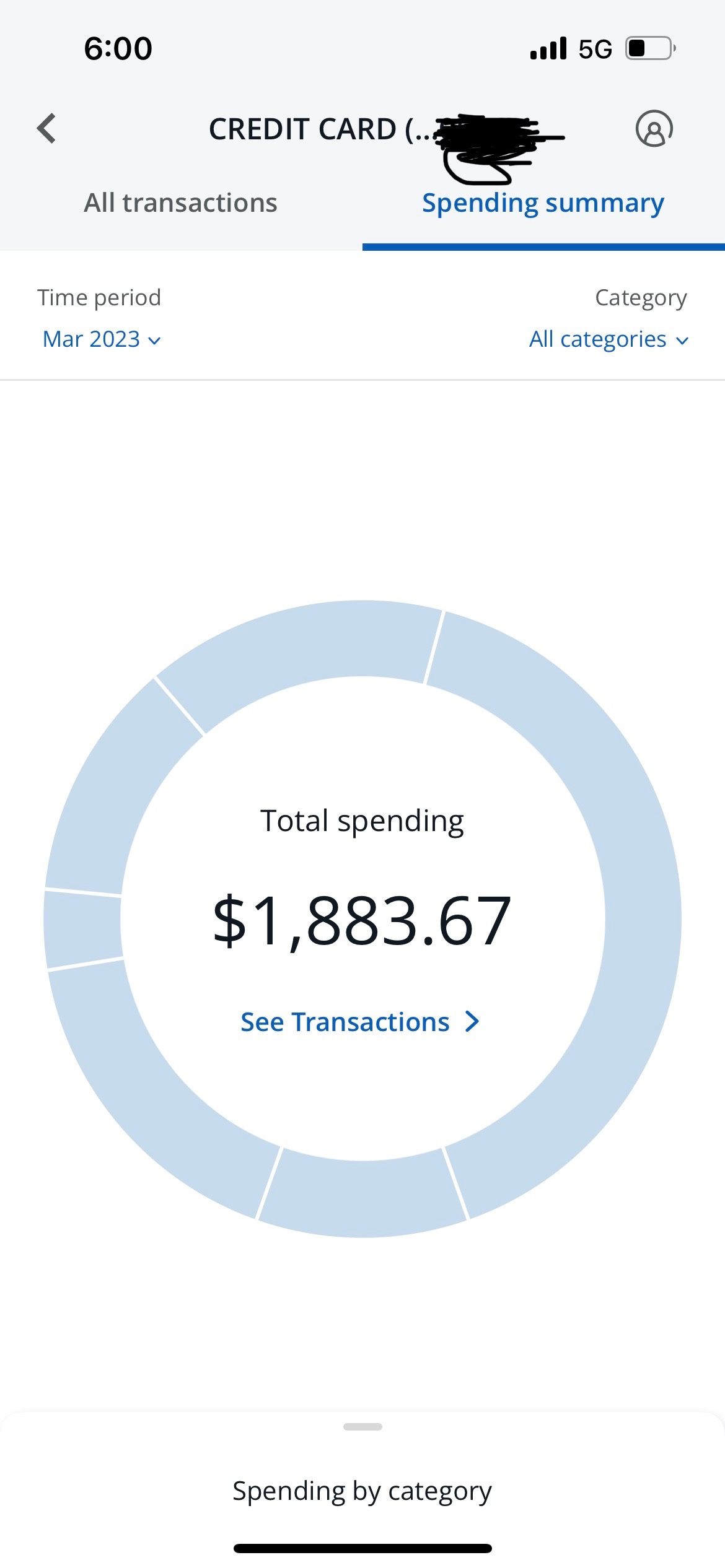

For the third straight month, I’ve reduced my spending from the same month last year. After deducting work expenses, my March spending decreased by $919.77 from March 2022.

My credit card balance carries the majority of my purchases so I can accrue airline points to fly for free. A few mainstays are excluded, such as rent, gas for my apartment and vehicle, my electricity bill and my $10 monthly gym membership. With the lion’s share of my expenses going on my credit card, it’s the best place to monitor my monthly spending, and each month I will share my progress, for better and worse.

The easy thing for me to do would be to ignore the $3,234.42 I spent while traveling for work in March 2022. But only by accounting for each transaction could I pinpoint my consumption pattern. Although I never splurge, I spent way too much on pizza and fast food for one month, traveling on the company’s dime or not. My choices have become healthier. It’s helped bring down my spending.

There are travel expenses from March 2022 I’m not sure I was reimbursed for, which is sad. It’s a result of previously not tracking my spending and checking my statements. Just this week, I spotted a $29 “resort fee” charge on my credit card statement for a work trip to Portland from March 24. I hadn’t expensed it and would have had to eat the charge had I not checked and found it in plain sight.

I shudder to think how much money I’ve let get away from not being diligent with my job related travel expenses. I’m not happy I had to eat two parking charges from a work trip to Los Angeles last month.

Total: $4.75.

Reason: The street meters didn’t provide receipts.

My personal spending during March 2022 included other pitfalls, such as attorney fees, a few expensive dates, frivolous shopping and drinking. Finally, I’ve graduated past most of those pitfalls.

But it’s hard to shake old habits.

I allowed two subscriptions to renew in March of this year that I should have canceled. They cost me a combined $27.94 last month. I also spontaneously bought shoes, albeit at a great discount that was too good to turn down. Otherwise, I enjoyed a clean month.

My highlight for the month was going two weeks, from March 6 to March 20, without making a purchase on my credit card.

Grocery shopping and eating at home go a long way.

Best money move of the month: Reese’s

It might sound silly, but a 5-pack of snack size Reese’s Peanut Butter Cups was my best purchase. It cost $1.18. I told you last month about my love for peanut butter. I was tempted to take home the family size bag of miniature cups, actual retail price: $6.74. But I landed on a happy medium. Rather than go crazy on a craving or throw away 200-plus calories scarfing down an instant-gratification fix, I paced myself. I enjoyed one snack size Reese’s Peanut Butter Cup per day from March 20-24. The daily pick-me-up cost less than a quarter a day.

Worst money move of the month: Shorts

On the same Walmart receipt as the Reese’s Peanut Butter Cups is an $8.98 charge I’m just not proud of. Something told me not to pick up these purple shorts. A voice said keep walking. But I rationalized. Purple is my favorite color (Skol!). Summer is approaching. I’m going to need shorts. The pair I purchased technically are swim trunks, which I need even more than casual shorts. They just might double as both, and some of you reading this probably are going to see me in them. So if we’re not at the pool, don’t call me out.

I consider myself lucky I don’t have expensive tastes. The purchase won’t break the bank, but I’m trying to kick the habit of mindless spending. I could have planned better. But I know I’ll look great poolside in my new, purple shorts.