Parker doesn’t remember much from the first money talk that captured her imagination, but I do.

Our conversation centered on candy, because of course it did. How else was I going to keep my then 8-year-old daughter’s interest in the topic of investing?

It was last October. And I used The Hershey Company as my example. We would stop in the candy aisle at Walmart, and I’d go to work. I’d point to Hershey’s Kisses or the chocolate maker’s classic candy bars and proudly inform Parker we own the company.

At the time, we held only one share of the company’s stock. But I was a proud shareholder. Even with our minuscule stake, investing into a brand I’ve long enjoyed helped shift my thoughts from those of a consumer to those of an owner. It was important to me that Parker adopt a similar mindset as early as possible.

Little did I know that within a month Parker would begin walking the candy aisle like she was Hershey’s CEO Michele Buck, loudly proclaiming for anyone within an earshot to hear, ‘Daddy, we own Hershey’s.’

The truth is when I decided to invest in Hershey last year, I fell for the company’s dividend. It offered one of those attractive and stable yields that I couldn’t resist at the outset of my investing journey.

Beyond that, my investing thesis was simple: people always will love chocolate.

Halloween also ensures a spike in candy sales at the same time each year. It made too much sense to not jump on one of the world’s largest chocolate manufacturers.

I quickly committed to holding Hershey’s in my long-term portfolio. Frankly, as long as the company churns out Reese’s Peanut Butter Cups, the greatest candy of all time, Hershey’s has my loyalty as an investor.

It’s one of about a dozen individual stocks I intend to retain after trimming my portfolio. For better or worse, Hershey’s will help build my buy-and-hold endurance. I can see myself holding the stock for the next 15-20 years.

I’ve already been on quite the ride.

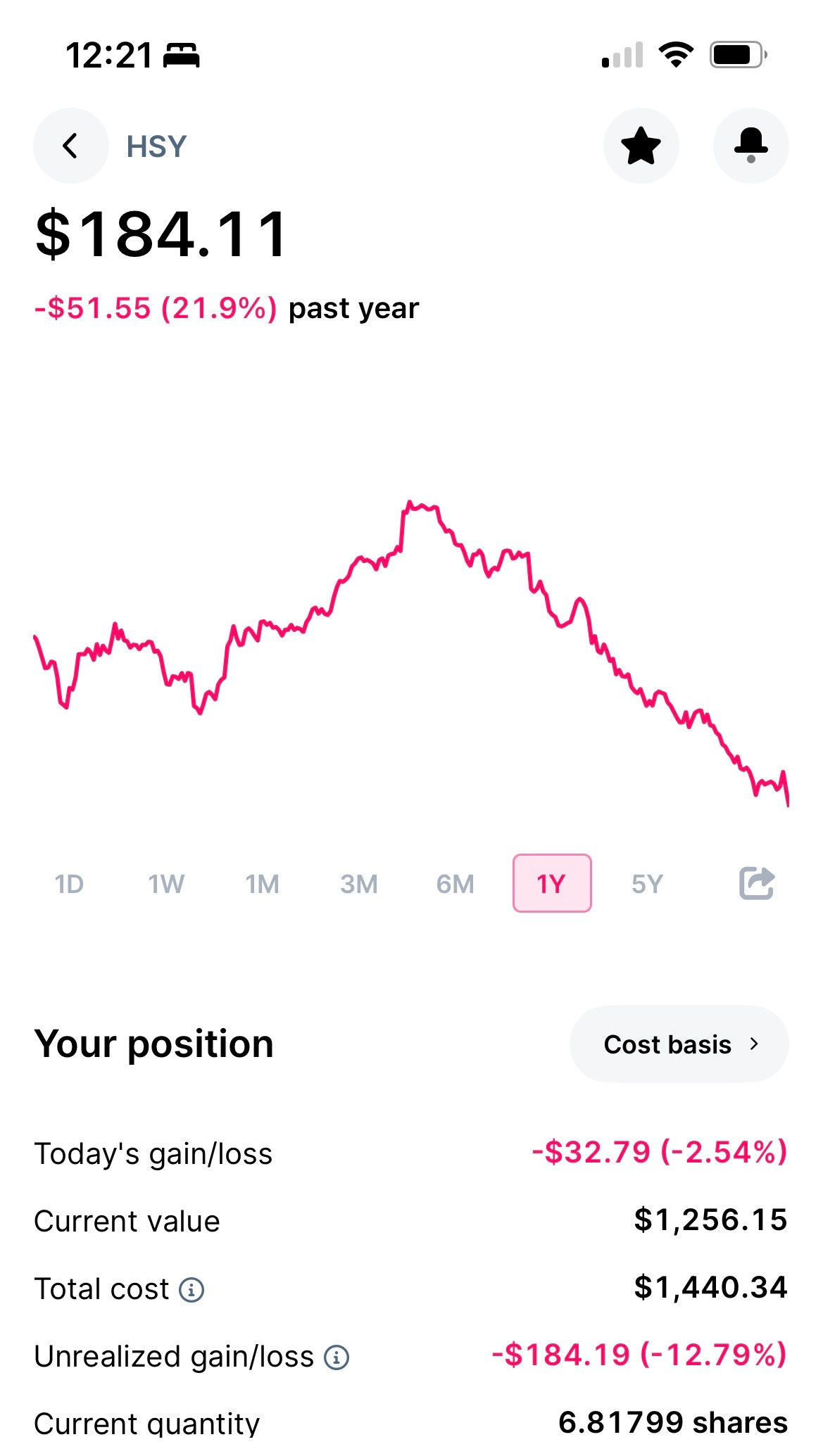

We’ve grown our Hershey’s position to a little less than seven shares. The current value is a little more than $1,250. It was one of my best performing stocks through April, when it hit all-time-high levels. But it’s been in a downward spiral the past six months.

But I don’t panic whenever my positions turn red. It didn’t take me long to learn that necessary patience. Instead, dips excite me as buying opportunities. I look at them the way shoppers look at sales. The difference is when I gobble up shares at a discount, their value in my portfolio will be worth more when the stock price shoots back up.

My goal is to acquire as many shares of Hershey’s as I can at a fair price. When it spikes, I’m content sitting back and collecting dividends until the next buying opportunity arrives.

We’ve collected and reinvested $20.54 in Hershey’s dividends so far. It feels like chump change. But it’s more than we would have generated in interest over a year’s span on the same amount in a bank. And that’s just the first-year return, from only $1,000, in just one of our dividend-paying companies. I’m confident in our money compounding.

In time, our dividends won’t look like chump change.

So enjoy as much chocolate as you can stomach this Halloween. Crush as much candy as you can.

As proud owners of the company, we recommend Hershey’s.

Disclaimer: The information contained on Money Talks is not intended as, and should not be understood or construed as, financial advice. I am not an attorney, accountant or financial advisor. These are my personal experiences, and this Website is not a substitute for advice from a qualified professional.