One of my first money moves after becoming meticulous about my spending was deciding I was done paying full price for gas.

Each time I fill up now, I save money and honor my late grandfather.

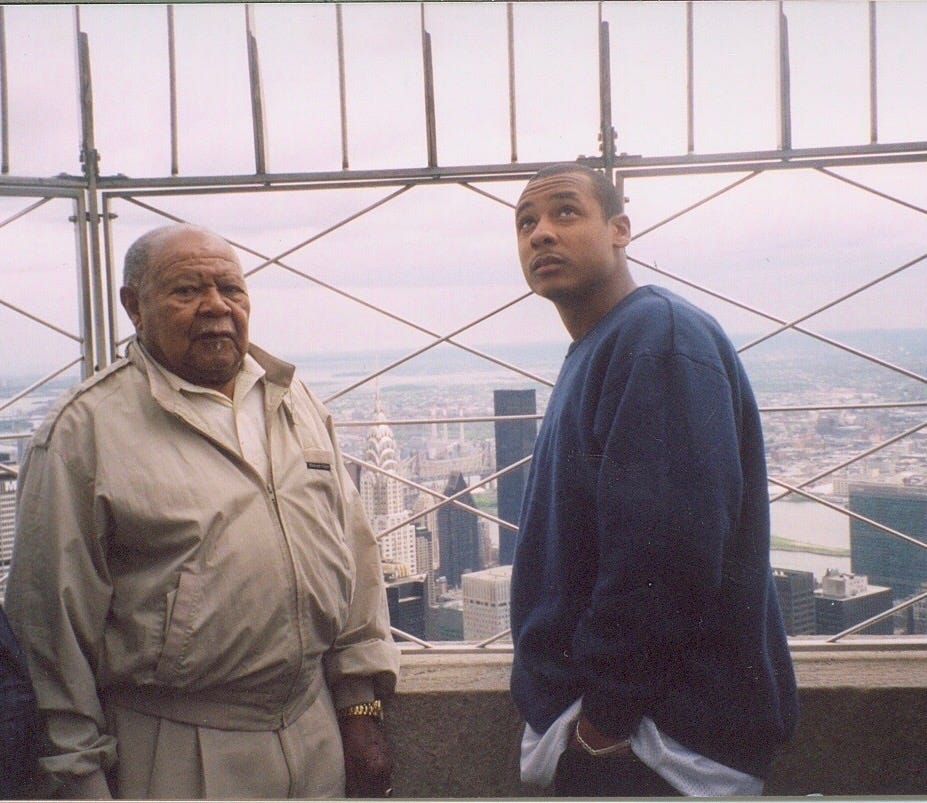

My mother told you back in February that her father, Shelby Johnson Sr., retired from Shell after more than 40 years with the company. My grandpa was the best father figure I had. He was a husband and hard worker, father and friend, protector and provider.

Together, we went bowling, played dominoes, read the newspaper and watched baseball. I used to watch him methodically navigate the kitchen. He loved steak, his way, some kind of rare, sausage and his midnight snack. He’s the man who showed me it is cool for men to love cooking.

I don’t know much about my grandpa’s time at Shell. But 40 years is a benchmark not many are built for anymore. I just remember my grandpa having money well into retirement. He was generous until his dying day. I guess in my mind, I attributed that in part to Shell.

And so in October, I committed to never getting gas from anyplace else.

Previously, for a routine task I’ve been doing since I was 16, I never formulated a cost-savings plan. My current method stemmed from personal sentiment and skyrocketing gas prices. But my first commitment came not at the pump but in the stock market.

I bought two shares of Shell stock on Oct. 3, 2022. It was just the 11th equity I purchased after plunging into the stock market only one week prior. Eleven days later, I bought two more shares. By the end of October, I was all-in on the company.

I signed up for the rewards program that offered five cents off per gallon. Then I stumbled across Shell’s credit card promo, which promised 10 cents off per gallon among other perks. I snagged that too.

To pay for gas now, I only use my Shell credit card, only at Shell stations. I’m a stickler about it too. Only in an emergency will I pay for gas from another station, reluctantly with my everyday credit card. That moment happened five weeks ago during our Father’s Day road trip to Oklahoma. I’m still not happy about the $6.20 I paid Motomart in the middle of Missouri.

