While contemplating life from a deck chair one night aboard my first cruise, I was surrounded unexpectedly by three men.

It was 11:22 p.m.

I’ve been in some dicey situations, so I wasn’t shaken by their presence. I was confused.

The guys, each probably younger than 23, weren’t confrontational. They were chilling too, conversing and concocting comical, young people’s plans for the rest of their evening. Why they pulled up on me with plenty of space to spread out, I’ll never know. But that wasn’t the most peculiar thing.

Their shoes were.

We were sailing off the coast of Jamaica, coasting somewhere deep in the Caribbean Sea.

And when I looked down, I noticed all three of these cats had on Jordans. To my right were a pair of cool grey 11s. Standing in front of me were the 5s and, my personal favorite, the Jordan 13s.

I couldn’t believe it. I was so amazed I had to take a picture.

I don’t know why I was so stunned to see a group of friends wearing Jordans on my first cruise. I’ve seen brothas at the beach rocking Jordans. But something about this setting made me analyze our behavior more.

The unexpected visual, from my unexpected visitors, showed me how embedded shoes are into our culture. Even on a cruise ship where you’re supposed to kick your feet up, the fellas refuse to board without their best kicks on.

And like millions of others, my heart is with Nike.

My closet is filled with Nike shoes. Not so many Jordans. But I’ve been a supporter of the parent company all my life. Nike’s shoes and apparel have been my preferred brand since I was a little boy.

Still, I never had an ownership stake in the company until Oct. 24, 2022.

I told you last year that shoes are among my money pitfalls. I’ve probably spent five figures on shoes in my lifetime. But all Nike has ever done for me is generate compliments from people I don’t know and others who may or may not like me.

Now, when I travel the country people compliment me on our Money Talks merchandise — and my kicks.

Now, when I purchase and put on Nike products I’m doing so as a proud owner, no longer as a slave to consumerism and cultural norms.

That’s why it felt so good adding to my Nike collection earlier this month.

I didn’t just buy shoes. I bought shares. Before I splurged on my feet, I increased my Nike position in my portfolio.

