Why I decided to get smart with money

The closer I looked at my finances, the less I liked what I saw.

My car wouldn’t stop stalling.

Something was wrong. I just didn’t know what.

Accelerating when stoplights flicked from red to green became a predictable but perplexing chore. Pressing my foot against the gas pedal routinely resulted in unresponsiveness, an almost inevitable, split-second hesitation before she budged. Sort of like a burp, only from a car.

I knew I’d have to tackle the issue at some point. But I’m no mechanic. Knowing little about the inner-workings of vehicles, my hope was it was nothing serious. Maybe an oil change would fix it. Replacing the starter or alternator, I assumed, was the worst-case scenario. Only when I took her in for that oil change did I learn how wrong I was and how much bigger of a problem I had.

My transmission gave out!

This was mid-August of last year. And it changed my life forever.

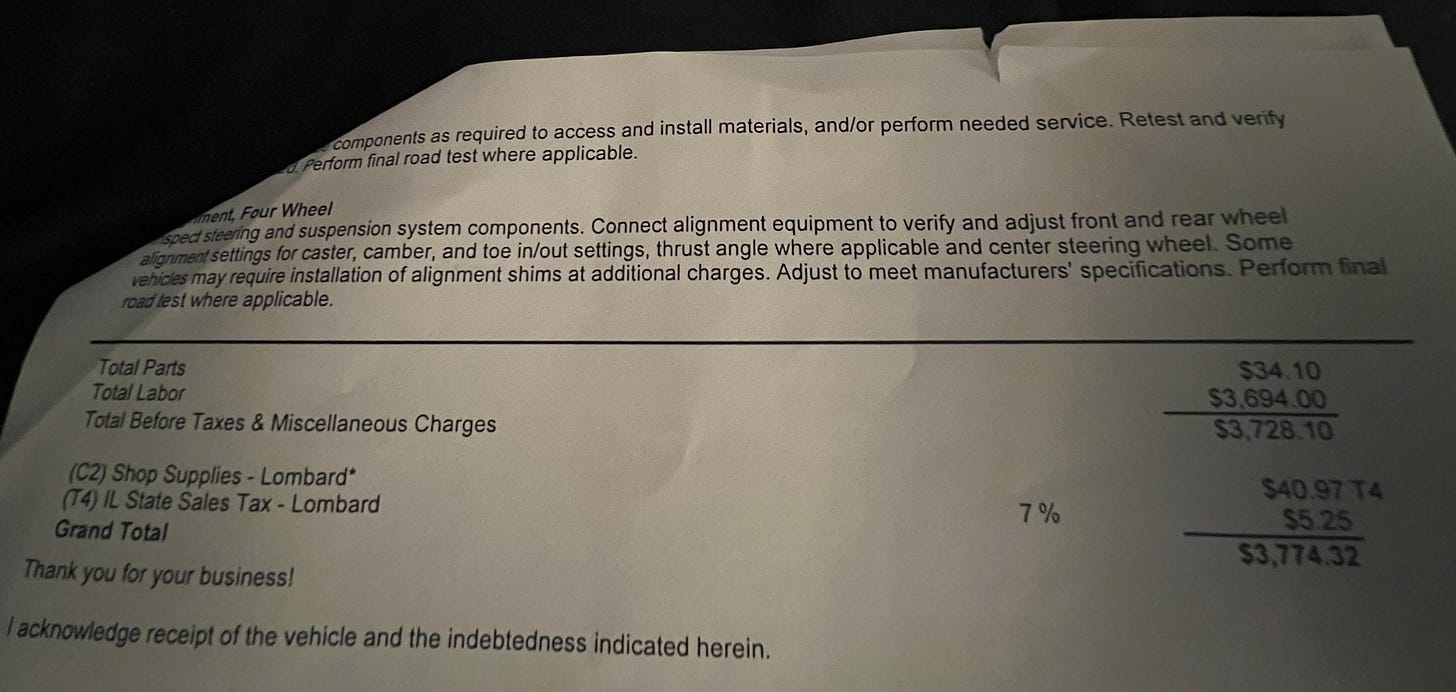

My final bill for a rebuilt transmission — and an oil change — was $3,774.32. It nearly broke me. Before deciding to pay it, the cost forced me to consider purchasing another vehicle. The odometer on my 2009 Dodge Journey showed 185,000 miles at the time. And I had spent the past nine years dumping money into it for other repairs. I didn’t know what to do, and the decision alone caused anxiety. I was close to wiping out debt from my divorce and dying for the fresh start that would bring. But here came an unexpected expense, and a big one.

The shop required a $2,000 deposit, and I didn’t have it. All my cash sat in a savings account for a down payment on a house, which I refused to touch, and a separate general savings account earmarked for Parker, also untouchable.

