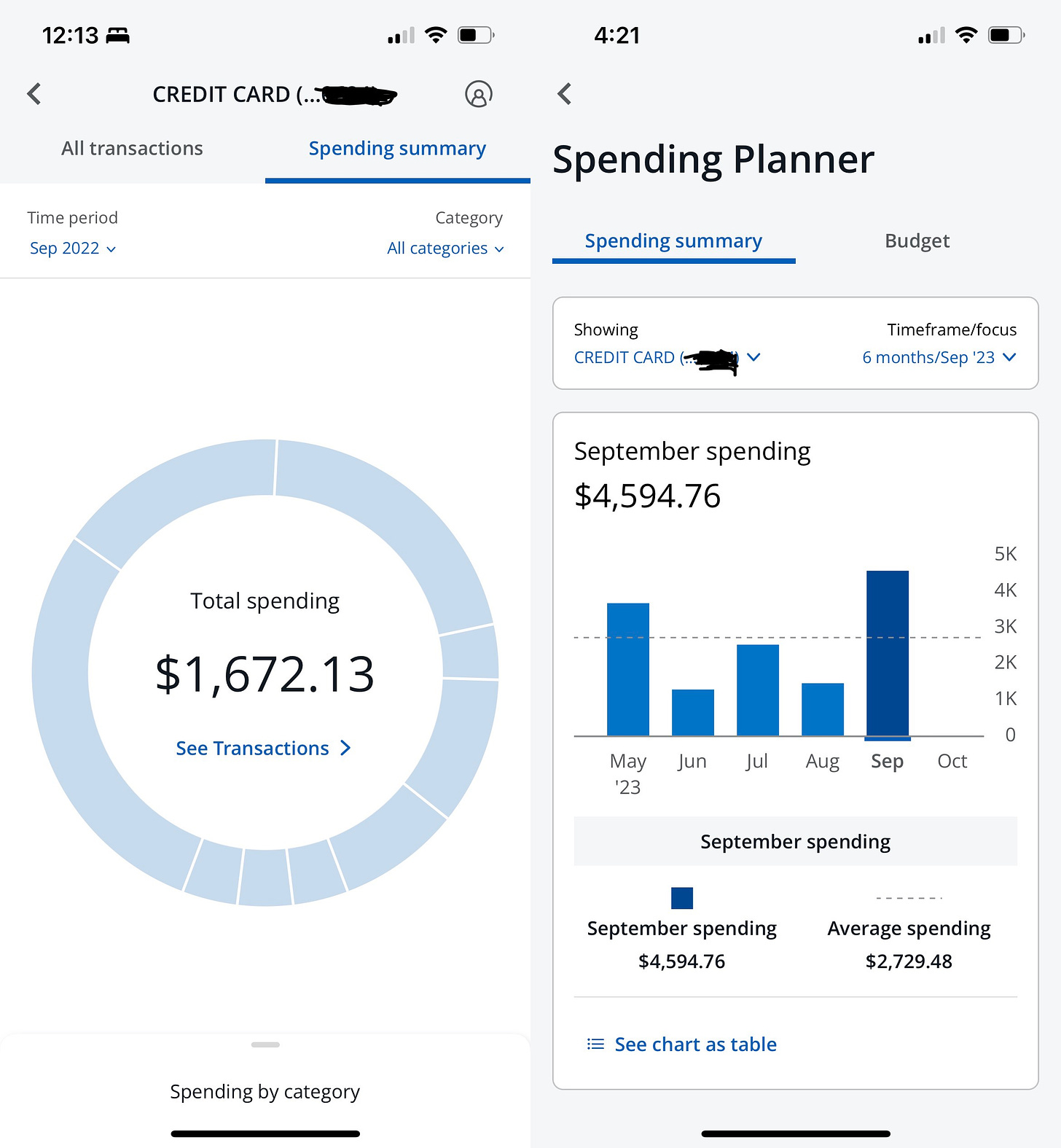

My spending was fairly sensible in September.

That’s if you don’t include the new car I bought.

Take away that $3,000 down payment and my credit card statement would reflect a mere $138.04 surplus in spending last month compared to September 2022 after accounting for separate charges for gas for my vehicle. It’s another indication that I remain on track with my fiscal discipline.