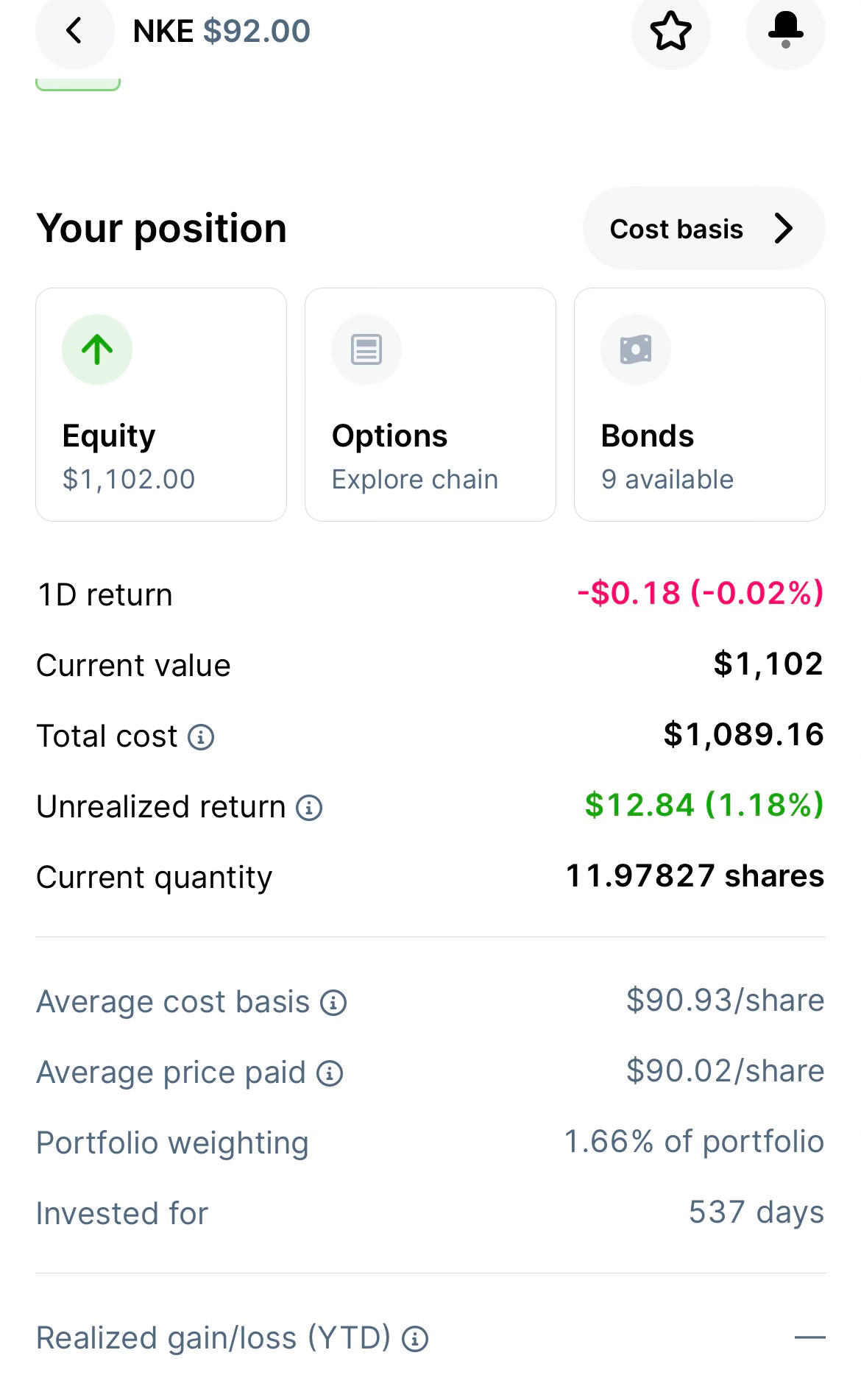

At the start of April, I mentioned that Nike stock was on sale. I’ve waited for a year to be in position to accumulate more equity at the company’s current share price, which closed at $92 on April 12.

I made a deal with myself.

