I had a bright idea to pay off my car loan.

The plan would wipe out my largest debt and save me from paying more than $2,000 in interest.

But before it could work, I had to swallow my pride. The idea might have been sound, but it mandated that I suppress my ego, stray from my long-trusted operating system and make an uncomfortable ask.

After pondering it for a week, I finally picked up the phone.

I called The Bank of Grandma Berta.

I needed to know if she had another $20,000 laying around.

My credit with my mother, Alberta Mayberry, is excellent. It took me three years, but last September I finished paying her back every penny of the $10,958 I borrowed to pay for one of my divorce attorneys.

She always told me I didn’t have to return the money. I never considered that to be an option. It was my mess. It was on me to clean it up. Monthly payments of $304.40 for 36 months was only part of the price I paid.

But my mother was impressed with my commitment to repaying my debt. I knew she’d help me with my car loan if she could. And thanks to my track record, I knew that she knew I would pay her back every penny.

In late March, I made the call.

My ask: $7,000.

A little more than $10,000 remained on my loan. But, remember, I still have $3,000 coming from a freelance job. Fortunately, my financial picture hasn’t worsened. So I’ll stick to my original plan to put 100% of my money from the freelance assignment toward my car.

Rather than paying Axos Bank $300 a month for the next two years at an 8.64% interest rate, it made more sense to keep the money in the family. My proposal to my mother was to funnel that same amount to her each month.

Without hesitation, she agreed.

But when we sat down to make the lump-sum payment online, incorrectly assuming it’d be more convenient than securing and sending a cashier’s check, we hit one snag after another.

