Our money made more in three minutes in the stock market than it earned in interest over nine months in a bank.

Three minutes. That’s all it took.

I’ll never forget the feeling of watching our money increase in real time. It was as educational as it was exhilarating. Although we hadn’t saved much, a better way to maximize the cash we had really did exist. I’m glad I finally found it five months ago.

It all started on Oct. 20, 2022, a Thursday. That was the day, frustrated and fed up with paltry interest returns, I began transferring money I saved for Parker’s future from a savings account into the stock market.

I played around in the stock market with my own funds for 3 1/2 weeks before trusting it to protect and produce money I earmarked for Parker. I made a little here and lost a little there on household-name companies like Netflix and McDonald’s, as well as lesser-known companies I should have avoided like Pineapple Energy and Top Ships.

Those few weeks in the market, however, taught me I could beat the bank simply by switching Parker’s money over. I already had a brokerage account. All I needed to do was determine where to place Parker’s funds.

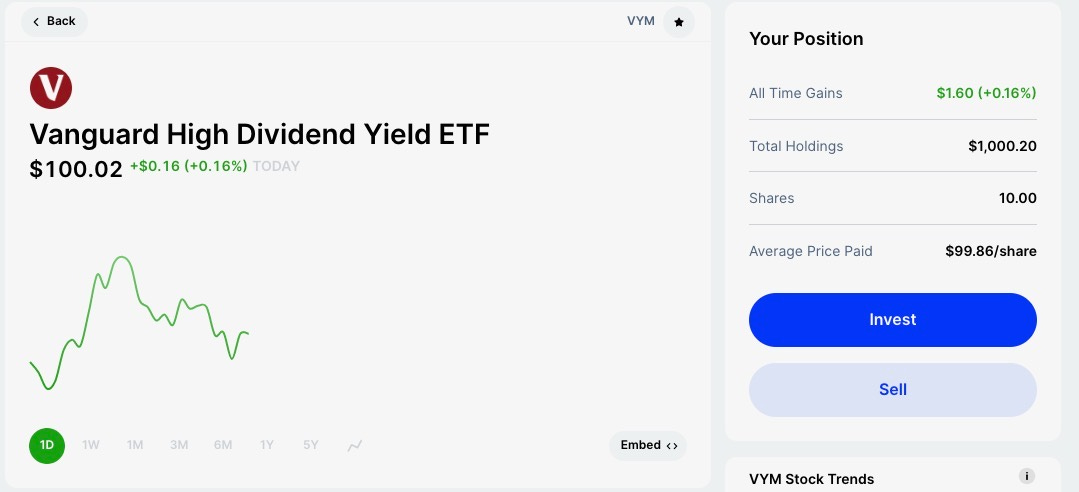

I selected the Vanguard High Dividend Yield ETF, ticker symbol VYM. This Exchange-Traded Fund, essentially a collection of hundreds of companies’ stocks, is designed to track the performance of stocks that project to have above-average dividend yields. Upon understanding how some companies incentivize stockholders by paying out a percentage of their profits, it was important to me that Parker’s money collect quarterly dividends and capitalize on that wealth-building tool.

The top six holdings of the VYM are Exxon Mobil, JPMorgan & Chase Co., Johnson & Johnson, Procter & Gamble, Chevron and Home Depot. The fund holds more than 430 other thriving companies millions around the world know and use in some way every day. All we’re doing is latching on to their empires.

Which is why I became a believer long before we received our first dividend.

Two years of stowing away money for Parker in 2020 and 2021 produced $6,153.60. Without additional contributions, that sum earned only 45 cents in interest from sitting in a savings account through the first nine months of 2022.

It’s laughable now to think back on my trepidation with leaving the so-called security of a bank. I was like most, trusting what I was taught and doing things the way I had always done them. Until that third Thursday in October opened my eyes and gave me a new perspective.

Fear prevented me from dumping all of Parker’s $6,000 and change into the VYM at once. I started with 10 shares, a $998.60 investment with the stock price sitting at $99.86 when my order was filled at 10:30 a.m.

My heart pounded and my stomach started forming knots after I pressed that button. I didn’t know what would happen. It might be the longest I’ve gone without blinking. My eyes were stuck watching the ticker.

And then the best thing ever happened. The stock price rose.

At 10:33 a.m., the VYM stock price hit $100.02. A mere 16-cents increase over my purchase price translated to a $1.60 gain on Parker’s initial investment. That’s all I needed to see. I was sold.

If our first $1,000, in only three minutes, more than tripled the bank’s interest return for $6,000-plus over nine months, no more proof was needed. Our money needed to be in the stock market.

I bought five more shares of the VYM at 10:58 a.m. Then another five shares two minutes after that. At 11:08 a.m., another five shares. At 11:14, 15 shares. Finally, at 12:51 p.m., another five shares.

In a matter of hours, Parker became the owner of 45 shares of the VYM. It is my hope that it becomes her greatest asset.

My plan is to fund the account each month through Parker’s high school graduation. That’s 10 years away. I’m starting with $4,040 annually, or the $336 monthly I’m currently committing while working to grow my ability to contribute more. If I’m never able to save more than $4,040 annually for Parker, that’s at least $40,400 she will have waiting for her as her graduation gift from Daddy. I anticipate the fund will be substantially higher than $40,400 given capital appreciation, dividends that will be reinvested and compound and additional contributions.

I don’t want to give Parker a car for her high school graduation. My goal is to give her $100,000 in an appreciable asset, along with a comprehensive understanding of money management and wealth building.

How we can strategically use the VYM as a vehicle was among my early lessons. It wasn’t simply those first three minutes but the first eight days of investing into the fund.

One day later, on a Friday, the VYM rose to $101.19 per share. With almost $4,500 now invested, a 13-cent increase in share price translated to a $7.68 gain. The following week, the market just kept rising.

The VYM hit $102.66 the following Monday morning, touched $103.41 Tuesday and $106.45 the following Friday, Oct. 28.

Three weeks later, on Friday, Nov. 11, the VYM closed at $110.39. Parker’s all-time gain, albeit unrealized, showed $482.70, a 10.76 percent return.

Suddenly, I saw our path to wealth.

By unintentionally doing something millions try and fail to do – successfully time the market – I couldn’t even add Parker’s remaining $1,600. Only recently has the market, thus the VYM, given back some of those lovely October gains. The dip opened opportunities to smooth in the rest of the money. I’m now caught up, and dividends are now pouring in.

Parker received her second dividend from the VYM last week. After adding her remaining funds, and beginning regular contributions, from December through March, Parker’s stake has increased to a little more than 68 shares.

That earned her a $49.18 dividend payout for this quarter. Coupled with her initial $43.91 dividend received Dec. 22, 2022 off the first 45 shares, Parker already has earned $93.09 in dividends.

More importantly, by reinvesting the dividends and turning them into shares, Parker is receiving free stock and strengthening her account with slightly more assets to help her fund compound faster. She’s already close to receiving and reinvesting a half share in only her second ever quarterly dividend. My scheduled investment currently buys her a little more than three shares each month.

I’m dedicated for the next decade. But let’s see if we can reach our goal sooner.

Disclaimer: The information contained on Money Talks is not intended as, and should not be understood or construed as, financial advice. I am not an attorney, accountant or financial advisor. These are my personal experiences, and neither this website, newsletter nor podcast is a substitute for advice from a qualified professional.

Darnell, do you know how often the fund is rebalanced?