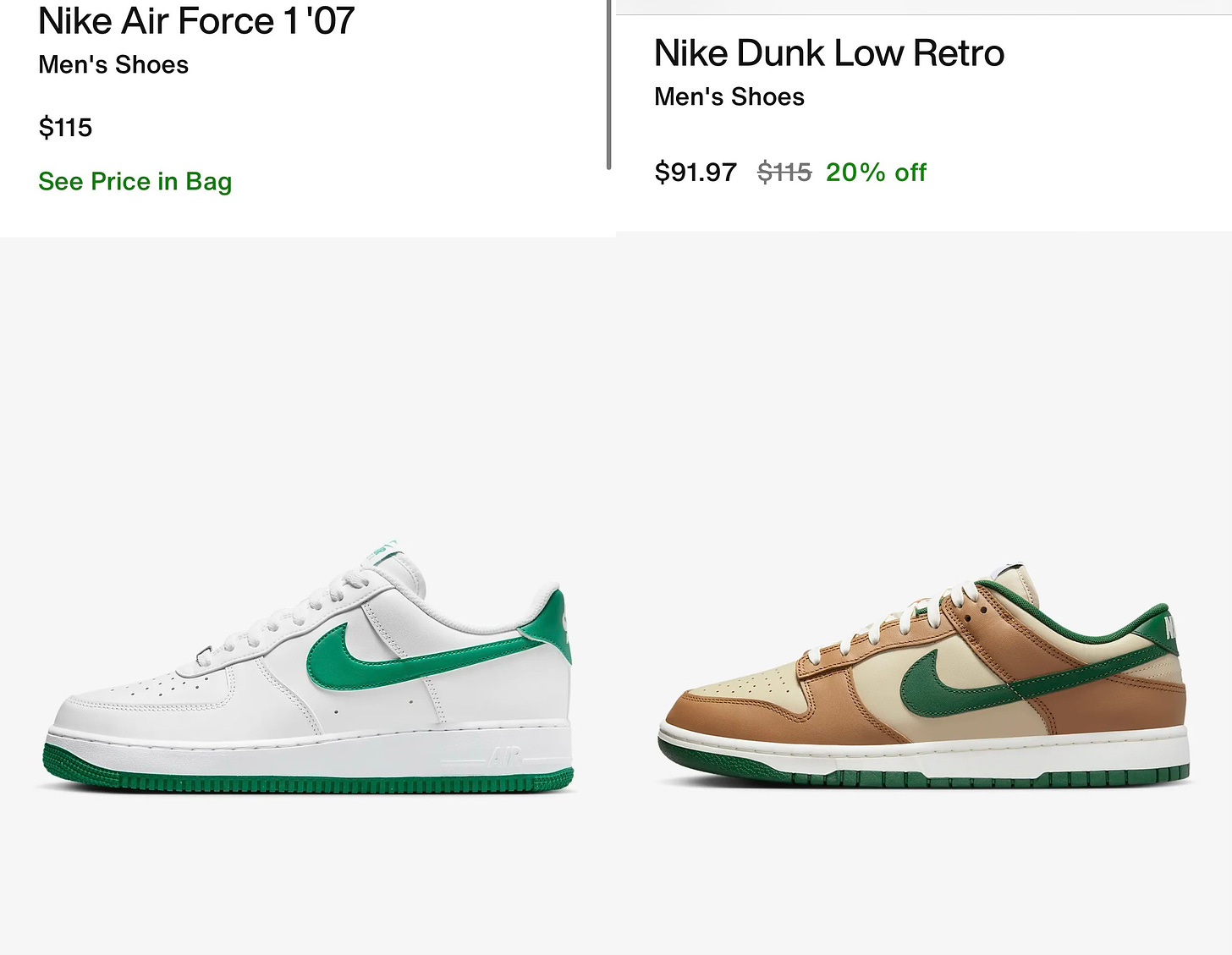

Before I could buy the crisp pair of white Air Force 1s with the Money Talks green swoosh in the middle I coveted, I had to buy Nike stock. The shoes were listed for $115 online, and I knew they would go perfectly with our Money Talks merch. On April 4, Nike shares traded for around $90.

That day, I bought 6.92 shares of Nike. My order put me over the $1,000 mark as an investor into the company as an owner as opposed to a consumer.

That night, I checked back on those Air Force 1s in the middle of the night. They were listed for 20% off. It was a good deal so I didn’t hesitate. At 4:06 a.m., I bought them. Total: $99.59.

Six days later, on April 10, I went shopping again.

I bought one more share of Nike stock for $88.80, which bumped my stake to almost 12 shares.

Two days later, I purchased another pair of Nike shoes. I initially passed, exhibiting restraint despite the gorgeous colorway on these Dunk Low Retros. The mix of rattan, sail, dark driftwood and that Money Talks green swoosh in the middle is sure to draw compliments from people I don’t know.

But when I checked on the Dunk Low Retros in the wee hours of the morning Friday, they too had been discounted by 20% from $115 to $92.

How could I resist? Total: $99.56.

That put me at $199.15 on Nike shoes this month and $710.55 on its stock.

In addition to my strong personal sentiment as a long-time consumer of the company, I’m comfortable investing in Nike because it’s the leader in its industry and a legacy brand. I believe it’ll be around for the next three decades. If all else fails with the company, I’ll still feel good having equity in one of the most recognizable logos in the athletics industry.

I could have thrown more money at the stock. But I held out, adhering to the investing principle of not trying to catch a falling knife. A day after I purchased my last share, however, Nike rallied. I successfully bought the dip. And I’m ready to load up more when another pullback arrives.

I file my shoe purchases under the principle of paying myself first. I don’t splurge or spend much. So when I have a deep desire for a clean pair of shoes that perfectly complement my wardrobe, a couple of hundred bucks is worth it.

By taking great care of my shoes, I also get more value out of them. I have two pairs of Air Force 1s, in different colorways, I purchased in May 2019. They still look fresh out of the box.

With the latest additions to my Nike collection, my shoe game is set for the summer.

But the stock is far more beneficial than compliments from strangers.

Disclaimer: The information contained on Money Talks is not intended as, and should not be understood or construed as, financial advice. I am not an attorney, accountant or financial advisor. These are my personal experiences, and neither this website, newsletter nor podcast is a substitute for advice from a qualified professional.

I love Nike, too.. I went to the University of Oregon so of course. Go Ducks! I finally watched Air and it was so inspiring. I don’t have any Nike stock though .. that may be my first purchase after we build up our emergency fund. Great idea.

You might like this podcast episode that dives deep into the business of Nike! https://open.spotify.com/episode/1HoB680S5p8JdtaoXxnE7P?si=gdmbpCYPSJ2EQUngPY-jYQ