It’s been one year since I decided to get smart with money, and much has changed with me and my finances.

The biggest difference with my money is impossible to miss. It jumps out to me more each month during the look-back period.

Last August, before crippling vehicle repairs forced me into action, I was a mess with money.

I spent frivolously. I saved sporadically. I invested materialistically.

Now, my money has purpose. Today, my finances are on autopilot.

I’ve been faithfully tithing since the start of the year. My emergency fund savings is automated monthly. I’m maxing out my 401K up to my employer’s match. I’m maxing out my Roth IRA via weekly automatic deposits. I’ve earmarked fixed amounts for Parker’s investment accounts and automated those deposits.

Most of my bills are on autopay. I have yet to pay interest on my credit card purchases in 2023. I’ve even paid my rent on the first of each month since last September.

Mountains aren’t moving. It just feels like they are in my life. And here’s where I must implore you to believe that if I can clean up my financial picture, you can too.

But you must start with your attitude and behaviors. First I needed to summon the desire to change and be better with my money. Then it took tremendous sacrifice, discipline, education and an unwavering commitment to delayed gratification to get here.

It’s been worth the toll. Money has become far less of a concern in my life and everyday decisions. I’ve taken back control, and I don’t plan to relinquish my power ever again.

You also must realize it didn’t take a year to complete my transformation. My mentality shifted immediately, which made all the difference. Gradual progress was felt daily. In only a few weeks, it felt like I was cracking codes. After four months, I knew I had figured out enough to significantly improve my family’s future.

My habits have improved so much I walk into better money moves even when I’m not trying. I was surrounded by them throughout August, a stellar month of spending that came in as my second lowest of the year.

