Why don’t we talk about money?

Examining, and facing, the reasons could lead to life-changing results.

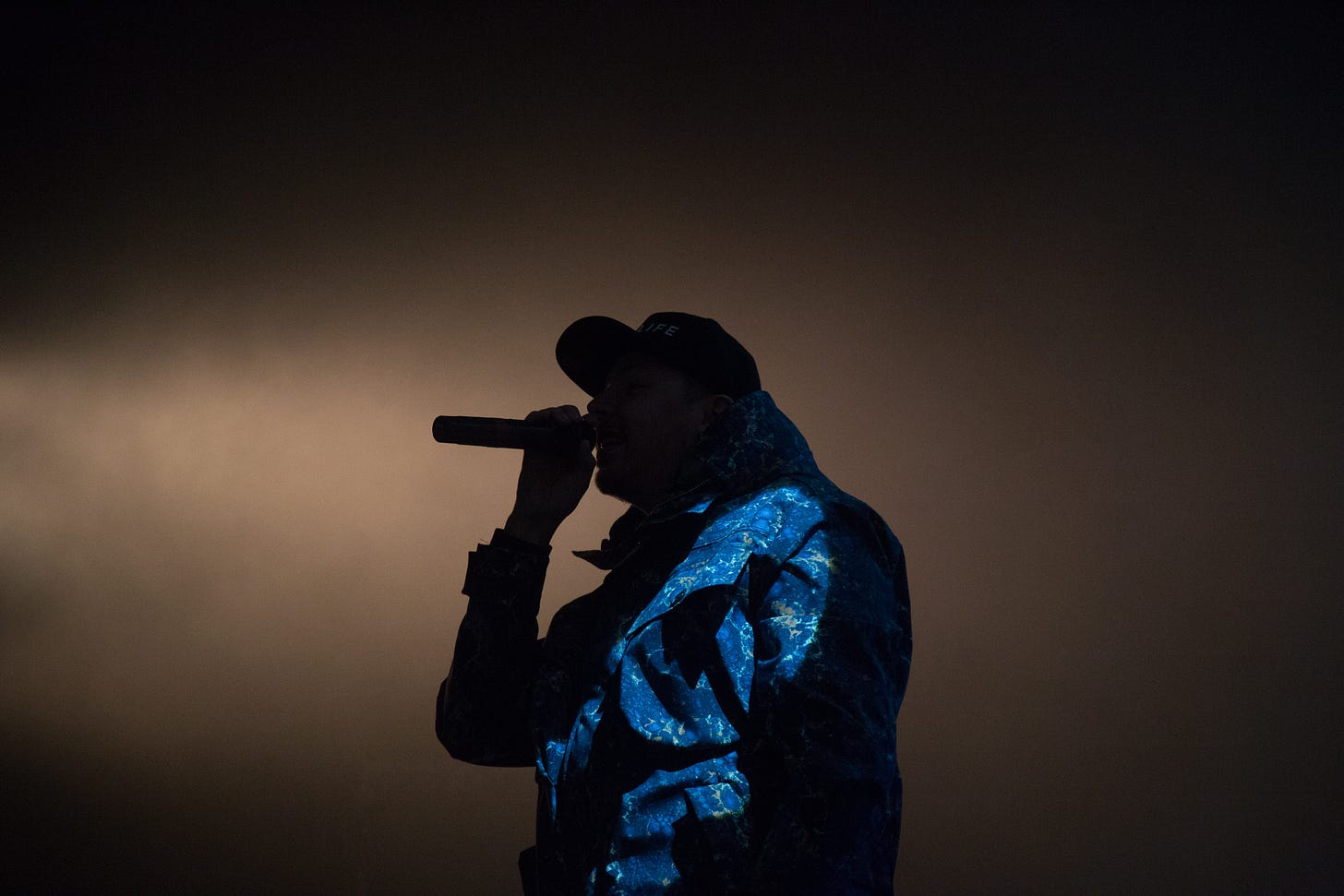

Who owns the stronger discography: Bruno Mars or Chris Brown?

