One of the personal finance podcasts I began listening to at the start of my financial transformation last year is one many of you probably know.

It was the Money Guy Show, with hosts Brian Preston and Bo Hanson.

They taught me my greatest lesson on compounding. They caught my attention with a prop. As seen on their YouTube stream, their wittily worded koozie worked like a charm on me.

“This $1 beer cost me $88,” the koozie read.

The math stopped me in my tracks. I couldn’t help but to wonder about the meaning behind the message. I had to know more.

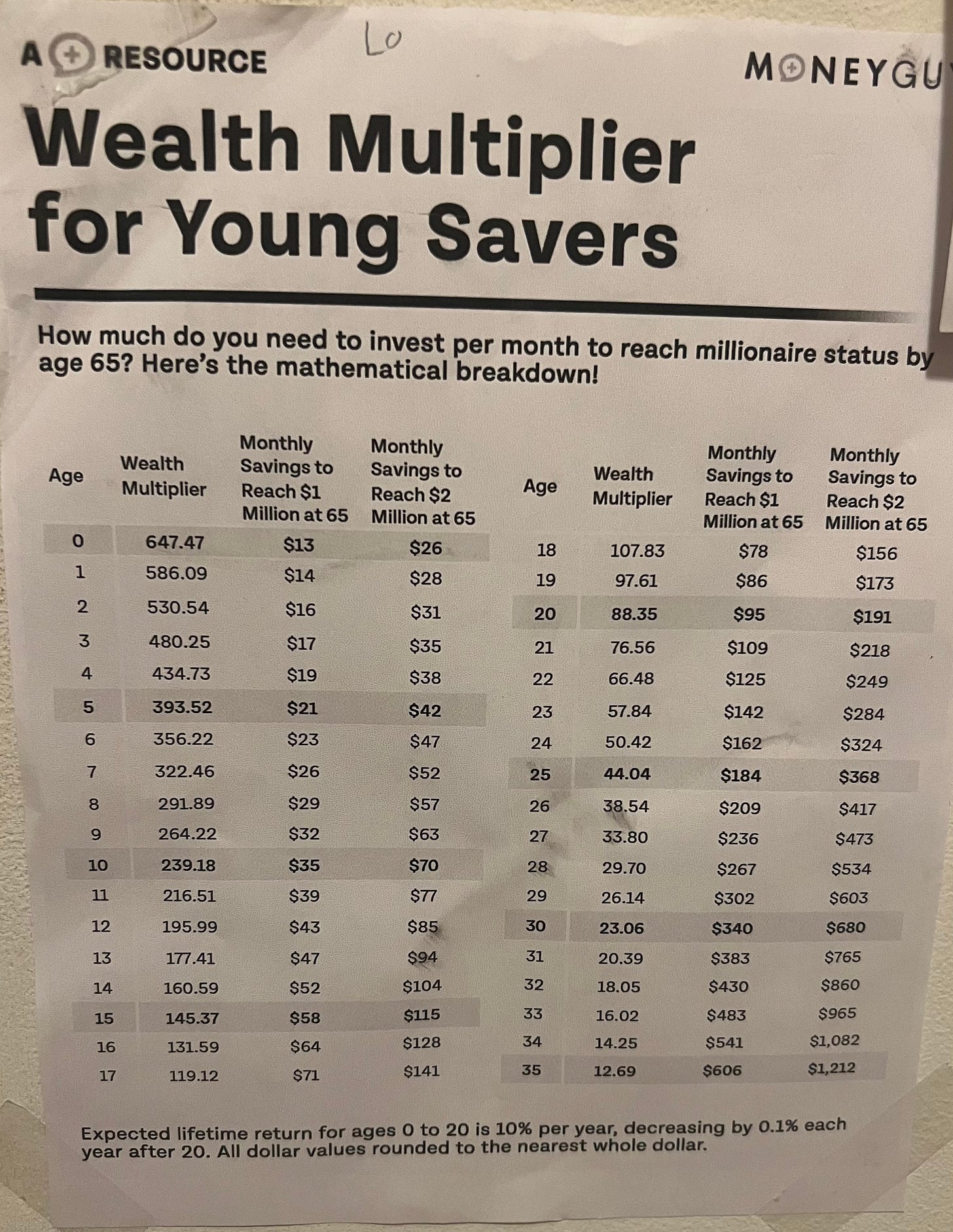

During one episode, the hosts made it make sense, saying a 20-year-old has a wealth multiplier of 88.35.

“That means that every dollar that a 20-year-old invests, if we assume a 10% rate of return, compounded on a monthly basis, can turn into $88 by the time they get to 65,” Hanson explained.

Regret was the first feeling I remember flooding my body. I was 20 years too late to maximize the wealth-building strategy. I thought about how I missed such accessible information and where I would be today if I didn’t.

But my thoughts didn’t linger on could-have-beens. I quickly turned my attention to Parker. I realized that everything I wish I knew in my 20s, I could start teaching my daughter today, before her 10th birthday. With time on Parker’s side, I grew determined to set her up with a healthy financial future.

Posted to Parker’s “money wall” inside her bedroom now is a printout of the Money Guy Show’s wealth multiplier for young savers chart. It shows the monthly amount people ages 0-35 must save to reach $1 million and $2 million at 65. It’s to remind Parker where she’s headed by starting her investing journey early and remaining steady as she ages.

For a 9-year-old, the monthly invested amount is only $32 to reach $1 million at 65 and $63 monthly to reach $2 million at 65.

The material changed my perspective. The information made me become more intentional with every dollar. I happily began investing a fixed amount for Parker each month. I even looked at drinking beer differently, eventually weaning myself off alcohol and ridding myself of the routine expense.

Every dollar I saved on alcohol and other frivolous purchases was one more I could funnel toward investments. The more I directed to investments, the faster our money could compound and the quicker we would reach financial freedom. That was an equation I easily understood.

But I didn’t stop there. I became fascinated by the concept of compounding. It wasn’t long before I journeyed down a rabbit hole. I watched YouTube videos on the subject, read articles, listened to podcasts and devoured the book, “The Compound Effect.”

The book left the biggest imprint. Its premise is everyday decisions shape your destiny, lifting you to the life you desire or keeping you stuck in despair. I ate it up, immediately applying the principles across my life.

I started tithing and making my bed every morning. Going to the gym five times a week and drinking water almost exclusively. Cooking instead of eating out and tracking my spending instead of being so spontaneous.

The power of compounding didn’t just add structure to my life, but it also brought greater purpose.

Now I want to live until at least 92.

I never thought about growing old. But it’s become something I’m chasing.

I want to be here and healthy to enjoy the fruits of my labor. To play with my grandchildren and great grandchildren.

And to see what 50 years of compounding looks like as an investor.

I love this!