Taylor and G.G. had my undivided attention, precluding me from seeing the email sooner.

I’d waited weeks for it to land, and this is when it came?

Passes for FinCon 2024 were released on March 20, in the middle of one of my favorite masterminds. Since mid-November, we’ve dubbed it our “Ethical Money Chat.” About once a month, we convene to compare notes on our successes and struggles while brainstorming ways to grow our brands.

I met Taylor and G.G. last year through FinCon, an annual conference for financial content creators that prides itself as the place where money nerds unite. That made the timing of FinCon’s email pretty cool.

I loved my response even more.

Without hesitation, I purchased my pass.

The email hit my inbox at 1:26 p.m. I didn’t see it until just before 2. At 2:13, I was registered, with a confirmation email from FinCon already delivered to me. By 4:41, I was booked for my flight and hotel.

Barring a life crisis, I’m headed back to FinCon!

But that only partly explains my excitement. Two things made it important for me to act swiftly.

FinCon’s current 50% discount was the first. That dropped the price of admission to $318.40 for the four-day conference, which will be in Atlanta in October. I passed up a chance to secure my ticket for a slightly cheaper price thanks to being a 2023 attendee. I wasn’t going to miss this deal.

The other factor isn’t financial but behavioral.

It’s not always easy to make decisions quickly. Many people struggle mightily to decide things no matter how much time they have. Even for those who make decisions easily, there is the challenge of making the right decision, as well as standing so confidently on the decision that you make it right no matter what.

In that regard, my decisiveness on March 20 made my day.

My take-home pay is lighter this year due largely to increased investments. But by committing to a second consecutive year attending FinCon, I’m investing in myself. I’m continuing the purposeful pursuit of finding my people. I’m carving out time to listen and learn from financial content creators who’ve found enormous success doing what I’ve set out to do — teaching others to be smart with money.

That intentionality, along with decisiveness, can only help make me a better man, father, creator, investor, business owner and leader.

My hotel for the event will cost $566.77, but I won’t have to pay until October. I used airline points for my flight and paid only $11.20 in taxes and fees. But I hadn’t budgeted for the hotel or the conference pass.

How I’ll manage to pay is less important to me than taking advantage of opportunities. I’ll find a way. That’s become my unofficial mantra.

Five days after booking FinCon, I made another money move I’m proud to share. On March 25, I increased my 401(k) contribution to my company’s match limit. I thought I was at the match max. But I missed the memo about it doubling from its previous rate at the start of the year.

The move will double my contribution each pay period, but it doubles my company’s contribution as well. It’s going to squeeze more of my take-home pay. But I’ll live. I’ll find a way. I prefer to take advantage of 100% of my employer’s match while I can.

But I must be smart with my spending for the rest of the year. Through the first quarter, I was pretty consistent.

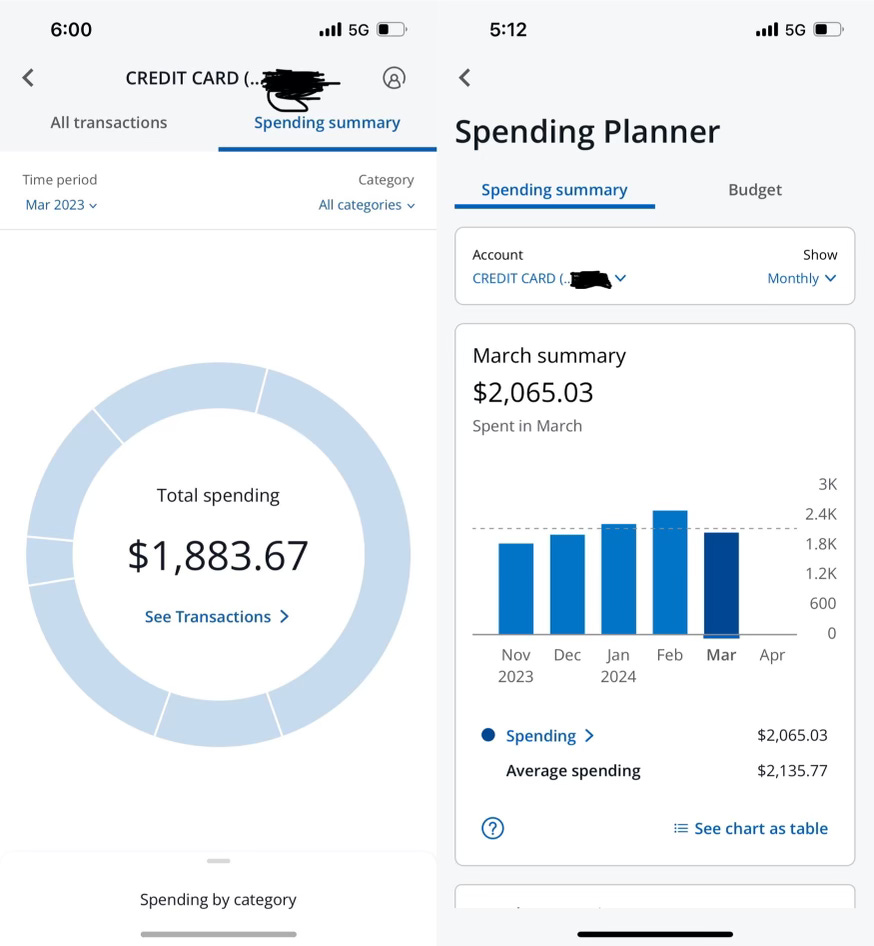

My credit card statement, which carries the majority of my everyday purchases, shows a surplus of only $181.36 in spending in March 2024 compared to March 2023. Deduct the FinCon pass, and I would have come in at less than last year. When accounting for four work trips, my March 2024 balance would be significantly lower than March 2023.

I can confidently say my spending is under control.

My decision making has made the difference, and it’s growing shrewder each day.

Best money move: Birth certificate

On March 4, I paid $29 to order an original version of my daughter Parker’s birth certificate. I had a copy, but I needed an original. It’s one of several vital records I’m in the process of securing. Not having a physical copy of Parker’s social security card delayed me from opening her Roth IRA. Having her birth certificate allows me to prove I’m her father. It will assist me in obtaining her other vital records, as well as additional forms of identification. It also will allow me to promptly manage any future banking needs we have. I was told Parker’s birth certificate would arrive in June. It arrived on April 1.

Worst money move: Vehicle registration

A $151 renewal fee is bad enough. But by paying at a Currency Exchange, I incurred costly fees. First, the company charged $9.50 to renew at its location. Then, I got hit with a 3% surcharge for using a debit card. That added another $4.82. It brought my total to $165.32. And I couldn’t pay with a credit card, meaning I missed an opportunity to accrue reward points. Next year, I’m renewing online.