Spend check: Creativity cut costs in June

I’m on pace to slash my spending by four grand in 2023.

My spending finally fell in June after two straight difficult months.

And through the first half of the year, I’m on pace to slash my credit card balance by more than $4,000 from 2022.

I spent $1,314.05 last month. It was my second lowest amount for any month this year. January, which came in at just $944.78, remains the month to beat.

But I enjoyed June.

We crammed in an inexpensive family vacation to Oklahoma. I splurged on Braum’s ice cream, Missy’s donuts, Chick-N-Beer honey lemon pepper wings and a case of my favorite Oklahoma-brewed IPAs. Me and Parker got to see The Little Mermaid for free. We shared the irresistible SmokeShack burger and a cookies and cream milkshake from Shake Shack. I even secured my next audiobook, “A Random Walk Down Wall Street” at a discounted price of $3.92.

The month showed how a little creativity can keep costs down.

After deducting gas for my vehicle from 2022, my year over year spending in June fell by $692.94. I expense gas differently this year, which I’ll write more about soon.

With that accounting, I’m spending $353.10 less per month than I did last year, a difference of $4,237.20 over 12 months.

My hope was to be ahead of my current pace. But major car repair bills in April and May, as well as a less costly bill in June, torpedoed that plan. I’m currently experiencing two routine malfunctions that require immediate attention. I already know another major repair bill is coming in the second half of the year.

If my vehicle would cooperate, I’d be doing even better with saving and investing. I’m right where I want to be with my other spending. I really don’t want to put up money for a new vehicle. But a review of my credit card statement from last year and this year shows I’ve spent $8,065.88 since 2022 on vehicle maintenance. That’s $448.10 a month — and counting — which could buy me more peace than a failing 2009 Dodge Journey approaching 200,000 miles.

It’s a difficult decision I anticipate will intensify in the second half of the year. I’ve realized between car insurance, gas, unexpected repairs, routine maintenance and minor upkeep, my vehicle is my biggest liability.

I’m also planning for additional irregular expenses in the year’s second half, including merchandise and various other company-related expenses for Money Talks, as well as a handful of financial seminars and investing conventions.

But I’m happy to report I haven’t paid any credit card interest through the first six months of 2023. Making it through the year without paying interest was a goal I mentioned in the first spend check column back in March after I paid $331.50 in interest fees in 2022. I’m doing everything I can to not only limit my expenses but also to pay my balance in full each month.

We’ll see what the second half of the year brings.

Best money move: Shirts

I’m tired of being a walking billboard for other companies. I’m ready to use my attire to build awareness for Money Talks. And so on June 6, I paid $107.92 for 18 shirts of various colors, styles and sizes. Soon, Money Talks apparel is all you’ll see me in. First, I’ve got to get them printed.

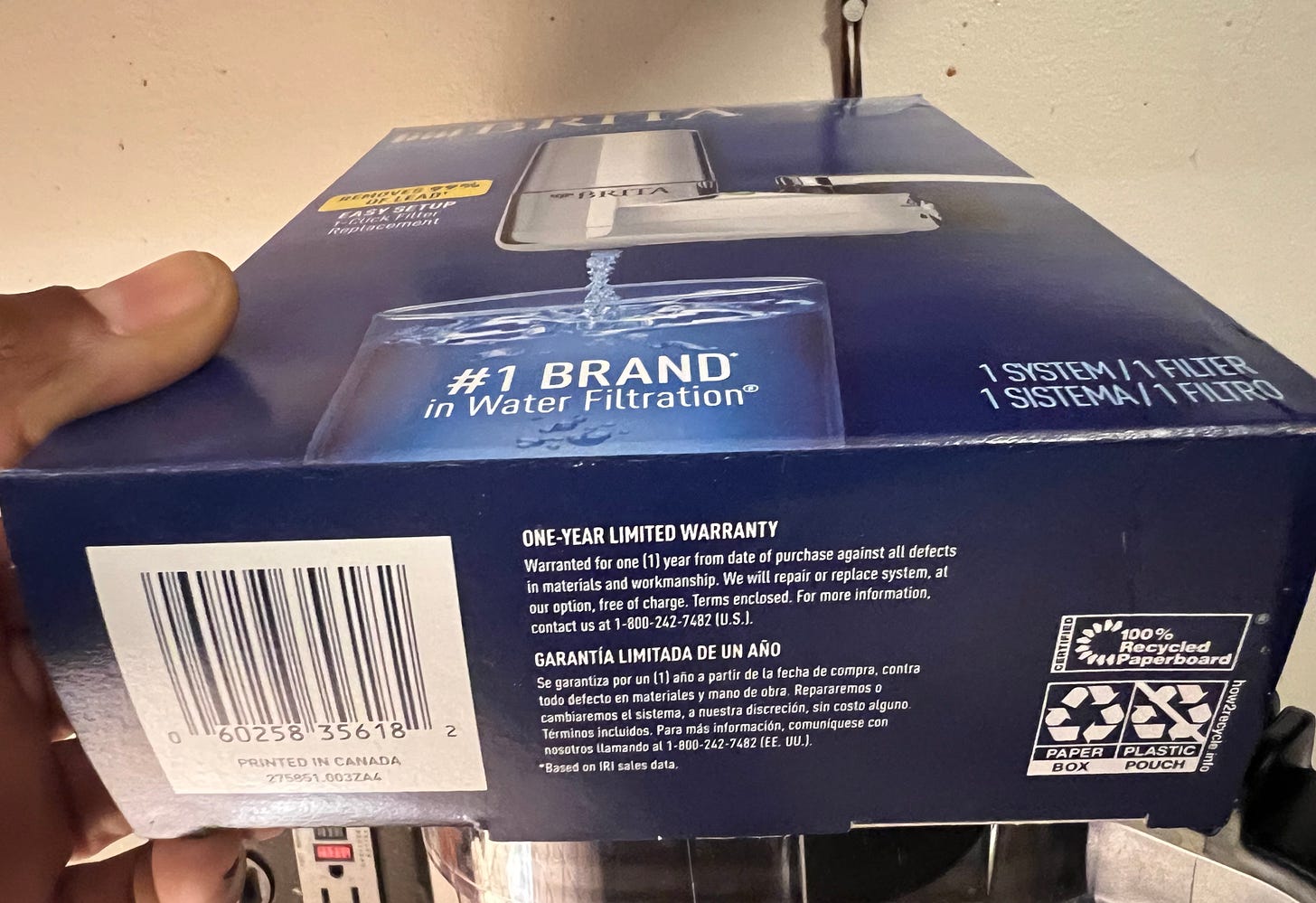

Worst money move: Brita

I told you last month that my Brita water filter has become essential in my life. But I went about replacing my broken filter all wrong. I paid $37.12 in-store at Walmart only to learn once there I could have saved $12 by buying it online. It later occurred to me that I shouldn’t have paid anything at all. Printed on the bottom of the box is a one-year limited warranty. I’ve never been great at holding companies accountable for faulty products. But after coming out of pocket for a replacement I shouldn’t have paid for, manufacturer’s defects are now on my radar.