For the past three years, I’ve been paying a debt.

It’s gone to my mother.

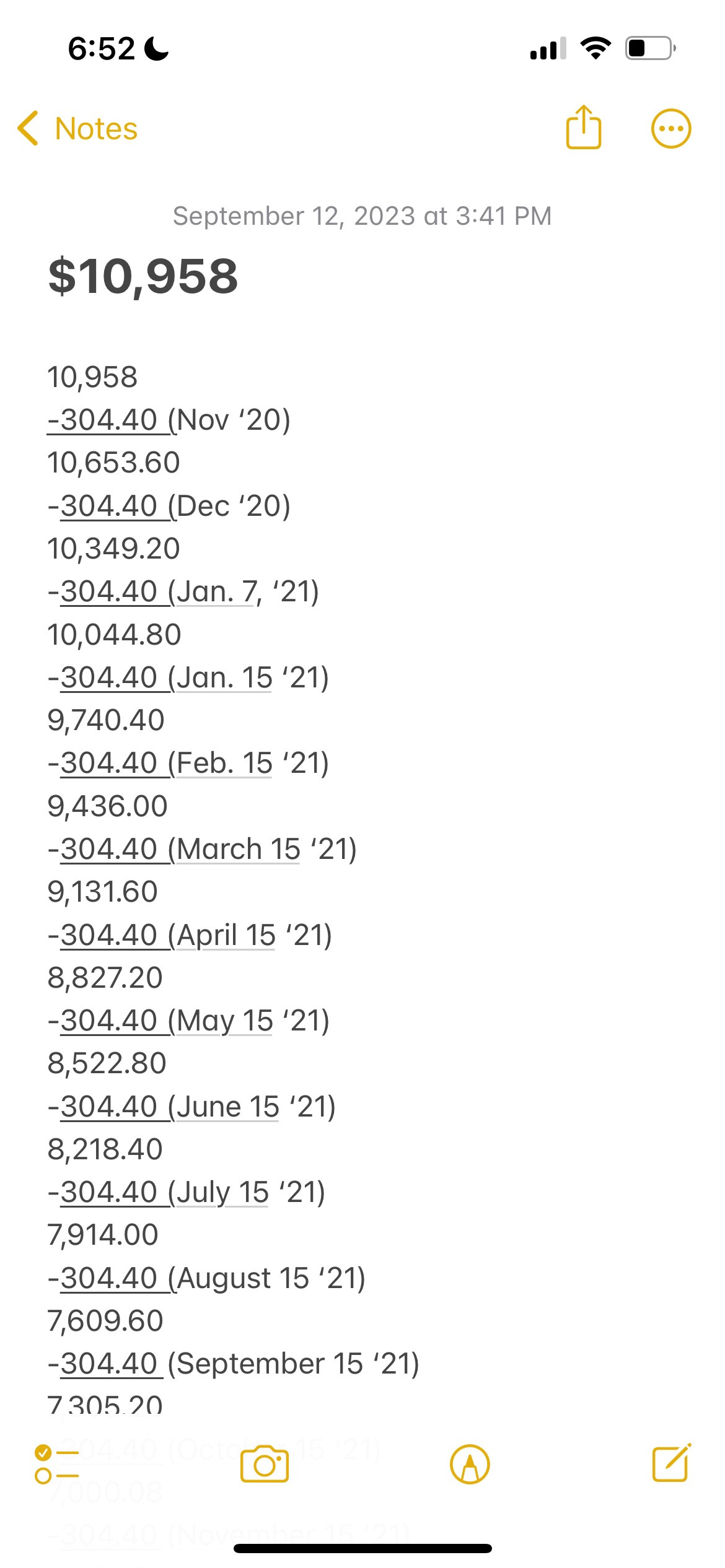

I sent her my final payment on Sept. 15. But it will take a few years for the amount to escape my memory: $304.40. That’s how much I wired without fail on the 15th of every month starting in November 2020.

It was reimbursement for costs from my former divorce attorney, the second of three I retained at separate times throughout my drawn-out ordeal. Consider that a lesson on the extraordinary cost of divorce. It took me three years to knock out one debt.