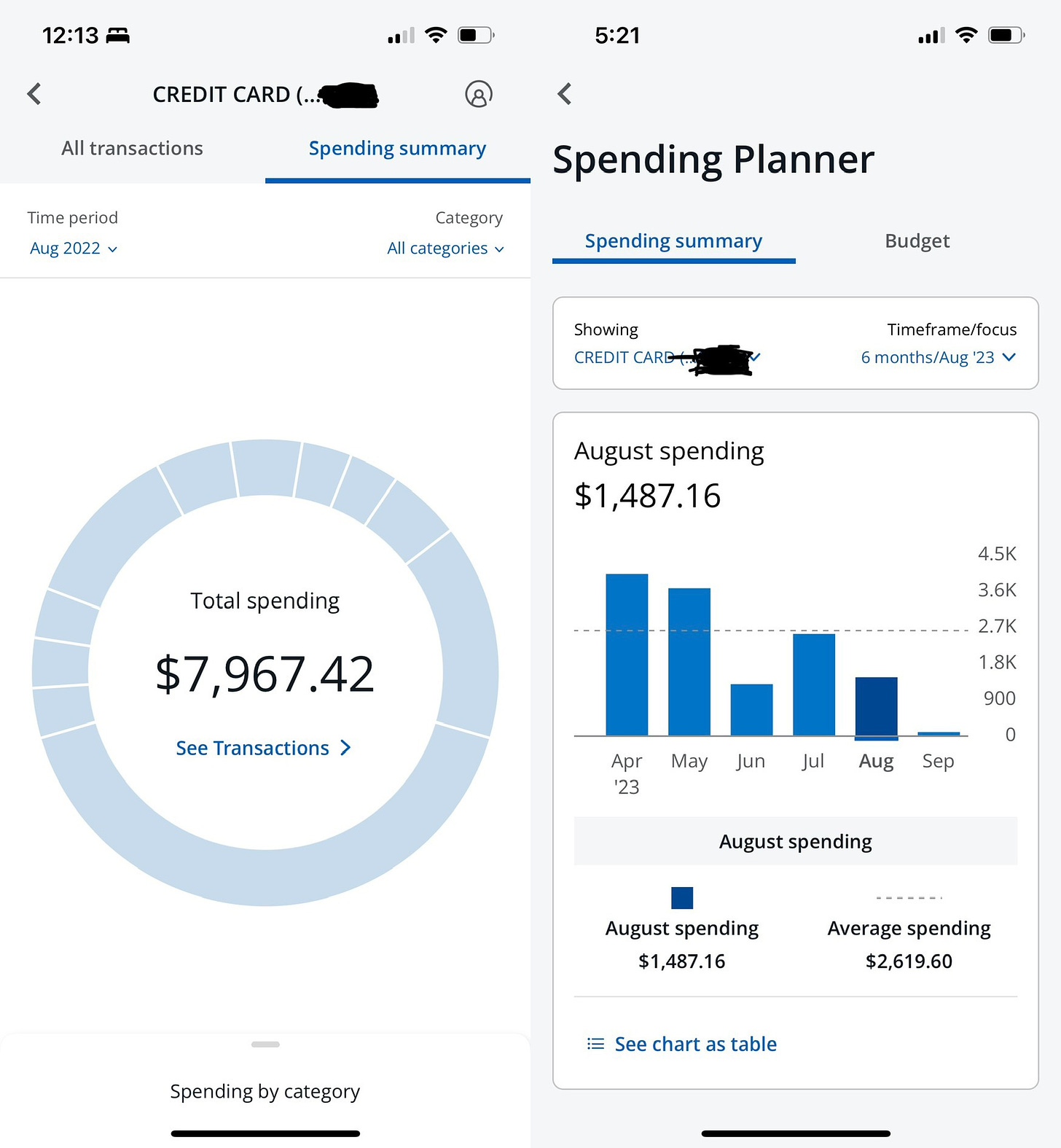

My vehicle repairs alone in August 2022 ($4,715.32) more than tripled my total credit card spending from last month ($1,487.16). I benefited from several money victories big and small last month.

I sustained my annual tradition of delivering Parker a sprinkled, strawberry-frosted donut on the first day of school, just before she boarded the bus. It cost $1.62. I also secured a three-month trial subscription to Bloomberg at $1.99 per month. I don’t have to tell you I’ll be canceling at trial’s end.

I scored two red roses for under $10 and used them to make my lady friend Triest’s day as a token of my love and appreciation for her two years into our journey. And I began a $10 monthly subscription for a popular stock trader’s community group in hopes it will improve my knowledge base and skills.

On Aug. 18, I treated Parker to a rare restaurant. We split nachos that surprisingly cost only $12.29. Parking for our brief stay was $12.60. For $27.21, I also bought Parker a children’s book on the importance of investing.

And I overhauled my wardrobe at a discounted rate.

On Aug. 17, I loaded an online cart of jeans from a popular retailer. My total for six pairs would have cost $368.68. But at a department store four days later, I paid $97.15 for four pairs of jeans and one pair of shorts.

I even stumbled into my favorite scented lotion, heavily marked down at $5. Retail price: $17.95. I left with two bottles and the matching body wash, paying $19.68 for all three.

When the wins pile, they far outweigh the losses.

My handful of hiccups included my $149 annual credit card fee coming due in August and a $120.42 fee for my Chicago city vehicle sticker, including the upcharge for my residential zone number. I also got hit with an unexpected $97 overage fee from my attorney as well as $55 rideshare for an early morning lift to the airport in Atlanta.

But once you alter your attitude and adjust some basic behaviors, money problems can quickly become a thing of the past.

With each passing month, I’m proof.

Best money move: A Walmart return

I told you last month that we finally did our long-awaited lemonade stand. But initially, we didn’t have a stand. And so I bought a rectangular folding table from Walmart specifically to fit our one-day need. We used it, tried our best to not damage it, and the day after our lemonade stand I promptly took it back. When the customer service employee asked if anything was wrong with the table I simply said, “I don’t need it.” It was the truth. And $43.15 was returned to my credit card.

Worst money move: Drinks

I spent $34.02 for two drinks at the LL Cool J concert on Aug. 13. It doesn’t sound like much. But for the same price, I could have purchased a bottle and enjoyed it before and after the show. That was my plan. But I allowed pure laziness to prevent me from going to the store. I ended up paying a premium and getting horrible value for my dollars. These are the money moves I’ve learned to reduce. Clearly, I have yet to eliminate them.

I also had the experience of paying $40+ for two drinks at a concert last month! 😝 Those were the only two drinks we had lol… But for that price, I could have bought a t shirt instead and had a lasting memento!

Congratulations! Improving money habits is as tough as altering any other sort of behavior or addiction. You are on your way and, just as important, so is Parker. (That Walmart move wasn't cool, though. They're not in the rental business -- and they didn't even clear rent on that return.)