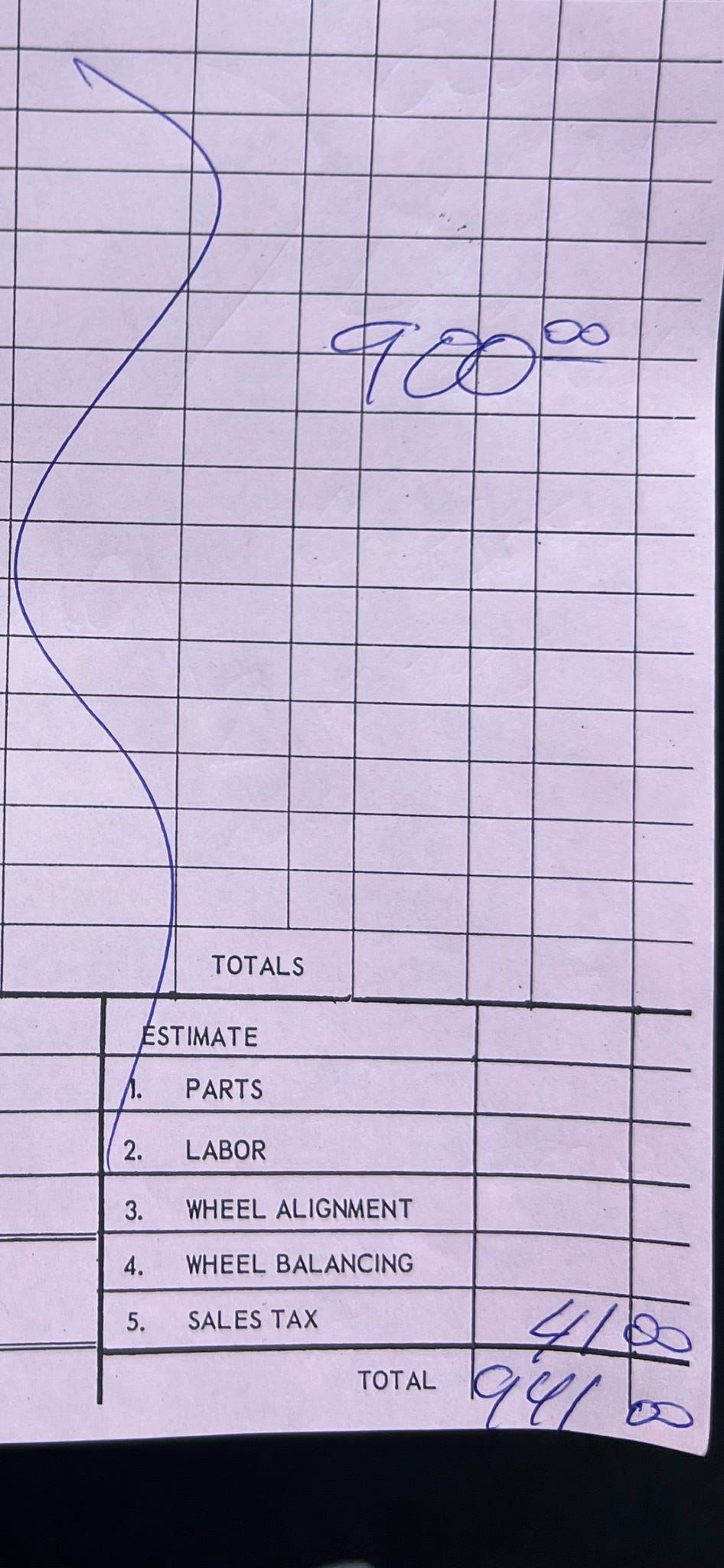

And so I did what one-quarter of Americans do for emergency expenses of $1,000 or more, according to Bankrate’s annual survey. I paid for my vehicle repair using a credit card. When I needed new rotors and calipers six weeks later, I used the same credit card. That bill was $941.

While you were enjoying the end of summer, mounting expenses sent me searching for side hustles to increase my income. I searched the internet for simple ways to make more money and soon started doing small things in my spare time to generate cash. I canceled subscriptions. I cut back on eating out. I sold used household items. I completed online surveys for small cash rewards. I even won a few dollars playing Bingo on my phone.

During this phase, I also stumbled across information about investing in the stock market.

I’m smiling as I remember how my brokerage’s offer of a few free dollars worth of stock drove me to dive in. It’s probably the most ridiculous carrot to ever entice a grown man to start investing. But thanks to those first $4, our lives will never be the same.

I quickly saw the power of investing. I immediately became hooked. It motivated me to grow intentional about every dollar after learning the magic of compounding.

Divorce put a much bigger dent in my financial picture than my faulty transmission. I heard many older men recite the cliché, “It’s cheaper to keep her,” but only an experience with multiple judges, attorneys, guardians ad litem, court costs and substantial fees does it truly click. I’ve paid well into five figures navigating divorce. To call it a setback would be an understatement. But it’s taught me a lot. Freeing myself from those financial shackles — and eventually soaring — also is at the core of why I decided to get smart with money.

Owning a home again is important to me as well. Tucking away money in a savings account, however, wasn’t the most effective method for getting back there. Learning better techniques to earn and spend, save and invest, now excites me. In less than six months, my wallet and my waistline already look better.

And I can’t leave out inflation’s role in reshaping my mindset with money. Only a few weeks ago, a carton of 18 eggs at Walmart cost $7.88. How could I not pay more attention to where my money was going?

The closer I looked, the less I liked what I saw. All it took to tackle my problem was facing it. One unexpected expense bled into another, and I couldn’t take it anymore. Back on that mid-August night, I decided I was done riding my lifelong financial rollercoaster.

That’s how I got here.

What will be the final straw that pushes you to commit to a different way?

Car issues will do it every time. There were times where I literally could not afford to hear or even acknowledge that rumbling rattling knocking sound. For me that final straw was realizing that there was no end in sight to always pushing priorities off because I didn’t make it a priority.