Here’s what my mother didn’t tell you about our history with money.

This isn’t a flattering story, but it’s one we joke about now.

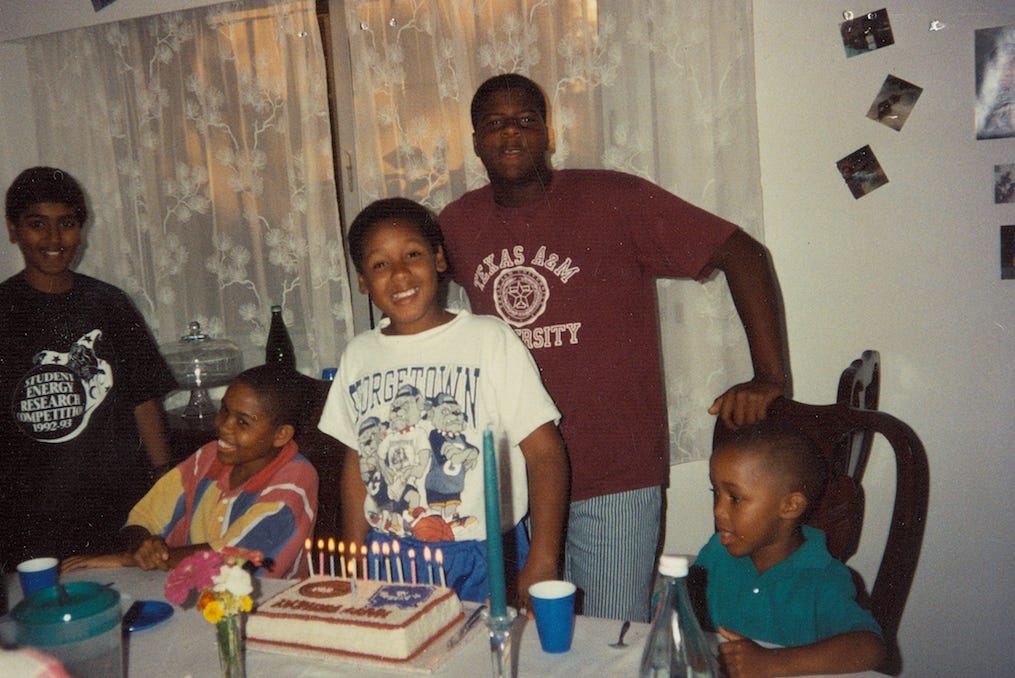

I was in sixth grade in Falls Church, Va. My school, George Mason, sat across the street from a shopping plaza anchored by Giant Food, a major East Coast supermarket chain and later one of my first employers. In high school, I worked there as a cashier.

But in my middle school days, my entrepreneurial spirit ran deep. At 11, I started my first side hustle. It was a bubble gum business.

In my adolescent mind, I had a foolproof plan. One pack of Bubblicious sold for $1. With five pieces of gum per pack, I sold each piece for 25 cents and happily took home a 25 cents profit per pack.

The problem, other than my paltry profits, was my mother wasn’t cool with it. At all. She didn’t approve of me strolling over to Giant to purchase my product before the morning bell and unloading my supply to candy-crazed kids all week.

One night my mother explicitly forbade me from going to Giant before school. Yet on the next morning, I deliberately disobeyed her. With a few friends by my side in the checkout line, I had my packs of Bubbilicious in hand, ready to rake in profits. But then I looked up.

At the checkout lane to my right, shooting me a death stare that left no doubt about her discontent, was my mother. She never shopped at that grocery store. Of course, that day she did. I was busted. I don’t remember my mother saying a word. I knew what I was in for when I got home.

My punishment was the worst butt-whooping I ever received. There were specific instructions that accompanied this whooping, degrading techniques better left unsaid but designed to match my brazen disobedience.

I lost my entrepreneurial spirit that day. Only now am I getting it back.

While I don’t blame or begrudge my mother for her reaction, I sometimes wonder what might have been if that moment was handled differently. Where would I be today if instead of a butt-whooping, I was sat down and taught about business?

But the money talks we had when I was growing up were far more basic. In recent years, I’ve had to examine the foundation of my financial education. There was so much I wasn’t taught, not only at home but also throughout my schooling. Societal norms and pressures only reinforced poor money habits.

Only by embracing my ignorance and being eager for more effective ways to earn and save was I able to confront my shortcomings and commit to change. It’s been an eye-opening process, revealing much about my long-held mindset with money and my approach to financial matters.

I encourage everyone reading this to examine the financial lessons you were taught and how you might still apply them today. We know that the way we’ve always done things isn’t the most effective or efficient. That’s also true with our money.

Here is a snapshot of what I was and was not taught about money:

What I was taught:

Go to school: Education was a non-negotiable. My mother, like her parents before her, stressed its importance. They saw education as a way out of poverty and a vehicle for advancing personally and professionally, socially and financially.

Get a good-paying job: Who hasn’t heard this? In my family, it was the expected next step after school. The emphasis here is on “job.” I was taught to work for a living. To be an employee and hunt the highest salary.

Work hard: It wasn’t simply said, it was shown. My mother was a workaholic by necessity. She worked long hours at every job she held. She instilled that work ethic into me. The harder one worked, in theory, the more one would advance and earn.

Save for a rainy day: Another oldie but goodie. I remember never really knowing what a rainy day meant — while rarely, and barely, saving for it.

Don’t gamble: I don’t recall this being verbalized as much as exhibited. My mother didn’t (and still doesn’t) gamble, and I realized early I wasn’t good at it anyway. Thankfully, it’s not among my vices.

Don’t be wasteful: From scarcity to abundance, an attitude of gratitude was instilled. Taking care of the things you had and making the most of what you could were among our tenets.

Do be charitable: Giving back was big. No matter our family’s circumstance, there always was respect reserved for the less fortunate.

What I was not taught:

How to budget: Only now have I started consistently doing anything that looks remotely close to a budget. It’s not familiar, and for the longest the thought alone made me feel stifled financially.

How to invest: I could point to plenty of examples of spending. Few of them involved the critical component of investing in appreciable assets.

How to have side hustles: As noted above, getting a stable job with the highest salary possible was the expectation. Working that job until you couldn’t or a better one came along was the custom. Supplementing income with additional revenue streams was not taught.

Ownership: Self-employment never was presented as an attainable option. My advice to Parker: start your own business. Be your own boss.

Frugality: Spending freely and lacking financial discipline has been one of my biggest pitfalls. Making smarter money moves can and has led to life-altering results. Don’t worry if friends or family call you cheap. Focus more on your net worth increasing.

Taxes: I wouldn’t have listened if someone tried to teach me. I might still doze in and out if given a lesson. Taxes are complex, and they bore me. But understanding taxes is hugely important to building and maintaining wealth. Regrettably, I still have a remedial understanding of taxes.

Had my first side hustle selling Pokémon cards, but got caught by the principal 🥸

I give you credit even at a young age you were courageous enough to test the waters of entrepreneurship. Many adults still fear failure and avoid setting out on their own. What are some examples you use to help Parker understand each of these pillars to financial literacy?