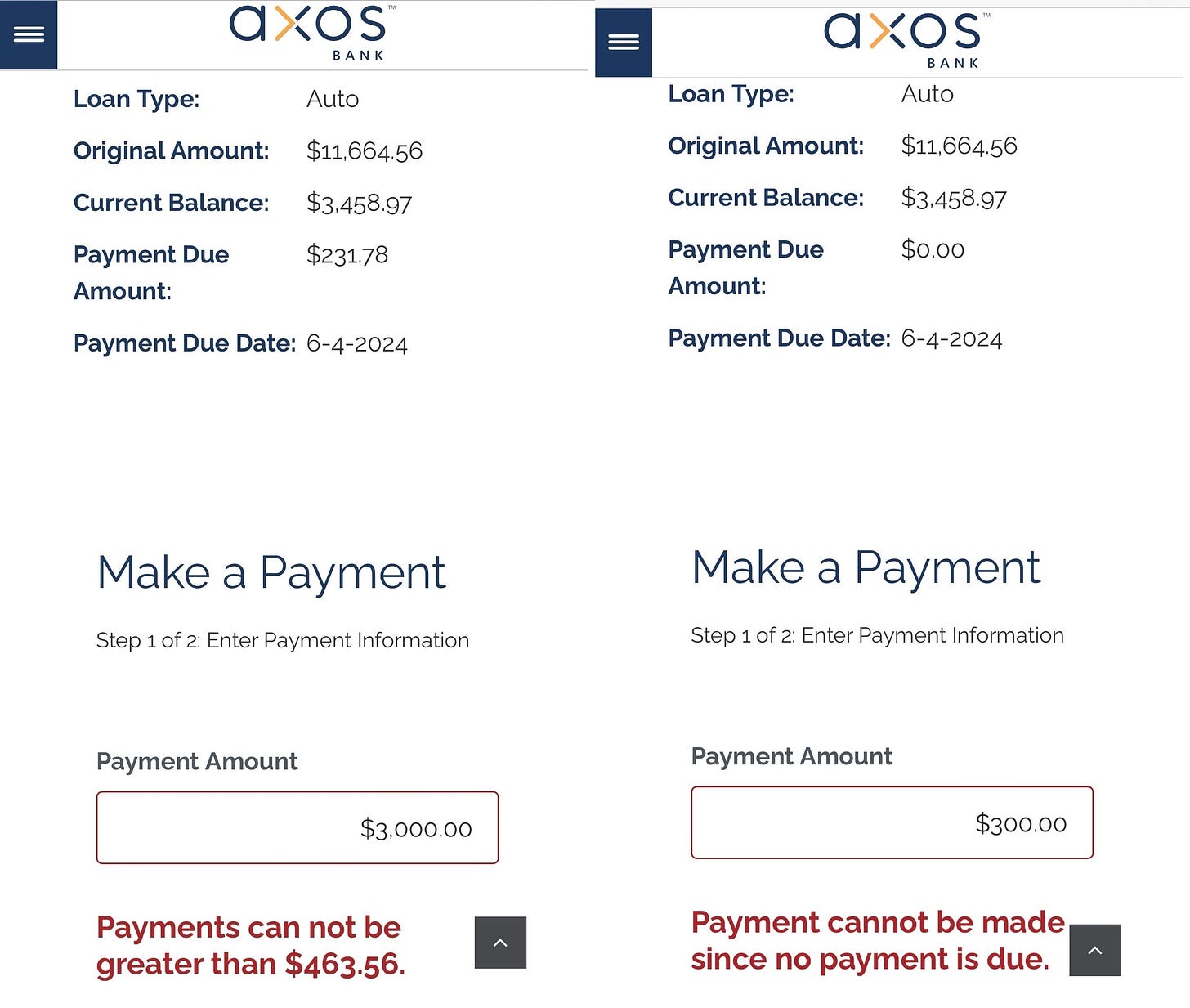

The first hurdle was the website not allowing us to pay more than double the monthly note, which is $231.78. I rounded up and sent an additional $68.22 to pay down the principal a little more each pay cycle.

But now I know that the lender limiting my online payment to $463.56, or double the note, is by design, a measure intended to lock me into payments for as long as possible.

If I paid only the required $231.78 each month, it would have cost an additional $2,937.58 in interest over the life of the loan.

We called to pay over the phone. But we were met with an automated service that also refused a complete payment. I called back for an operator, and that didn’t work either.

The operator informed us we couldn’t pay over the phone directly via my mother’s bank account. The person also told us credit card payments weren’t allowed. Only debit cards. And there would be a 2.25% surcharge.

To make a $7,000 payment, it would have cost another $157.50.

We rejected that route too.

Finally, my mother logged into her bank account and initiated a transfer directly to my lender. I was skeptical after the series of purposeful snags.

But it worked. I checked my car loan online on the morning of May 4 to find $7,000 had been deducted from my balance.

I tried inputting my routine $300 payment. The system wouldn’t allow me. Despite a $3,458.97 balance showing, an error message said a payment wasn’t due.

When I punched in the balance as if trying to wipe out the debt, the error message provided a number for me to call to pay off the loan.

The reason for the obstacles were obvious. My lender’s aim was to milk me for every dime it could. Each hoop we had to jump through — just to pay hard-earned money — was put in place to ensure I couldn’t easily escape my debt.

It wasn’t enough that I chose a practical vehicle at a reasonable price, making a prudent decision to live below my means. It didn’t matter that my credit is clean or that I’m capable of exceeding the minimum payment.

I made all the right moves, yet the bank continues to try to bleed my bank account until the very end.

I refused to let it happen.

The chain of eye-opening events made me view my original request totally differently.

Instead of reluctantly requesting my mother’s resources and generosity, I realized that I did exactly what I’m supposed to do. It’s the same request I want Parker to be able to come to me and make whenever she has a need.

That’s one of the many perks of pursuing financial independence.

So that no lender can ever have our family staring down the barrel of a gun with nowhere to run.

I had no idea, but I’m not surprised, that lenders have so many hurdles to offer when trying to pay down your loan. I’m not quite ready to pay off my car but I’ll still look into their payoff practices so that I’m well prepared. Thanks for the heads up!

I can’t wait to be able to get my “Bank of Grandma Berta” on! Learning and teaching these lessons now definitely has us on the right track to be Grandparent Banks later.