Spend check: Surviving an aggravating April

Spending skyrocketed in April, personally and professionally.

Nobody ever talks about their least favorite month.

Plenty of discussion centers on people’s favorite season or, because of their birthday and interests, their favorite month. But rarely does one’s least favorite month get mentioned.

Mine is April.

Between tax season, a busy period with work, spring showers and, in Chicago, lingering snow, you can have it. I dread doing my taxes, struggle balancing work-life commitments and crawl into funks when crummy weather affects my mood. Aside from that, April is just peachy.

But the month gave me another reason to welcome May: my spending spike.

Before getting to the bad, I must recognize the good. I’ve made it through the first third of the year diligently tracking my spending. That’s a victory in itself. My behavior has changed for the better, and I’ve felt the benefits immediately.

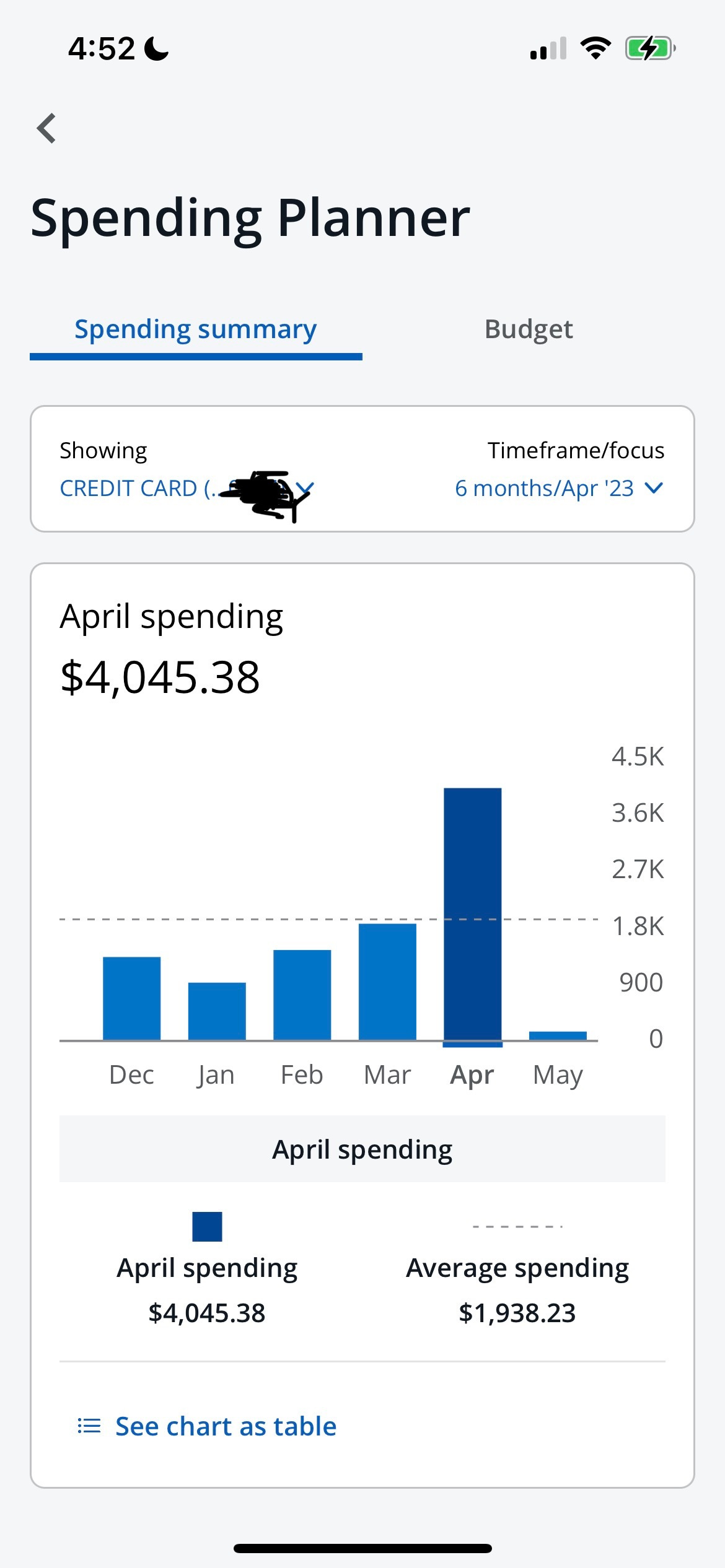

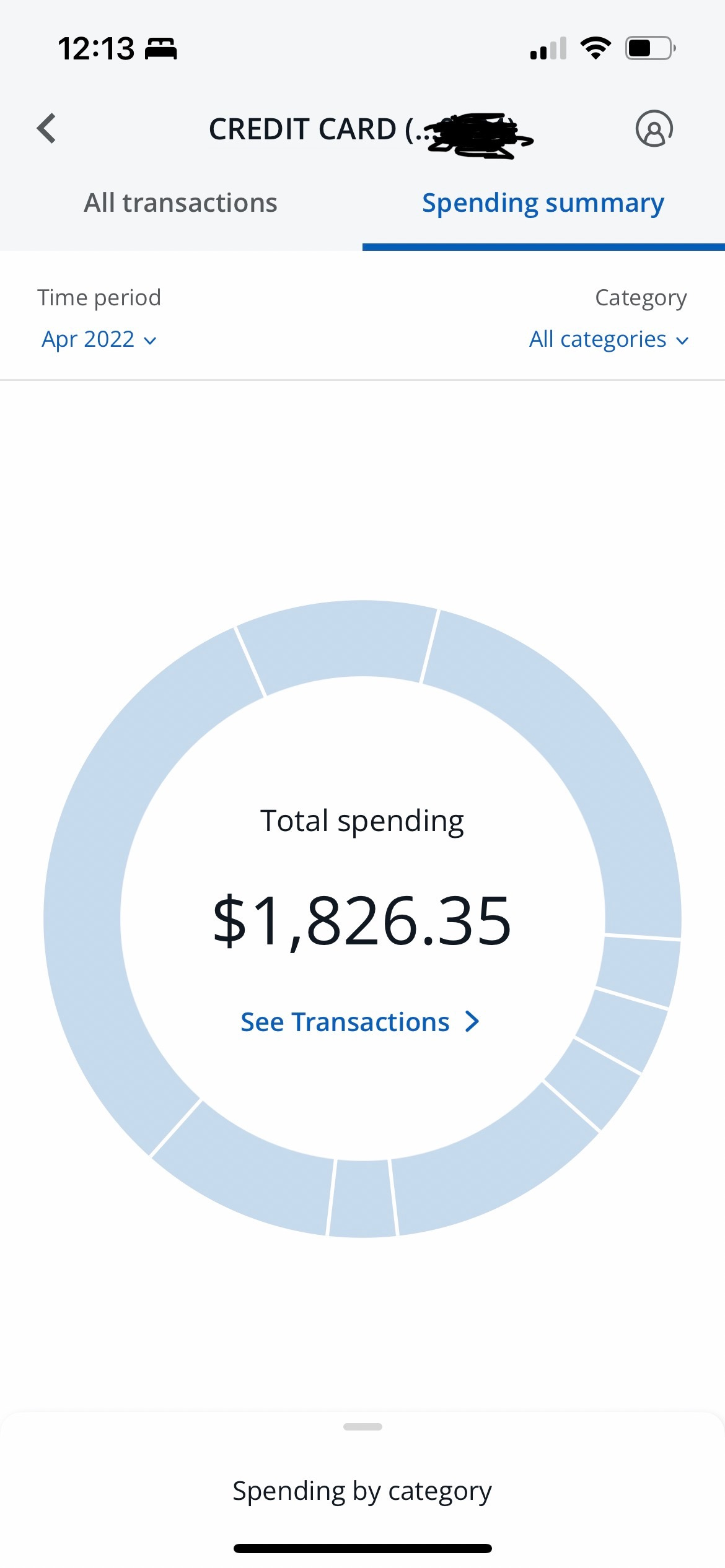

So far my credit card statement shows my average spending this year is $826.57 less than 2022. But I expense gasoline differently this year, so the true number after accounting for that change is $593.17. Over 12 months, that amounts to $7,118.04. Not bad.

With the lion’s share of my expenses going on my credit card to accrue airline points so I can fly for free, it’s the best place to monitor my monthly spending. Each month, I will share my progress, for better and worse.

What have I learned through the first third of the year? What patterns have I spotted?

The biggest is my spending increased for the third straight month, which I do not like. My goal is consistency, a fixed and predictable outflow. Apparently, I’m not as close as I thought.

April marked my highest spending month of the year. But my year-over-year spending for April, while appearing to dwarf last year’s total, still came in about $200 less than 2022. That makes four straight months of beating last year’s spending. No matter how slim the margin, the streak remains alive.

Travel expenses for work and a hefty tax bill combined for about $3,000 of April’s spending, which moves us to my decisions that weren’t so great in the month. Subtract those and my routine personal spending for April came in just under last year’s less job-related travel expenses.

