How I started saving for Parker’s future

A basic, one-year challenge changed my behavior for the better.

I still have the text message that started it all.

A friend named Candice sent it three years ago. It pinged my phone on Jan. 20, 2020.

“We should do this,” the text read, accompanied by a graphic.

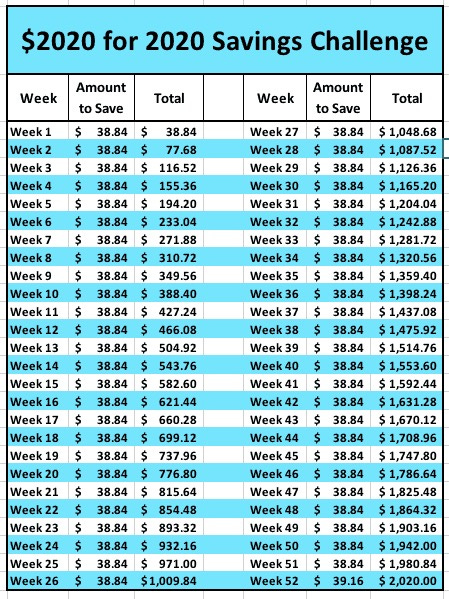

Presented within the blue and white table were figures comprising a straightforward savings plan: a 52-week challenge of $2,020 in 2020.

Candice had no idea of the financial mutant her message would help create. The transformation in me started immediately. My excitement for the challenge jumped off the screen.

“Let’s do it!! That makes it look so easy! It’s just what I needed. Thank you!”

The plan required saving $38.84 a week for 51 weeks before topping off the final week with a $39.16 deposit. In those days, that basically was my beer money. I spent much more each week when adding my bar tabs and dining expenses.

It was an attainable goal. It needed my full attention.

At that time, I barely was saving money for anything. I held a distant goal of buying a home again but hadn’t started stashing significant funds. Whatever I had left after bills and divorce debt, I spent however I saw fit. Temporary pleasures and trivial purchases drained my bank account on a scheduled loop. I never thought twice about my spending pattern since my bills were paid and I could afford my creature comforts. I considered myself responsible, even good with money.

But then I began thinking about Parker.

Ignoring my savings account was one thing. I would never be able to forgive myself if I didn’t put away money for my daughter. I decided to earmark the money from the challenge for Parker.

Rather than a weekly deposit, I streamlined the process. I tucked away $168.34 each month. Originally, I designated the fund for Parker’s general purposes. If she needs cash in a pinch, she’ll have it. When the day comes she wants a car, money will be available to lessen the blow.

I hit the target with ease and didn’t miss the money I started saving. The monthly commitment fit into my budget so well I never felt a difference in my finances. I grew more aggressive. I doubled the goal for 2021. I authorized bi-weekly transfers of $168.34 to begin Jan. 1, 2021 and recur on the first and 15th of each month.

Remember my $4,040 savings goal for Parker this year? That’s where that number stems from.

I stopped saving in 2022 due to a costly year that included more court costs, expensive car repairs and excessive spending. I’m back on track, with more discipline and a far better savings vehicle now.

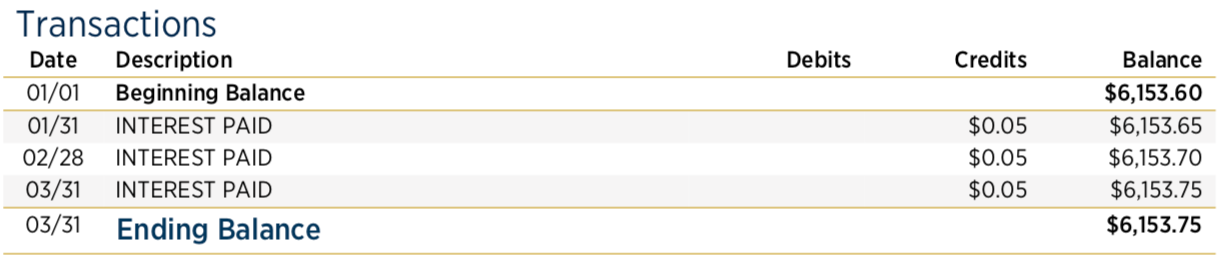

But only after pausing Parker’s savings did I gain important clarity — that the bank was getting over on me. Big time.

By parking Parker’s funds in a savings account with a 0.01% APY (annual percentage yield), I was pulling in peanuts on my money. Each month, I was collecting only five cents worth of interest.

Even in a separate, “high-yield savings account” I opened in the summer of 2021, the APY topped out at 1.50%. Better, but the equation still heavily favored the bank.

I needed a tool that truly maximized my dollars and super-charged my savings goals.

What I found, and will share in greater detail Thursday, is now the backbone of Parker’s successful financial future.

It took far too long for me to learn this. But I’m done thinking the bank is the best place for maximizing my money.

I have learned the power of the stock market.