The posted sign caught my eye the second I sat.

How could it not? My vehicle was rapidly descending into a magnificent mess. It wasn’t quite a clunker. But it had become rickety and unreliable. I couldn’t help but to inquire about the discounted vehicles the dealership promoted for sale.

This was last Friday, and I was only there for an oil change. But with my 2009 Dodge Journey constantly malfunctioning, I used the opportunity to gather information.

For approximately two hours, a salesman happily talked me through options and gladly walked me around the lot to peruse any vehicle of my choosing.

Five days later, despite much apprehension, I did it. I finally bought a new car.

I owned my Dodge Journey for 10 years. I purchased it in October 2013 while still married and just before Parker was born. At the time, it was a safer family vehicle. Lately, it’s become a money pit.

I told you in July that I anticipated another major repair bill in the second half of this year. A $2,500 bill in May bumped my vehicle repairs north of $8,000 since 2022. I couldn’t, in good conscience, throw anymore money at a vehicle that had clearly become a chronic problem. The list of issues was piling faster than I could keep up.

There was the main problem, the car almost comically starting when it felt like it. It had done it for years but worsened whenever the weather turned hot. Recently, the problem grew more frequent. It reached the point where I never knew if it would start on the first try or take several minutes before cooperating.

Occasionally, the car would go haywire. Three times since June, all the lights on the dashboard turned on and the front windshield wipers activated unexpectedly. I feared the issue was electrical, which would cost a small fortune just to diagnose.

My hope was that by getting an oil change at the dealership their service department would run tests to determine the issue free of charge. Nope. I would have had to pay $149 for a diagnostic test, then eat the price of the actual job. Worse, the service department rep informed me I’d likely need a new battery and something called a rear main seal. And because the rear main seal is between the engine and transmission, replacing that $80 part also would have required extensive labor to remove the transmission.

That was just the start of my troubles.

My rear dome lights didn’t stay in the off position without small pieces of paper lodged in the crevices. My back bumper was loose following a fender bender in which I allowed the non-insurance-carrying guilty party to slide. My passenger side seatbelt didn’t hold its locked position. My passenger side vanity mirror had a broken cover that, without fail, surprised riders whenever they opened it only for it to land in their laps. And my retractable compartment above my rearview mirror that housed sunglasses broke, leaving it forever in the down position.

I think my brakes were about to require attention again too based on slight squeaking.

Other than that, it was a great vehicle.

None of the problems were worth the trouble. Rather than look into the cost of repairs, I decided to be done with my Journey and move on. I sought reliability and durability. I just hated the thought of a car note.

I don’t remember when I paid off my Journey. But I’ve lived without a monthly car payment for at least the past seven years. The vehicle cost about $11,000 back in 2013 and came with a little more than 61,000 miles. When I left it with the dealership as a trade-in Wednesday, the odometer read 201,034. My plan was to push it to 300,000 miles. I truly wanted it to be Parker’s first vehicle.

I grew more determined after reading “The Millionaire Next Door.” The book was among the first I devoured last year on my road to financial literacy. It dedicates an entire chapter to the cars millionaires drive and how they purchase them.

The book portrays millionaires as owners of the most cost-efficient, reliable vehicles on the market. Their vehicles are practical as opposed to status symbols. The book, albeit originally published in 1996, states that the typical millionaire, those in the 50th percentile, paid $24,800 for their most recent vehicles. It goes on to say that 50% of millionaires surveyed never spent more than $29,000 in their entire lives for a vehicle and that nearly 37% indicated that their new vehicle was used.

Another reminder, posted for Parker on her bedroom wall, are the four main causes of debt: housing, car loans, student loans and credit cards. I knew better than to succumb to the car trap.

I test drove a 2016 Jeep Compass Sport on Friday but didn’t love it. By Monday, it had sold anyway. But that gave me time to search for something I preferred. And I found exactly what I wanted.

Because my credit is excellent, the salesmen I worked with were eager for my business. They gave me $1,700 for my Journey as a trade-in despite its many miles and detectable defects. I also remembered advice I had heard several times on “The Money Guy Show” about the 20/3/8 rule, which calls for putting down 20 percent, financing for no more than three years and absorbing a monthly payment no greater than 8% of your gross monthly income.

I crunched the numbers before driving back to the dealership Wednesday. My desired vehicle fell nicely into those guidelines.