Filing my taxes using a popular online tax preparer cost $161.32. The expense swelled with surcharges. Because of a mysterious banking error that wouldn’t allow my payment to be withdrawn from my chosen account, I paid my tax bill at the last minute with my credit card. I thought, ‘Well, at least I’ll get the points.’ That’s my hope, anyway. But it cost me $35.95 to use my credit card for my federal return and another $6.75 to use it for my state return.

Then there was the $62.40 I spent on an oil change. The rising prices for that routine service has me contemplating learning to do it myself and someday switching to an electric vehicle.

I allowed a $12.99 subscription to renew for a third straight month, largely because of my inability to strike the appropriate work-life balance needed to knock out the basic task that requires the subscription. Recurring expenses like these that sit unused drive me nuts the most now.

I bought concert tickets that I do not regret and will write more about in July. But I splurged on marijuana and smoking products, an eye-popping $295.40 worth that has me considering cutting back. I also invested $100 for a small but official ownership stake in Substack. Total surcharges for that credit card transaction: $8.

This heightened awareness is the best part about tracking my spending. When I eat out while traveling, the charge is noticeable given how much I’ve reduced dining out. A fast food charge at Wendy’s used to be commonplace. Now it sticks out as unlike the rest.

On Saturday, while crunching numbers for this column, I came across a work-related expense I had yet to submit. I almost ate a $26.38 parking charge from a hotel stay during a trip to Milwaukee. I shared in my March “spend check” column how I likely have allowed hundreds of dollars in such work expenses to go unreturned over the years.

But I’m getting better. And I’m building consistency.

Best money move: tickets

On April 19, I secured a pair of tickets to what I anticipate will be a memorable concert this summer. I’ll save the artists and share more after the show. I won’t share the price because the special person accompanying me is a loyal reader. But the amount was sensible, and the purchase falls into the “experiences” bucket. I want to keep collecting them, and I’m happy to pay for good ones with my people.

Worst money move: towels

I’m a paper towel guy. I use them to dry my hands and for quick clean-up. I like to keep a sheet close by when eating so my hands and face aren’t a mess. They’re my creature comfort. But it’s time to say goodbye. I spent $14.36 on a six-roll, raising my Walmart total to $83.35 on April 25. If purchased once a month for a year, that’s $172.32. My next investment: a quality set of kitchen towels.