ATLANTA — I booked my flight and hotel for Atlanta back on Sept. 16.

The fourth and final business conference I committed to this year for personal development is today.

But somehow, it didn’t hit me until a month after booking my travel that my Minnesota Vikings would be in town to play the Falcons. And the game’s kickoff just happened to align perfectly with my plans.

You already know what I did.

I pounced. I promptly bought a ticket to be in the building Sunday.

I told you about my irrational obsession with the Minnesota Vikings in the about section of Money Talks online. In March, I mentioned that my Vikes are among my top 10 money pitfalls.

As fate would have it, this NFL season wouldn’t pass without me spending on my favorite sports squad. In this instance, I was powerless. The moment I realized my boys would be in town at the same time as me, an impulse buy became inevitable.

I didn’t plan to attend a Vikings game this season. The experience wasn’t in my budget. But tickets were reasonable, especially when compared to the $650 price tag I considered for Bruno Mars back in February.

More important than price was value. That’s become a theme.

It didn’t matter to me that I didn’t plan to attend the game. It all came together perfectly. When that happens, I view it as a sign. There aren’t many other experiences that bring me joy like the Vikes. So I’m willing to pay.

What I didn’t anticipate is that starting quarterback Kirk Cousins would tear his Achilles’ heel five days after I paid $167.02 for my ticket on Oct. 24. Minnesota already was without injured star receiver Justin Jefferson among others. When Cousins went down, I almost felt like I threw money down the drain.

But I consider the Vikings family. And I’m so glad I came. Despite the adversity, we went to Atlanta and got it done, winning in the final minute against all odds.

Needless to say, it was money well spent.

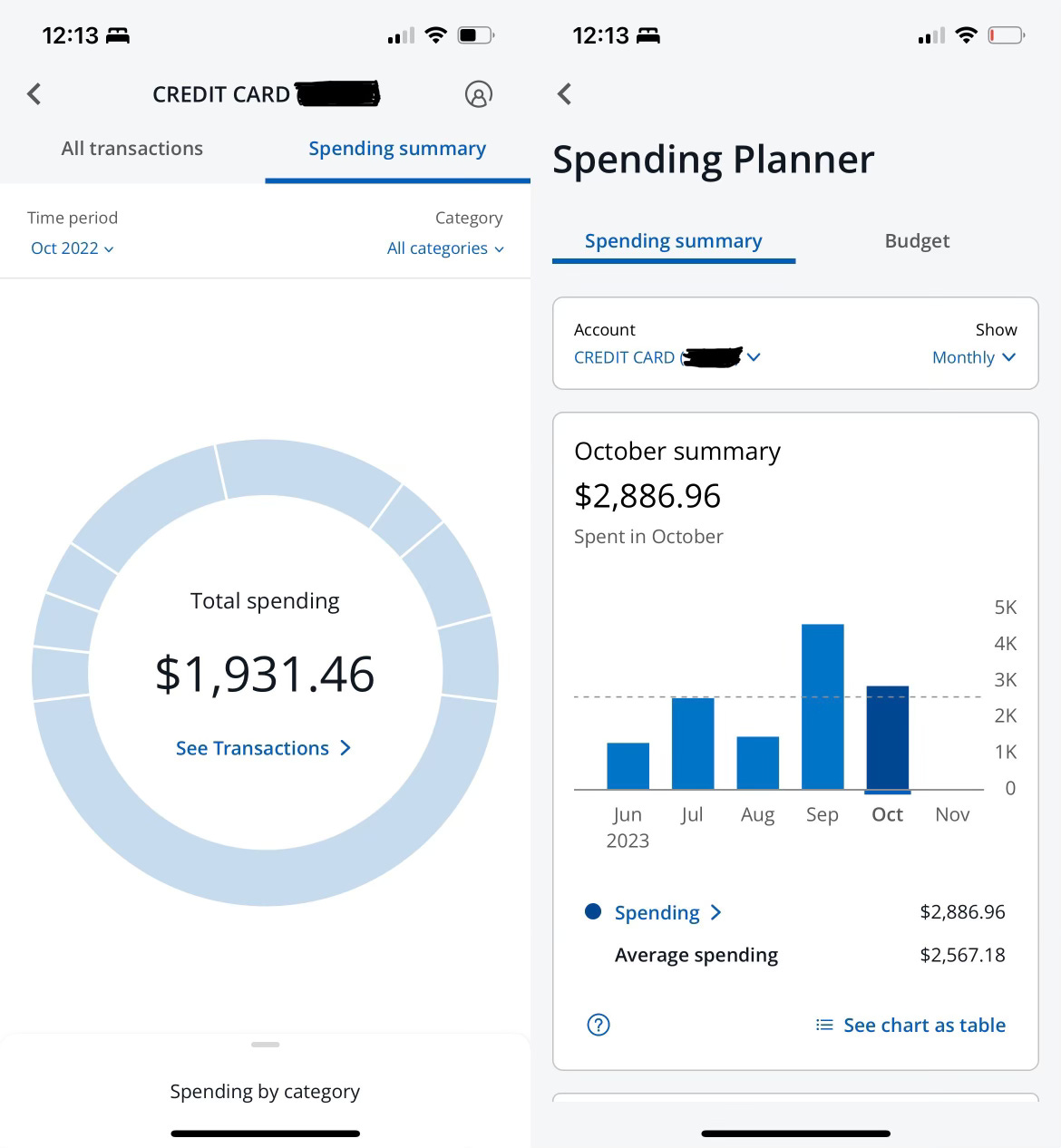

The rest of my spending in October was on operating expenses. Business travel made up $1,368.85 of my October credit card bill. That includes work travel and events I paid for as part of my personal development. The majority of that sum, which stemmed from work expenses rather than the personal variety, already has been reimbursed.

I spent another $250.50 on food and drink, which rivals the most I’ve spent in a single month this year in that category and is mostly from business travel. It’s a sign that my habits have changed, and I’ve committed to cooking.

Other than that, it was another clean month.

I’m ready for business expenses to slow to a crawl as I transition to applying what I’ve learned while focusing on my day job. But I don’t know if they will ever stop.

The goal is to continue growing, continue learning and continue making meaningful connections.

That costs, and as I’m learning it’s more than worth the price.

Best money move: Vikings tickets

Within reason, spend on what brings you joy. That doesn’t mean splurging on every good or guilty pleasure. But within reason, and after consistent sacrifices, there’s nothing wrong with a passion purchase.

Worst money move: Crawfish étouffée

I don’t have a picture, but I spent $16.95 on the smallest bowl of crawfish étouffée while in New Orleans last month for FinCon. It was at a restaurant in the French Quarter, a tourist trap if you ask me. I know better. I’ve traveled to New Orleans for years. But I didn’t expect a bowl this small. And it wasn’t that good. A perfect example of why it’s not worth my time or effort to eat out while on this journey.

Skol, Vikings! Schooled me. Now I know some Danish. Cheers y’all.

"Skol, Vikings!”