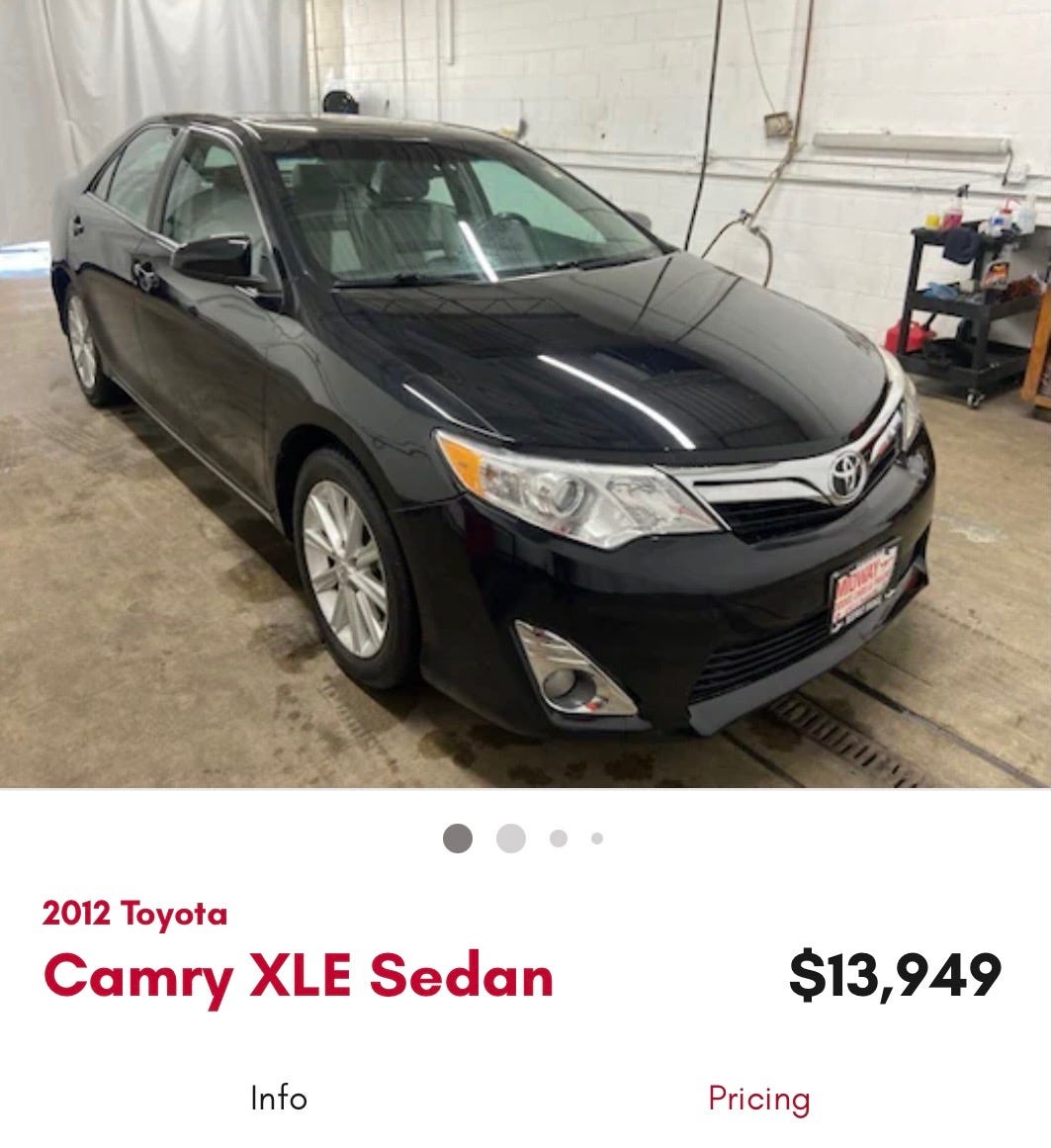

I bought a 2012 Toyota Camry with 82,000 miles. It cost $13,949, with an 8.64% APR. I made a $3,000 down payment and stretched the financing to 63 months solely to lower the monthly payment to $231.78. I declined a three-year, 36,000-mile warranty that would have cost another $3,240.

My plan is to pay substantially more than the required note each month and knock out the loan much sooner than 63 months. If I paid only the required $231.78 each month, it would cost me an additional $2,937.58 in interest over the life of the loan. But with no prepayment penalty, I’m golden.

I would have preferred hanging on to my decrepit Dodge. But I’m pleased with the decision I’ve made.

I secured a reliable vehicle and with it returns my peace of mind.

Now let’s see if I can make it to 300,000 miles.