That doesn’t account for additional attorney fees, both mine and a portion of the other party’s, court costs, guardian ad litem fees, child support, spousal maintenance (alimony), the division of real estate assets and my 401k account balance and many other payments. By the time it’s all over, I will have paid well into six figures for a marriage that dissolved after only five years.

Sometimes I envy couples that enjoyed a clean break after marriage. Regardless of their result, and the real emotional scars sustained, they had the maturity or mere sense to allow themselves and each other to go on with their lives. To enjoy newfound freedom and flexibility in ways that probably could have helped preserve the marriage. Regrettably, that hasn’t been my reality.

Instead, divorce has been my biggest financial setback by far. That nagging number, the monthly $304.40 payment, was my last reminder of how much of a drain divorce has been. Don’t get me started on child support. That’s another story and an obligation I’ve made peace with even though as a loving, supportive and present father I shouldn’t have to pay it. I’ve mentally circled June 2032 as another joyous moment I look forward to on the calendar.

In the meantime, I couldn’t wait until September 2023 arrived. The closer it drew the more I kept track of how many months remained. I started a countdown. I meticulously tracked each month and subtracted each payment.

I was determined to pay back my mother all $10,958 even though she insisted it wasn’t necessary. She figured she could deduct it from my inheritance so that I wouldn’t struggle financially when I needed money the most. I figured the mess was mine. I made it, and I needed to clean it. I never missed a monthly payment over those 36 months.

But with great joy, I stopped automatic payments on Sept. 19, after the final payment showed it had gone through. Throughout July and August, I fantasized about how I would use the additional funds that would be staying with me. I had grand plans, with visions of splitting the extra money between my brokerage account and my daughter Parker’s. The basic cheat code in our wealth-building journey is to invest every dollar possible, for as long as possible. Regained money represented extra investing capital.

But then I went and bought a car.

Paying off my new car loan as soon as possible has catapulted its way to the top of my priority list. It took a few days to stomach the sting of losing that capital and, with it, the chance to accelerate my investing. The security of knowing my car will start on demand, however, already has been worth taking on a little short-term debt.

But I finally can say I’m free of divorce debt.

I know now that my many monetary losses were a blessing in disguise. Those setbacks forced me to closely examine my finances, to reduce my standard of living and raise my fiscal discipline. They opened my eyes to how easily money flows out and how fast others are to take it from you. They made me realize that if I had room to pay thousands of dollars each month to climb out of the bottomless pit we call divorce I could do wonders for myself simply by becoming more intentional with my money.

Now, my money is mine again. Now, I know exactly what to do with it.

I thought I was good with money before. Not the best. But smart enough. I felt confident largely because of my discipline and lack of desire for material things. I felt like I was on the right track, checking off boxes society ascribed to me long before I understood them.

College … Check. Career … Check. Homeownership … Check. Marriage … Check. Fatherhood … Check.

I thought I was climbing the social and economic ladder. It wasn’t until suffering my biggest setback did I learn how wrong I was; how titles can mislead and mask an incomplete man.

Divorce didn’t just spur me to get smart with money. It also allowed me to live in my truth. Anyone who has gone through a divorce understands the shame and embarrassment and guilt that closely follows the heartbreak. You feel like a failure. When the life you hand-built and proudly shared with the world crashes and burns you feel like a fraud. Never mind the money, the amount of time you can spend managing those feelings alone can take years. While navigating them, you almost never feel like your best self.

What helped me was surrounding myself with support. To my surprise, I benefited most from a group of strangers, at the Christian-based, 12-step program Celebrate Recovery. They helped eradicate my embarrassment. They set me free of my shame. Before I tackled the taboo subject of money, I had to grow comfortable talking about my divorce.

I learned that many of us are suffering in silence as we struggle with the same afflictions. In opening up to others in my hunt for healing and desperate attempt to save my marriage, I experienced for the first time the power of fellowship in the lives of broken men.

It taught me I don’t have anything to hide.

I shed my burden long before I buried my debt. It’s helped transform me into the best version of myself.

There’s no better time to have a little more disposable income.