Spend check: A fantastic January and justifiable February

Tracking and taking back control of my monthly spending.

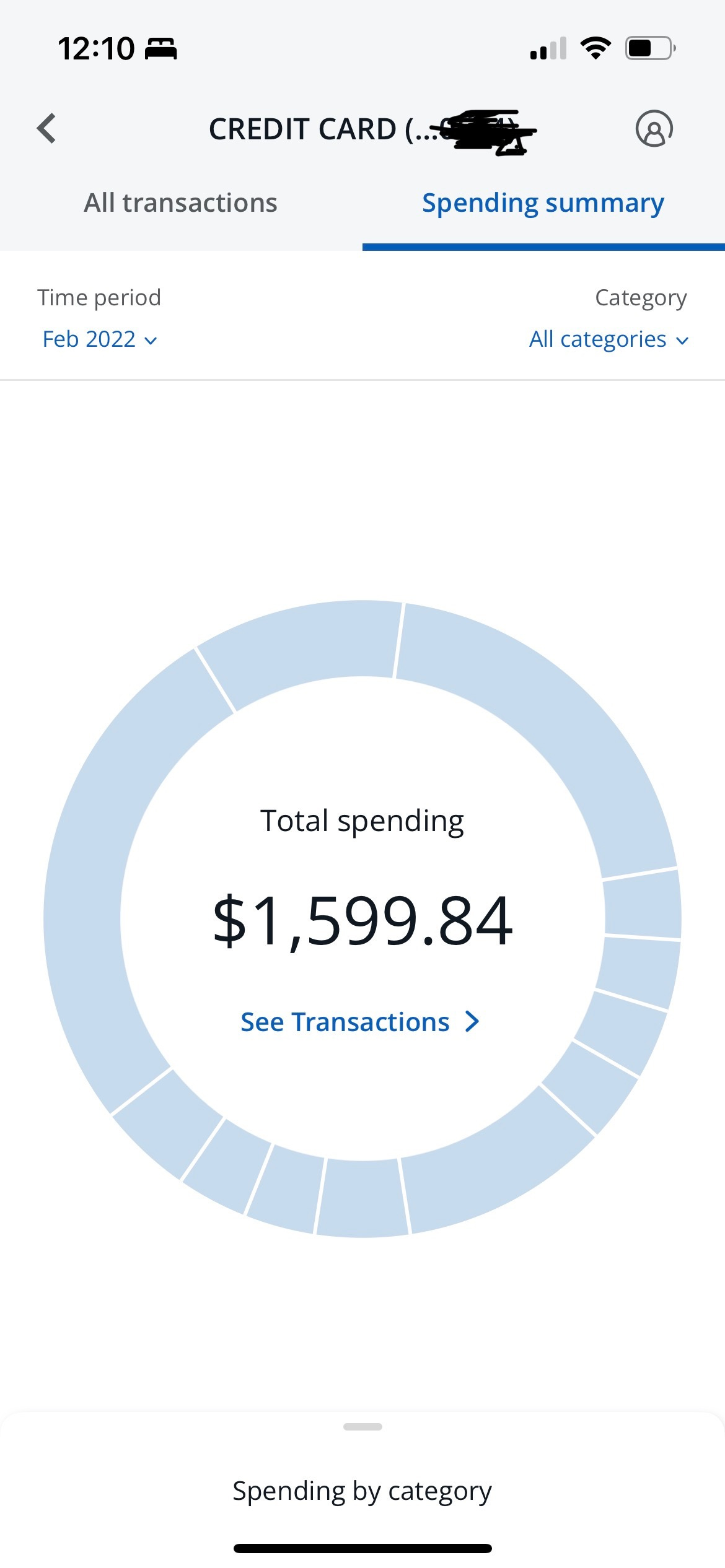

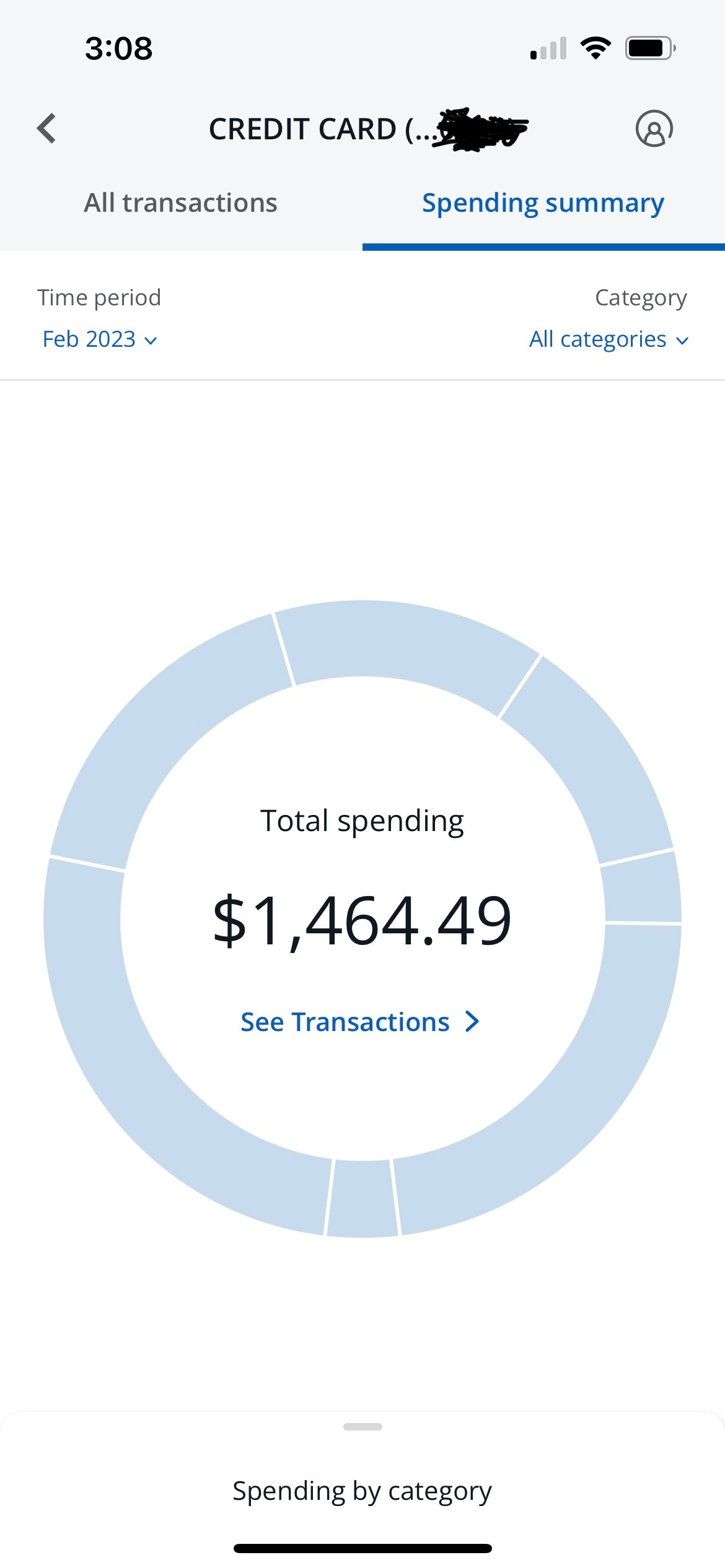

My year-over-year spending for the month of February was higher than anticipated.

But it remained shy of last year’s figure so I consider that a victory. Call it two straight when coupled with January. Let’s see if I can sustain it for 10 more months. That’s my plan.

To achieve my financial goals for this year, I first must seize control of my spending. But before committing to this pursuit of financial freedom, I never thought of my spending as out of control. Only during a recent review of my 2022 credit card statement did I realize my tumultuous spending pattern.

From bar charts so basic even I could comprehend them, I saw painful pictures of how I’d splurge one month only to slash spending the next. Worse, I spent progressively more from April to July, before an August car repair bill smacked me in the face and forced me to get my financial act together.

My problem was I had no idea what I was spending each month. There always was just that imaginary line I knew not to cross. To accrue reward program points, I use a credit card for the majority of expenses, excluding rent, gas, electric and my $10 monthly gym membership. I’ve long known better than to allow my credit card balance to linger. Yet, I paid $331.50 in interest charges last year. That figure makes me cringe now. My goal is to avoid interest altogether this year.

Reducing my spending will go a long way, and each month I will share my progress along the journey.

In 2022, my monthly average spending was $2,764.80. I haven’t graduated to a target number for this year. I just know I can do much better. Cutting my spending by just $500 monthly will result in $6,000 back in my pocket, practically covering my annual Roth IRA contribution limit. Because I have an all-or-nothing personality, I strive to slash substantially more than $500 a month.