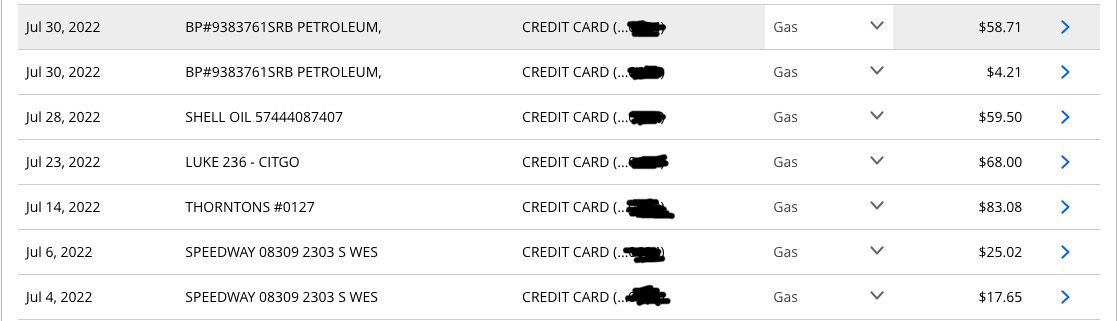

But a few gallons to get us down the road to the next Shell isn’t so bad. A look back on my gas purchases from July 2022 shows how haphazard I used to be. Whenever I needed gas, I just pulled over. I hoped for the best and got mad at the worst. I made two stops at Speedway, two at BPs, one at Thornton’s, one at Citgo and one at Shell. I didn’t save money at any of them.

As if gas prices in Illinois ranking in the top 10 wasn’t painful enough, last summer’s inflated fuel prices pushed the national average nearly $1.50 higher than today.

I grew tired of paying the equivalent of a monthly bill for gas and feeling powerless to do anything about it. A charge from June 7, 2022 shows I paid $89.20 at a BP. I don’t have to dig deep in my records to know that’s the most I’ve ever spent to fill up my 20-gallon Dodge Journey.

Instead of complaining, I concocted a plan. When I became an investor, Shell’s sticker shock wore off. My small ownership stake combined with my savings to make each fill-up feel like I wasn’t just paying for gas but I also was paying myself. And in a way, I was.

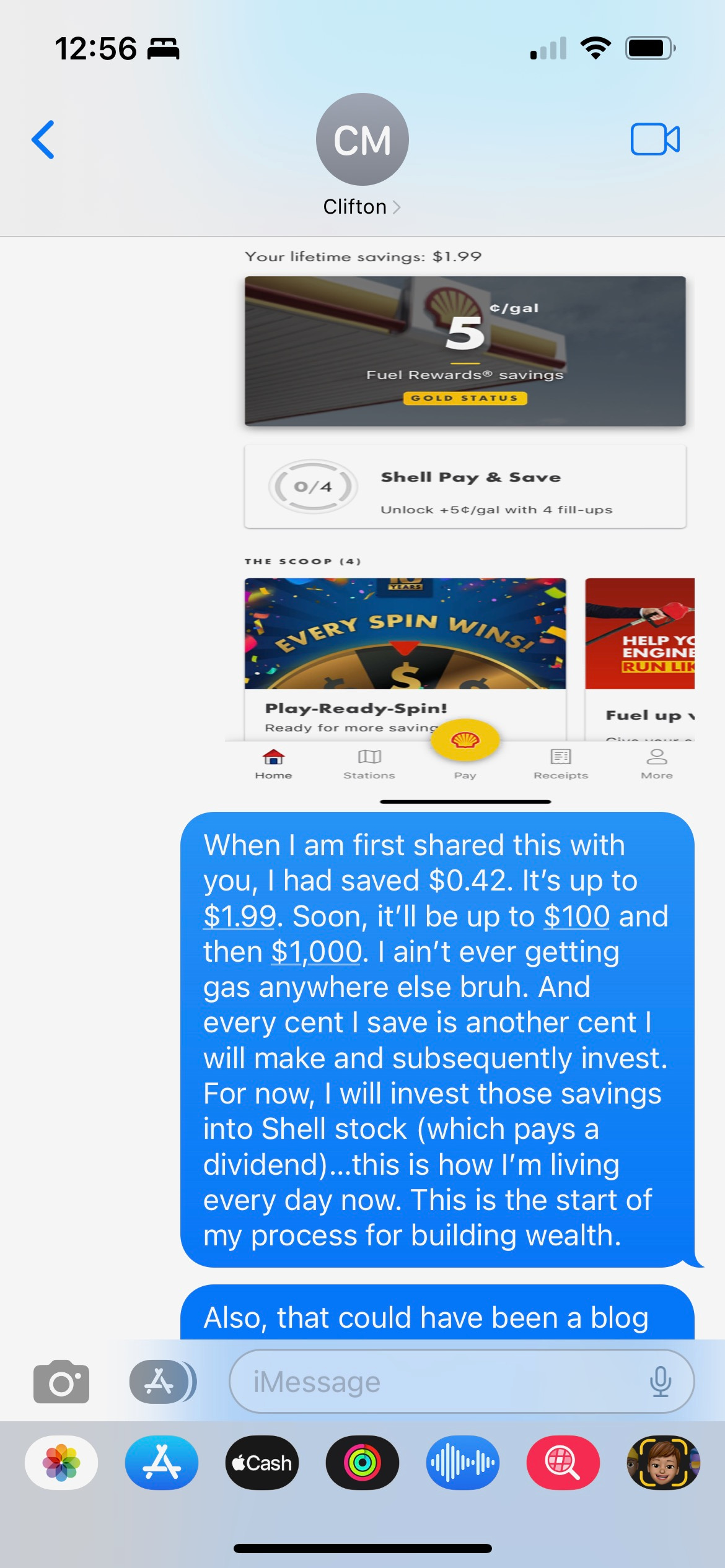

I shared my commitment to Shell with my brother Clifton in a text message on Oct. 28, telling him “most of what I do with my money these days MUST be something where my money is working for me.” Two weeks later, I texted him again when my gas savings had reached $1.99 but my sights already were set on $100 and $1,000.

