My final credit card payment this year will be made automatically Friday.

The balance: $1,403.33.

It’s a sum I’m satisfied with. It doesn’t infringe on my danger zones. We all have them. You know those imaginary spending thresholds you dare not cross because you know you don’t have the money to pay?

I learned my levels long ago. If I ever exceed $2,000 in any cycle, I start getting nervous. Push past $3,000 and I’ll bet you an unexpected expense arrived. Anything over $4,000 and I know I’ve lost control.

My December bill brings me joy because it’s one I can cover. That means I will achieve my goal. I’ll make it through 2023 without paying any credit card interest.

If you’ve read Money Talks throughout the year, you know I use a credit card for the majority of my purchases. It’s a travel credit card that allows me to accrue airline points as I pay. Whenever I’m ready to vacation, or just jump on a quick flight, I’ve got plenty of points. I don’t have to dip into my cash or pay out of pocket for my flight beyond taxes.

A few mainstays are excluded from my credit card expenses, such as rent, child support and childcare costs, gas for my apartment and vehicle, my electricity bill and my $10 monthly gym membership. Everything else goes on the card.

I switched to this method years ago. I don’t remember when. But it’s just smarter the way I see it — if you do it properly. To me, that means paying the balance of your card each month. If you can do that, it doesn’t make sense making purchases with a debit card or cash. You might as well find the travel card that best suits your needs and take advantage of the perks.

In years past, I blew through my levels. Dates, dining out and bar tabs did me in. Mindless entertainment and other misguided purchases routinely drove up my bill. And whenever I couldn’t pay, interest hit on cue. Like a fool, I just kept paying it. I was the credit card company’s favorite customer.

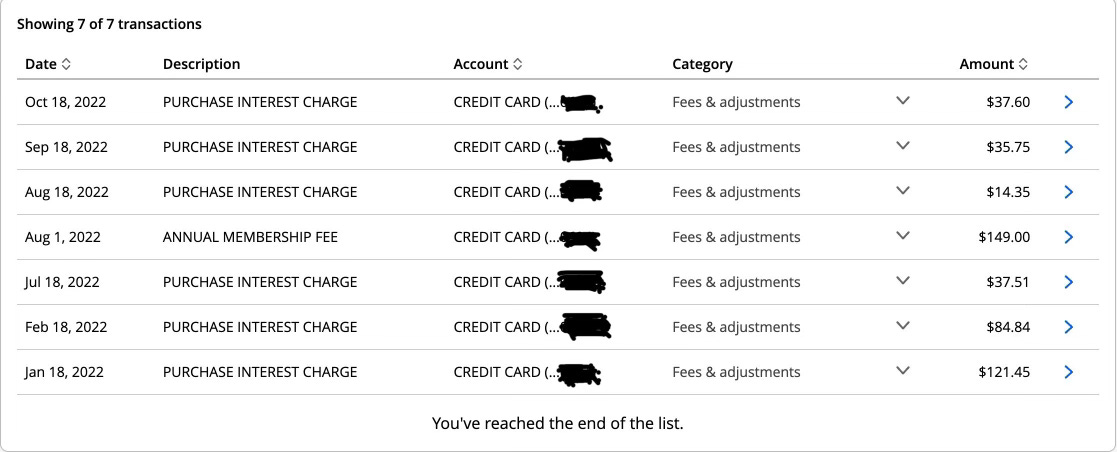

Last year, I paid $331.50 in interest fees to my credit card company.

I’m still kicking myself. But I’ve corrected my behavior, and I’m doing everything I can to ensure I never fall into that lifestyle again.

The scariest part, though, is how my fees piled slowly but steadily — and sneakily. The largest charge, on Jan. 18, 2022, was $121.45. The following month, I paid $84.84 in interest. The final charges were death by thousands of pennies: $37.51; $14.35; $35.75; $37.60. Just negligence on my part month after month.

I recognize that some reading this could be drowning in debt and might consider selling their souls to pay only $331.50 in annual credit card interest. It is not my intention to be insensitive to anyone’s situation or come off as dense by mentioning my minimal amount from last year.

Instead, I hope my story encourages you to be vigilant if you aren’t already and keep at it if you are but bills have worn you weary.

I used to believe I was good with money. I thought I had a sound understanding of how to manage my finances. My interest charges, however, proved otherwise. They represented one of the many ways I bled money without being aware.

Be it ignorance or apathy, my money mindset wasn’t mature enough. I didn’t endure hardships that warranted interest fees. I wasn’t forced to rely on plastic or left with no choice but to borrow. I splurged. Plain and simple.

But tracking my spending and credit card statements ignited a change in me. By scrutinizing my 2022 statements, I discovered my shortcomings and swiftly took the necessary steps to strengthen my financial behavior.

In eliminating my credit card interest, I have flipped the equation. Instead of the credit card company working me, I’ve taken back control.

Now, my credit card is working for me.

Can’t get enough Money Talks?