My guy Eugene from work goes into an elaborate routine every time he sees me.

He squints his eyes as they track me across the Chicago Bulls media workroom. He furrows his brows and scrunches his nose when our eyes connect. He sniffs twice.

“I smell money!” Eugene says.

Without fail, I smile and shoot back the retort Eugene loves hearing.

“I’m broke, baby! I ain’t got no money!”

Our scripted exchange comes from the 2002 classic movie, “Paid in Full.” Mitch, the drug-dealing lead played by Mekhi Phifer, from whom I adopt my line, slides up his tracksuit’s sleeves just so, throws out his hands and reveals the jewels adorning his wrists and fingers as he dismisses his disowned Uncle Ice.

Ice, played by the late Ron Cephas Jones, doesn’t buy it and lets his nephew know it as Mitch walks away.

“Even Ray Charles can see you got money,” Ice tells Mitch.

Eugene, as much as anyone, has watched my transformation. He’s one of the few people I had real conversations with upon moving to Chicago in 2017. He remembers my early days as a newbie and how I had to, at times clumsily, find my way in the city.

Whenever Gene sees me now, he can’t help but comment on my Money Talks makeover. What he and others see today, I call my work uniform: a Money Talks shirt, sweatshirt or hoodie, a Money Talks hat, a crisp pair of jeans and a pair of stylish but inexpensive sneakers.

I carry myself differently in my work uniform. I’m not just more confident. I feel bulletproof, capable of conversing with anyone and accomplishing anything. With our clean logo hugging my slimmed physique, I know I look good. But in my work uniform, I feel like money.

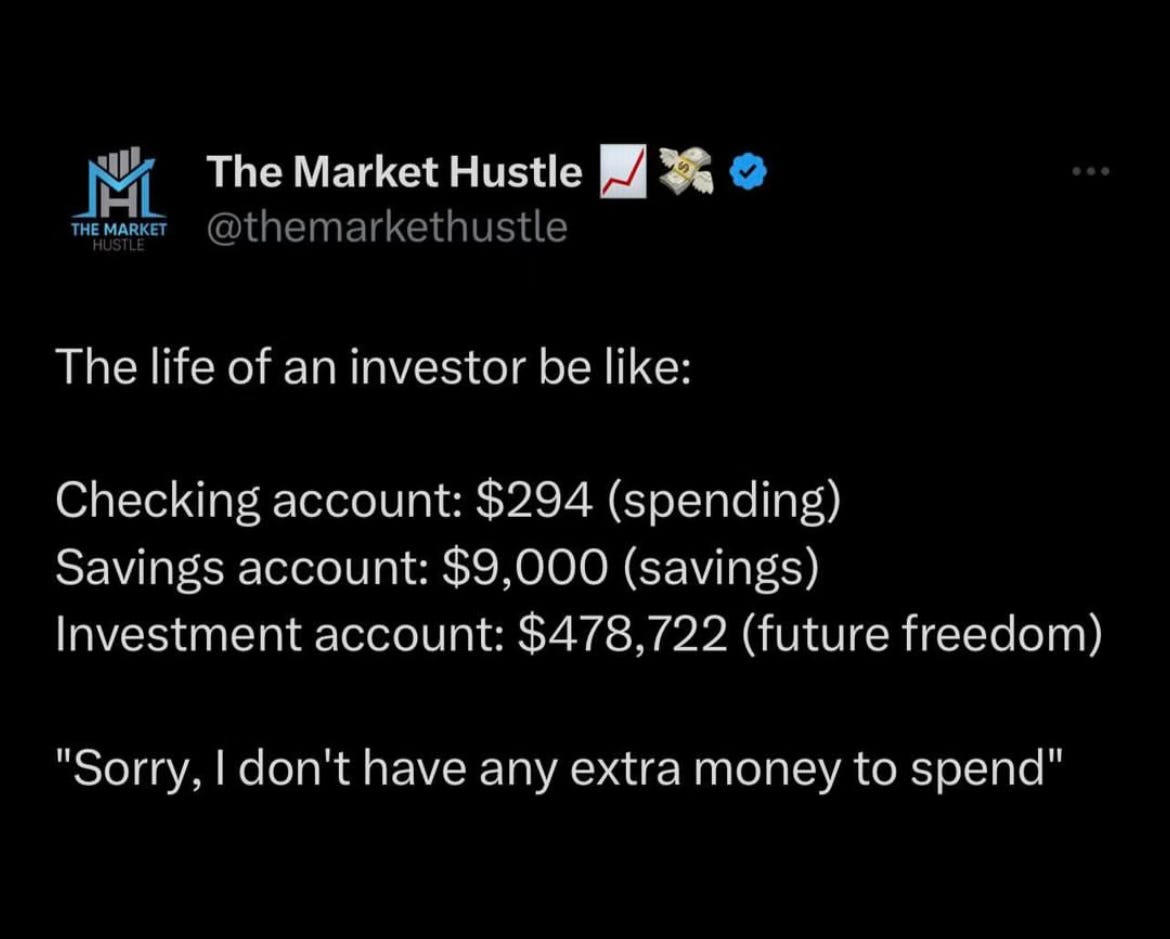

I just don’t feel like I have any. Despite how I present, I still feel broke. My net worth is increasing, but my discretionary income has disappeared.

I wish there wasn’t so much truth to my running joke with Eugene. I wish I could deliver that claim as sarcastically as “Money Making Mitch” did to Ice.

Here’s where it takes a mindset shift and steadfast sacrifice to remain an investor.

I’m broke, not poor. It’s important to understand the difference. I don’t have any real debt. My bills are paid on time each month. Money is only tight by choice. I’m investing most of it now to ensure my family has something to live on later.

But it’s different watching accounts stretch from four to five to six figures and still not feel comfortable spending. It can be difficult. I see my money growing. But I’m in this weird place where I can’t touch it. Not unless I dare disturb the power of compounding.

I knew what I was getting myself into when I started this journey. But I’m waist-deep in the accumulation phase. It requires hyperfocus, diligence and discipline. The requisite sacrifice remains. It only intensifies. As more money becomes available, more restraint is needed. It’s a money mind game. It’s not fun. It’s exhausting.

Meanwhile, the better I do with my money, the more I develop a sense of “I deserve to.”

I deserve to have a nice meal.

I deserve to have a few drinks.

I deserve to take a trip.

Even with the long view in mind, I can’t help but want to claim victory today. But I know myself. I adopt addictive behaviors easily, both good and bad.

If I go to the gym on a Monday, for example, chances are good I’ll go Tuesday and make it through the week. If I miss a day, I might skip the rest of the week. Same thing with dining out or drinking. One restaurant or round always makes me crave another. And so I’m selective.

I’m searching for the right times to stop and celebrate. To temporarily turn off my money mindset and turn up. Birthdays, graduations and holidays are obvious occasions. But what about everything in between? I don’t want to be so focused on accumulating that a decade passes before I loosen up.

But I have that much catching up to do. And I remain committed. Until then…

“I’m broke, baby!”

Can’t get enough Money Talks?

That deserving question is so real.

Deprivation leads to splurging!

MY SUGGESTION!!! -- Avoid neglecting yourself and putting off enjoying life NOW by budgeting. Set aside a reasonable amount of funds for pleasure--taken at a minimal amount from other categories. AND then, stick to that budget. You have the self-discipline to build wealth and to enjoy life during that process!! Just saying!