The year’s final quarter feels like it will be smooth sailing now that I’ve committed to a routine. Assuming this last leg goes how I anticipate it will, this will be by far my most successful year financially. Not because I made more money than I ever have or landed a better job. I didn’t and haven’t.

Instead, it’s because I learned how to better manage the capital I possess, and I have committed to working the process until the process works for me.

Examine my credit card statements through the first three-quarters of the year and you’ll find consistency. The only spikes in spending are from tax season, car repairs (or a purchase) and reimbursable work-related expenses. Gone are the impulse buys that used to line my ledger. Missing are the makes-no-sense bar tabs and pizza grabs that once ballooned my monthly bill.

My unremitting discipline in marching daily toward our destination matches my burning desire to get there. That also is reflected in my spending. In that sense, September was similar to July. When I wasn’t busy throwing down money on a car — which still nags at me; even though it was a necessity, nostalgia and a new car note make it tough to celebrate — I was again putting money into my personal development. My new vehicle isn’t the only area where I must adapt to change.

I registered for three business conferences in September. I attended the first virtually last month. I’m traveling this month for the second one, as well as next month for the third. I’ve never been the type to attend many conferences. I’m more of an introvert. Saddling up to strangers and striking up a conversation, and actually finding common ground, has never been my strong suit.

But before I can reach a new stage I first must step out of my comfort zone and embrace the changes that come in a new season. I anticipate I’ll learn and grow from all three conferences while also networking with scores of like-minded individuals.

This month’s conference is a four-day affair that costs quite a bit. Yet I based my decision on value rather than price. With a discount I received from attending a prior conference, registration ran me $234.18, down from an early bird price of $299 when I secured my ticket on Sept. 1. The current price for the same admission is $369. Suddenly my deal looks sweeter.

The hotel is what will hurt. For my four-night stay in New Orleans, I’ll spend $923.14. That doesn’t include meals and ground transportation. Those charges will be posted on my October credit card statement, which I’m already bracing for.

I didn’t suffer too many other blemishes in September. I got slapped with a $75 parking ticket at 9:52 a.m. on Sept. 8. And I deserved it. I parked in a residential zone without the proper permit. It was raining, and I was without an umbrella, running in for only a hot second to drop off paperwork. The funny thing is I had a feeling I’d get a ticket, as if the parking enforcement crew was determined to ruin someone else’s day because they had to be out in the rain. Oh well.

Positive cash outflows included an impromptu but prudent dinner outing with Parker, nine holes of golf with Parker, a birthday gift for Parker’s friend Tiffany, supporting a Black-owned candle business and securing more sweatshirts and hoodies for additional Money Talks merchandise. I even made it to the dentist.

One thing I didn’t do also stood out. I had a change of heart while walking the aisles of Walmart and decided I didn’t need my favorite locally brewed IPA to pair with the Minnesota Vikings’ season opener. At $10.98 before tax per 6-pack, I saved my bank account from leaking at least $22, and I saved my body from a sea of empty calories.

Boozing while watching my Vikes lose to Baker Mayfield and the Tampa Bay Buccaneers would have only induced more drinking.

I’ve come too far to let Baker Mayfield break me.

Best money move: Plutus Impact Summit

The aforementioned virtual conference was the epitome of money well spent. In its 14th year, the Plutus Impact Summit is a two-day event enriching financial content creators and brands. The organization, like the second conference I’ll be attending this month, will connect me with like-minded individuals who all share some version of my mission to help others become smarter with money. For $49, I met and mingled among my peers and pioneers in the personal financial space. It was a small price to pay to start building my community.

Worst money move: Chicken wings

The race was close this month. There was the parking ticket, which was bad. But a boneheaded decision to pay $62.74 to get the oil changed on a vehicle I wound up selling five days later might have been worse. At least my new, pre-owned car came with a fresh change of oil. There’s no justifying the untouched chicken wings I was forced to toss on Sept. 4. The “sell by” label read “Aug. 29.” By the time I opened the 4 1/2-pound package, the wings’ repugnant odor immediately invaded my nostrils. Infuriated, I had no choice but to bag up the wings and walk them to the dumpsters in the back alley. It was $13.47 I literally threw away.