I spotted the question on Twitter after professing my love for Bruno Mars’ artistry last week. It almost sucked me down a rabbit hole.

The person who posed the question provided context for his exercise (language warning) in a follow-up tweet two minutes later. It was a 90-second video clip of a spirited podcast discussion on Brown’s reach relative to rapper Drake.

The debate intensified when one person claimed Chris Brown could sell out the same venues as Drake. To make the point, the person dragged Bruno Mars into the conversation and grew indignant when told to put some respect on the showman’s name.

“He’s a glorified cruise ship performer,” the person said of Bruno Mars.

I about lost it. Up until those final 15 seconds, I understood the person’s point on Chris Brown and agreed. But when Bruno Mars somehow got dissed, it nearly hijacked my day.

I scanned replies and rummaged through the 400-plus quote tweets the original question elicited. I played a Chris Brown banger then a Bruno Mars masterpiece. I shared the podcast clip via text, angrily expressing how a stranger’s hot take had caused my temperature to rise.

Finally, it hit me.

This was the type of material I have spent the majority of my life on. Since middle school, conversations among my circle centered on sports, music, television and movies, video games and girls/women. I’ve sat in debates about those subjects all day, every day, and seen people nearly come to blows because of their loyalties.

But when the topic turns to finances, the fiery debates disappear. I’ve found, be it family or friends, few have the same energy for money talks. It makes no sense to me. Neither Chris Brown nor Bruno Mars — or any entertainer — significantly impacts our lives. Money does. Yet we expend tremendous time and enormous energy on one but often not the other.

I’ve decided to flip that equation and focus more on what matters to the long-term health and well-being of my family. That means growing comfortable having open money talks in a culture where the custom is staying silent on the subject.

Numerous studies show Americans would rather discuss anything but money, including marital problems, mental illness, drug addiction, race, politics, sex and religion. Yet, according to one study, 90 percent of Americans are stressed about their financial well-being.

Truth and transparency are our best tools for overcoming what society has deemed a sore subject. Before fixing any problem, we must face it. That gets easier with time and intentionality. This project is proof.

Examining the roots of why we don’t talk about money, or find it difficult, might be a good launching point. Here are eight common reasons I’ve found.

It’s what we’ve always done: Our parents didn’t talk about money, and we don’t either. It’s just the way we’ve always done it.

It’s taboo: It’s considered socially unacceptable to talk about money. If you’re well-off, you’ll be perceived as boastful. If you’re broke, people will think you’re begging. Nobody wants to hear either.

It’s too emotional: Feelings of frustration, shame, embarrassment, guilt or resentment often arise over money. Those feelings can be hard to face.

It’s too uncomfortable: Examining finances forces you to look yourself in the mirror. Sometimes we don’t like what we see. Few things reveal more about us than how we spend.

The fear of judgment: One might fear being looked down on for not measuring up, or fear being ridiculed or exploited for overachieving.

Avoidant: Ignorance, for some, is bliss. If you don’t look at your finances, you don’t have to figure them out, right? Wrong. Avoiding the problem only exacerbates it, never alleviates it.

It’s no fun: We’d rather debate the musical prowess of Chris Brown versus Drake and Bruno Mars.

It’s nobody’s business: Many believe finances are personal and private, period. What we do with our money doesn’t concern anyone else. We made it. No one can tell us what to do with it. So stay out of it!

What are some other reasons you’ve found for why we don’t talk about money? How many are healthy? Do they help multiply money, or are they distractions?

I’ve had my fun and experienced enough distractions. It’s time I get serious about money. It’s time to reject the status quo and refuse silence. It’s time to turn a taboo subject into a staple taught in schools and discussed at the dinner table.

But first, let’s agree Bruno Mars has the stronger discography.

my financial coach would agree with all

of your reasons. + shame.