“This is how I’m living every day now,” I texted. “This is the start of my process of building wealth.”

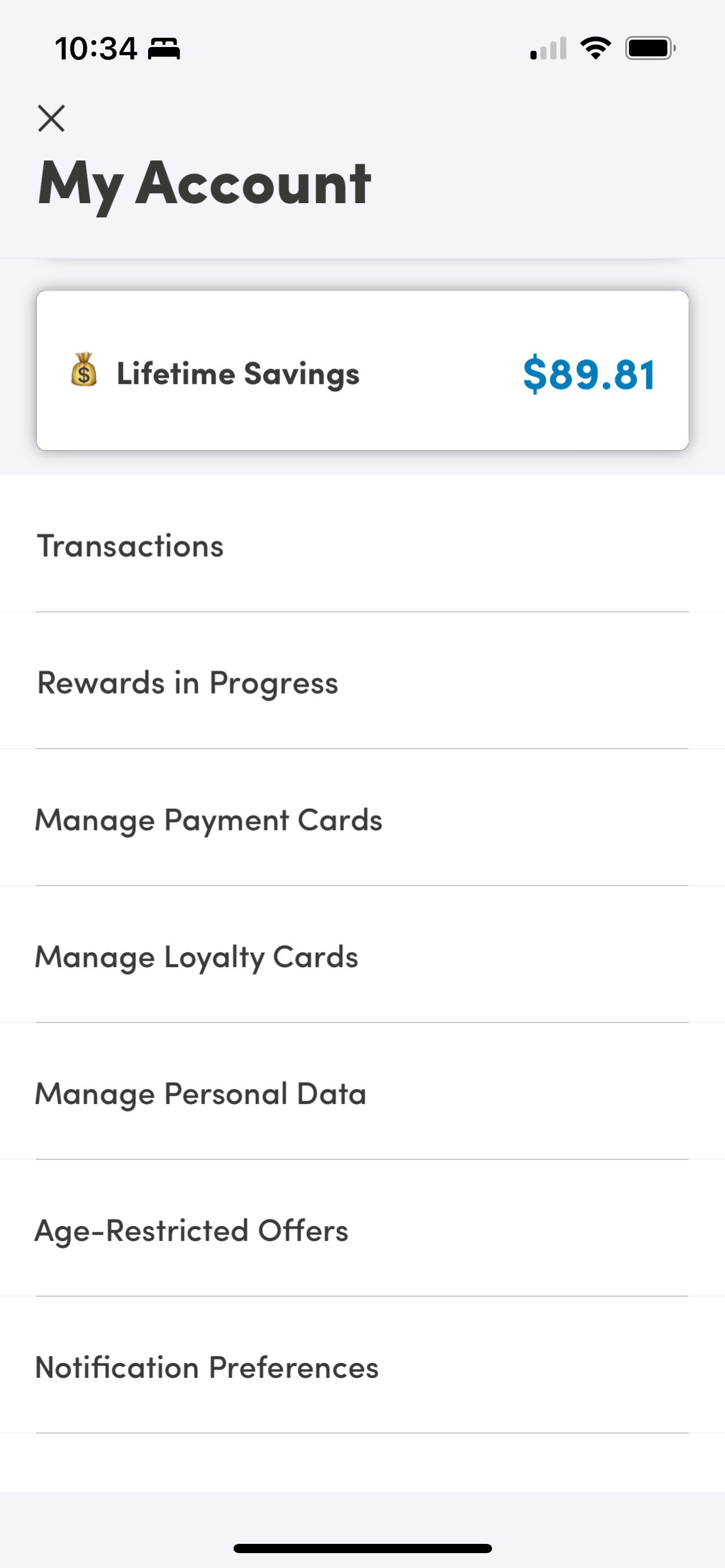

It’s only a small step. My new mentality is what’s most important. Getting gas is no longer a guessing game, and filling up now comes with perks. I pay my balance in full every month so I don’t accrue interest charges, and I’m proud to say that after only eight months I’m nearing the $100 milestone.

I’m saving $53.32 per month at the pump through the first 6 1/2 months of 2023 compared to the same time frame last year. That translates to $639.84 a year. And after the first half of the year, I’ve identified ways I can cut down driving to save more.

Gas charges made up 10% of my spending in 2022, according to my credit card statement. It’s more proof that my vehicle, although paid off, is my biggest liability. With gas, however, I’ve become hellbent on lowering my hit.

I sold my Shell stock, a little over five shares, on Jan. 13. It was part of my transition from individual stocks to index fund investing. I made a $38.59 profit from closing my position, but I remain committed to Shell for my pit stops.

My grandpa would be proud.