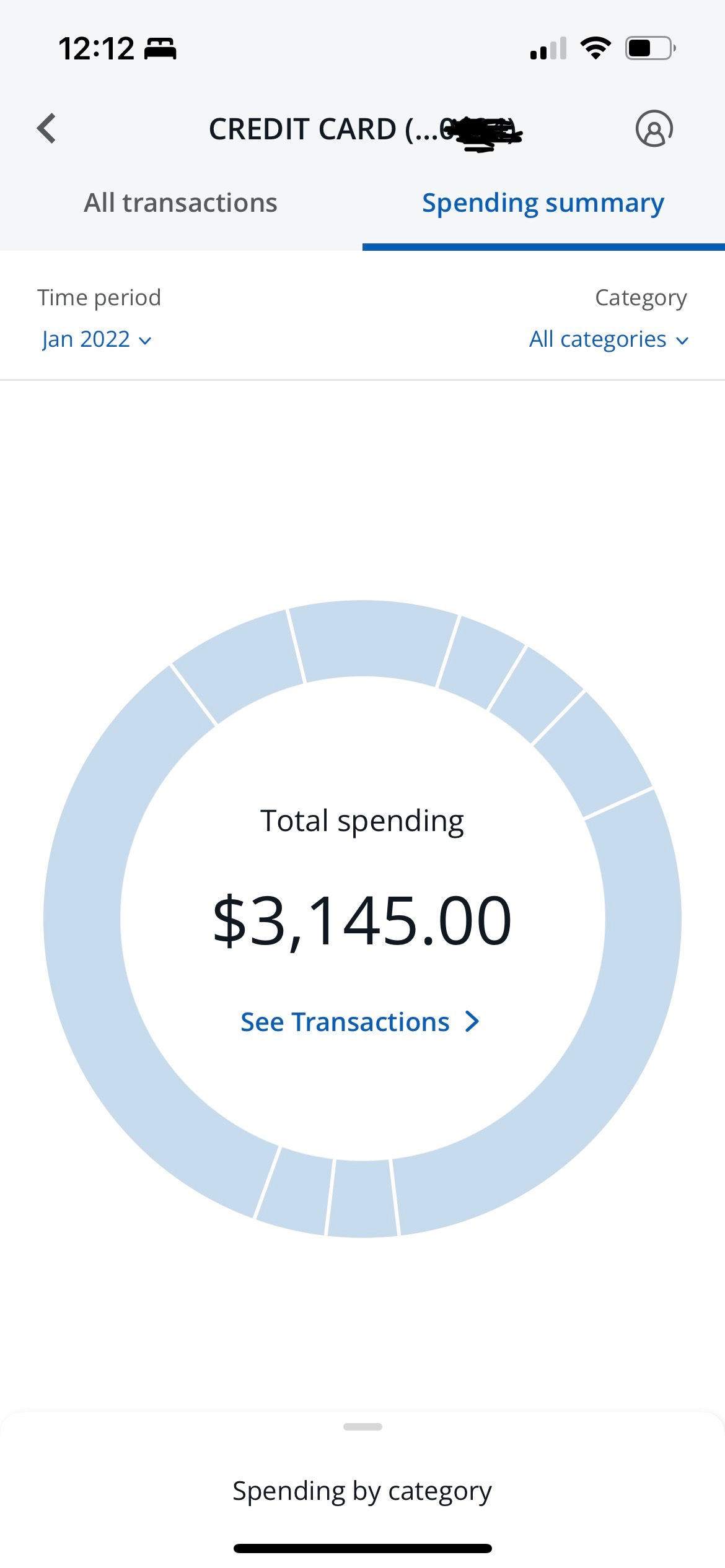

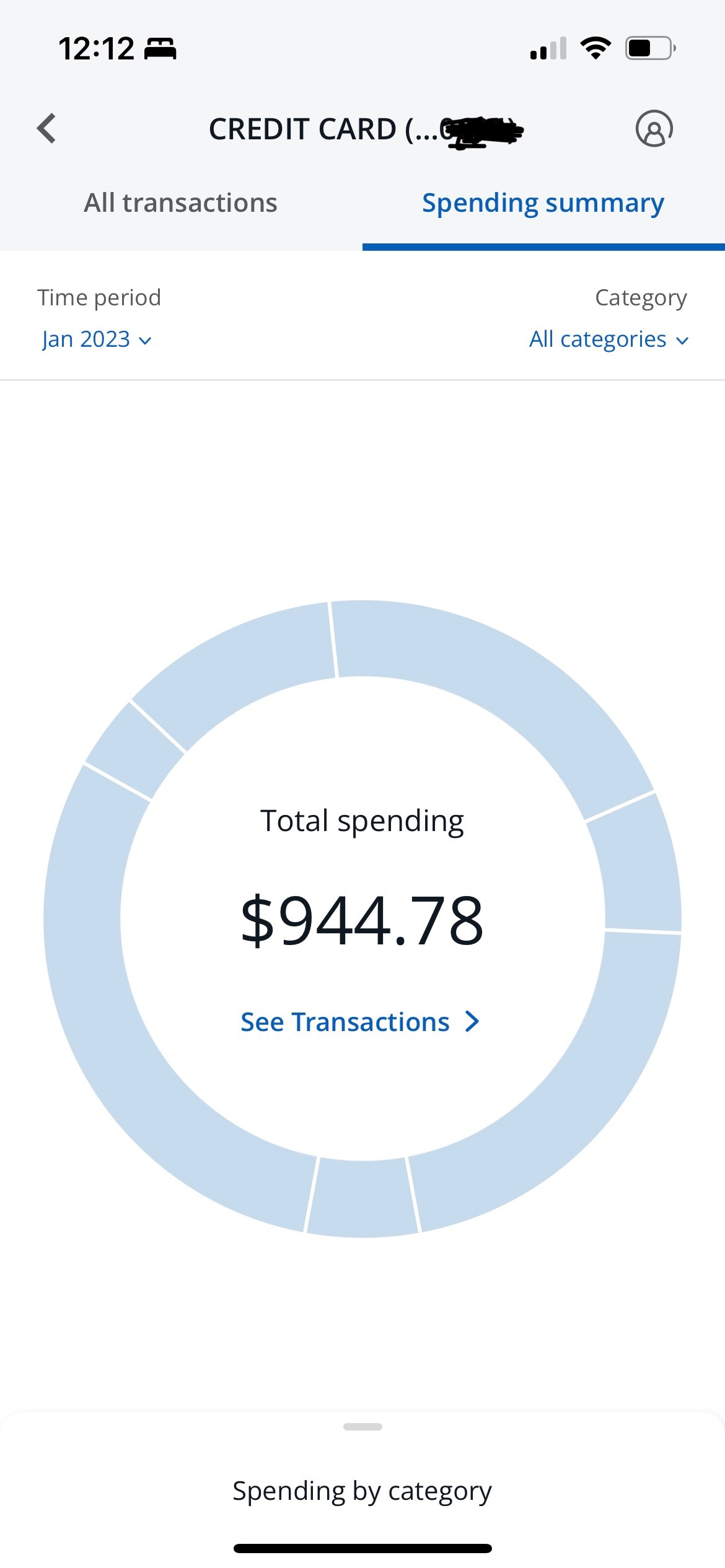

I did just that in January. My spending was so much lower than January 2022, I almost can’t believe it’s my credit card statement. But there’s a catch, or at least more than meets the eye.

Some of my monthly statements from October through April (never mind May, and forget about June!) will include reimbursable travel expenses from work. I traveled a ton for work in January 2022 but made only two business trips at the start of this year. That explains the steep year-over-year reduction in January.

But I also have committed to cutting back. I’ve changed the way I shop, eat, entertain myself and indulge. It’s made a noticeable difference, and it’s become addictive. It feels like I’m competing against myself, and I refuse to lose. Each month, I want to get better with my spending and grow smarter with how I save and invest.

I could have fared better in February. With business travel expenses being approximately the same, I spent only $135.35 less last month than February 2022. My spontaneous trip to Las Vegas, a special treat I secured for the summer (the details of which I can’t wait to share here) and a date swelled my statement. All three were sensible expenses, although none were planned. But they are experiences I won’t regret.

Best money move of the month: Dinner

I picked up dinner with my friend Will at Bacchanalia, an Italian restaurant in the Heart of Chicago. The bill was $50.04. Will left the tip. I have almost completely stopped eating out. But even while committed to a lifestyle of discipline and sacrifice, I understand the value of relationships. Will has been a strong supporter since I moved to Chicago in 2017 and has picked up countless dinners and bar tabs. Before this, he had picked up all our tabs. This was the first time he let me pay. It wasn’t much. But it was long overdue and a small token of my appreciation for our friendship. I plan to always make room in my budget for valued relationships.

Worst money move of the month: Blades

I bought windshield wipers from O’Reilly Auto Parts. They cost $46.28. I’m fine with the price. I couldn’t help but kick myself over the place of purchase. I’m a Walmart investor. I could have purchased my wiper blades there. But I didn’t think of it. It just goes to show old spending habits die hard.