My life is simple. I like it that way.

My priorities are clear. My stress level is low. I don’t spend major time thinking about minor matters.

That wasn’t always my reality. I didn’t find true peace until this past year. But reshaping my mindset with money organized my life.

By becoming intentional with every dollar, I didn’t simply set out on a journey toward financial freedom. I also stumbled into side effects, big and small, I never expected. I can trace them all back to one thing.

I decluttered my decision-making.

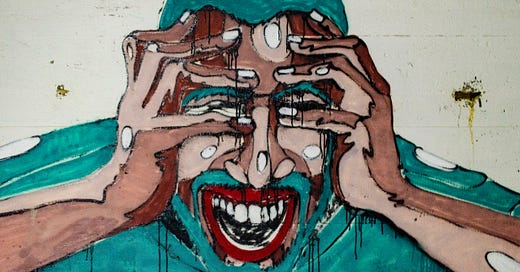

Medical professionals define decision fatigue as a phenomenon where the more decisions a person makes over the course of a day, the more physically, mentally and emotionally depleted they become.

Every waking second offers a chance to decide something. What to eat? What to wear? Who to call? What to watch? Where to go? Which route to take?

Over the past 14 months, I’ve almost completely removed those largely trivial choices from my daily life. It wasn’t my intention. It was a side effect but a hugely beneficial one. It’s brought greater clarity between my wants and needs, saved me precious time and eliminated unnecessary worry.

In June, I shared with you 10 steps for a happier life. They were basic but healthy behaviors. Incorporating them added structure and discipline. They didn’t just save me money, but they also boosted my mood.

The same can be said for many other practices I’ve outlined in columns detailing my routine spending. Individually, they might seem minor. Collectively, they’ve become a trusted roadmap that’s made life much easier to navigate.

Here are 10 steps I’ve taken over the past year to reduce my decision fatigue.

Prepared for the next day: Making a to-do list before bed has brought better focus and productivity to my days. It’s a reminder of my most important tasks and the things weighing heaviest on my mind. Jotting them down gets them out of my head. Seeing them on paper or digitally on a screen keeps me focused on completing them rather than committing to distractions. Crossing them off my list leads to a clear conscience.

Developed a gym/workout routine: I listed this in 10 steps for a happier life. I included it again here to stress the importance. My weekly gym routine doesn’t just help my fitness. It also provides me with direction. Every day I wake up from Monday through Friday, I know I must make it to the gym. I don’t have to think about it. It’s become second nature. And when I make it in the morning, my gym routine structures my days so that I’m putting myself first in a healthy way. The clarity that comes from regular exercise then helps me make better decisions.

Stuck with one grocer: Whether groceries or household products, I no longer have to think about which store to shop. I’m loyal to Walmart. A shopping list also has helped me curb costly impulse buys.

Bought generic over name brand: Not only am I loyal to Walmart. I’ve also committed to purchasing its Great Value brand almost exclusively. It’s cheaper, and I never have to spend time thinking about what brand to buy.

Committed to cooking: Whether fast food or fine dining, I love restaurants as much as the next person. But routinely dining out had real consequences for me, physically and financially. Not to mention the time spent thinking about which establishment I would give my money to just for my next meal. Cooking has changed that. Now, I prepare the groceries I purchase and am just as pleased as I used to be when I ate out.

I chose water: My Brita filter was a game-changer. I have little reason to reach for any other beverage. Water is truly all I need. Choosing water helped me to kick my drinking habit and stop buying sugary juices. It’s helped to streamline my grocery shopping, eliminate ridiculous bar tabs and reduce costs whenever I do dine out.

I simplified my wardrobe: I said in July that Money Talks apparel is all you’ll see me wearing soon. I’m proud to have reached that point. By rocking Money Talks shirts, sweatshirts, hoodies, jackets and hats, I’m not only raising awareness but also greatly reducing the daily decision of what I’m going to wear. All I have to decide now is what color shirt or hoodie I’m going to throw on. My wardrobe now is basic. It consists of Money Talks tops, inexpensive jeans and cool gym shoes. My Money talks hat complements my attire perfectly and helps to keep my bald head warm. I love not having to think about what I’m going to wear.

Stuck with one gas station: Getting gas no longer is a guessing game. Whenever I must pull over, I go to Shell. I stopped caring which station offers the lowest price when I became a loyal customer. Now, filling up comes with perks. At least five cents off. Most of the time 10 cents. And sometimes more.

Eliminated mindless entertainment: One of my favorite columns I’ve written so far is The Monotony of Morning Talk Radio. It details how I shifted to a money mindset by refusing to settle for entertainment and instead seeking education. I also shared how I’ve cancelled more than a dozen subscription services. I don’t waste time figuring out what I’m going to watch. Unless it’s “Market Mondays” or “Trappin Tuesday’s” on YouTube, or the Minnesota Vikings, my television is mostly off.

I chose consistency: I can go down the list of household and miscellaneous products I repeatedly purchase, from razors to shaving cream to toothpaste, mouth wash, soap, lotion, laundry detergent, trash bags and more. Rather than shopping for the best deals or hottest new items, I’ve reduced my decision fatigue by becoming a repeat purchaser. It’s exhausting searching for the perfect new lotion.