I’ve learned there are four basic principles for becoming rich.

They’re so simple, anybody can do them. It’s what gives me confidence along our journey.

The first is spending less than you make.

Mastering this will automatically grow your net worth. But for many of us, it requires an extreme mindset makeover, which mandates we examine and eradicate long-held habits.

And while everyone isn’t comfortable looking in the mirror, I am.

Before I could begin building wealth, I had to reshape my behavior. No amount of income can offset a larger outflow.

In the first half of last year, I still was living above my means. I didn’t think I was. But my credit card interest said otherwise. I finished several months in 2022 with a balance that I didn’t and couldn’t pay off. It didn’t bother me nearly as much back then. It was what I did. It was how I lived.

Now I avoid bad debt or eliminate it as quickly as possible if it can’t be avoided. It’s the second principle for becoming rich. You can’t build if you’re buried from borrowing. You can’t truly own if you always owe. It’s another reason why I’ve grown meticulous about my spending.

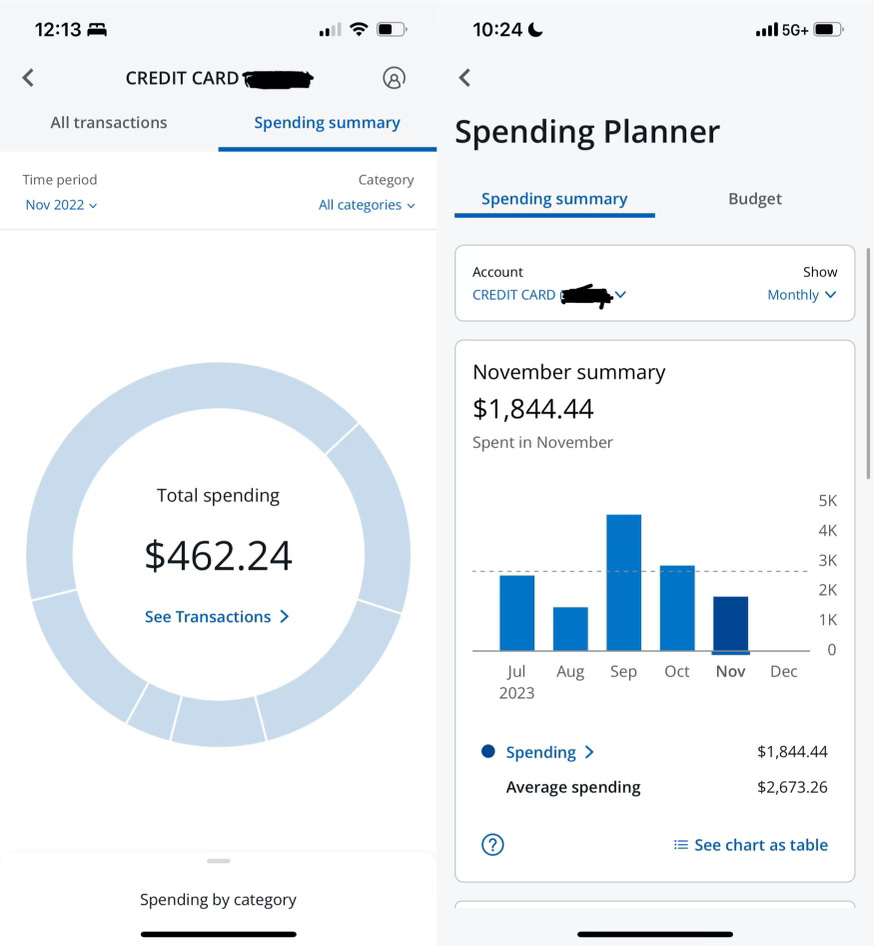

But there’s a limit to how much spending you can cut. I found my floor in November 2022, three months after undergoing my financial awakening.

Determined to get my money right, I didn’t spend a dime unless I absolutely needed to. I bought inexpensive groceries and cooked. I didn’t go out to eat. I cut out drinking and dating.

I stopped spending money and started working on myself.

I did go crazy in the stock market with money from an inheritance, which isn’t reflected in my November 2022 spending. Also not shown is the five-day, Caribbean birthday cruise I enjoyed and paid off previously. Still, the biggest shift in my everyday financial behavior can be seen in my November 2022 credit card statement.

My credit card balance carries the majority of my purchases so I can accrue airline points to fly for free. A few mainstays are excluded, such as rent, gas for my apartment and vehicle, my electricity bill and my $10 monthly gym membership. But with the lion’s share of my expenses going on my credit card, it’s the best place to monitor my monthly spending. Each month, I have shared my progress, for better and worse.

I had no chance of my November spending coming in below November 2022.

But that doesn’t mean my habits have worsened. No, they’ve only evolved.

More than half of the nearly $1,400 differential in my spending from November 2022 to November 2023 stemmed from work related travel expenses and personal development. I spent almost $800 on my trip to Atlanta for the ForbesBLK Summit, as well as reimbursable meals and ground transportation/parking for work trips to Milwaukee and Oklahoma City.

The difference in my spending without those expenses: $592.69.

No longer am I driving myself crazy trying to reduce my spending. I don’t have to. My habits are in place. I’ve streamlined my routine decisions and removed that worry.

Now, my focus is on the third and fourth principles for becoming rich: developing multiple streams of income and investing the surplus without ceasing.

I’m already eager to experience my transformation next November.

Best money move: Books

Every year since 2018, I’ve created yearly picture books of me and Parker to document our Daddy-daughter days. If you don’t already, I highly recommend looking into this route. They’re cherished possessions for us, a tidy space to store the memories we capture along our journey.

But I’d been slipping for the past two years. I neglected to complete our photo books from 2021 and 2022. Finally, I caught up. With Parker’s input on design, we finished the books on Nov. 13. I paid $96.52 for both, including tax and shipping. I saved 40% off the regular price by doing a quick search for Shutterfly discounts.

The best part? Parker declined to open the books last Thursday. She chose to wait until her birthday in a couple weeks. “See, Daddy,” she said,” I can be patient sometimes.”

I never imagined the books also would provide her a lesson in delayed gratification.

Worst money move: Fruit

It started with a pack of blueberries.

The carton was already molded when I purchased it from Walmart. I didn’t notice nor did I return it for my money back after I did. Instead, I foolishly bought another package a few days later. This time, I let them sit in my refrigerator too long and mold as well. That was on me. Still, I wouldn’t recommend buying the Blueberries Bleuets from North Bay Produce. It’s not a good product. I should have read the reviews.

At $7.94 per package, I spent nearly 20 bucks and didn’t eat a single blueberry. Add in a nearly $3 pineapple that rotted before I sliced it, three bananas and two apples from the incomparable Honeycrisp family and my total loss likely exceeds $20.

It’s a small example. But I’m furious about those blueberries.

The larger point, however, is wastefulness. It’s an issue I’ve mentioned before, which makes it a problematic pattern — still. The amount of money I wasted on fruit in November is negligible. The behavior is what matters. And my habits clearly need more work.

The yearly book of pics is a great idea. Takes some discipline!

My man freeze those blueberries as soon as get them home. Few things are worse than seeing them molded. It's really easy to defrost them if you want to add them to something besides smoothies.

https://oregon-berries.com/recipe/frozen-berry-quick-defrost-technique/

Also, invest in a Pineapple corer I think it might make it on your Best Money Moves list after the first use. https://amzn.to/3QZFxL6.