Suze Orman refuses to eat out.

“I think that eating out on any level is one of the biggest wastes of money out there,” the legendary personal finance expert told The Wall Street Journal.

I would have missed that gem if the publication didn’t auto-renew my subscription at its higher $38.99 monthly rate in December. But after immediately canceling at that price, I’m happy to report I resubscribed for $6 a month on Jan. 26. It’s $2 more than my previous subscription to The Wall Street Journal. Now, I get access to MarketWatch and Barron’s too as part of a bundle. It’s one of my better money moves in January.

But I digress.

Back to Orman.

It’s hard to believe she never goes out to eat. It’s not that I don’t believe her. It’s just the 72-year-old has done extremely well financially. Clearly, she can afford it.

I can only imagine the types of meals and, more than that, experiences Orman has everyday access to. Surely, she must at least employ a personal chef. My guess is Orman enjoys some combination of a chef, a joy of cooking and perhaps a personal garden from which she takes pleasure in growing, plucking and consuming her own fresh produce. With those three in play, Orman’s lifestyle would make perfect sense to me.

But without the benefit of added context, I’m left to conclude restaurants simply don’t align with Orman’s spending values. They all get a hard no from her.

And I thought I was stubborn with my money.

Scaling back my spending on eating out was among the first steps I took to regain control of my finances. I’m only 17 months into my transformation. Yet I’ve already lost much of my appetite for meals out. Still, I’m not ready to personally denounce all forms of dining out. There are cuisines and recipes and concoctions of all kinds my eyes and belly will both always crave.

But I can see where Orman is coming from.

Restaurant prices have soared higher, which has forced consumers to rethink their choices.

In a recent survey by the polling firm Global Strategy Group, half of respondents reported being unable to afford to eat at restaurants.

Perhaps it’s no coincidence the same poll showed respondents prioritized having disposable income to put into savings or spend on things like restaurants more than they prioritized buying a home or sending a child to college.

Quickly ask yourself these questions:

How committed are you to taking control of your money?

Where can you scale back your spending, and who or what would benefit if you did?

I was grappling with what felt like dismay from being unfaithful to Walmart when I stumbled across Orman’s view on eating out. I had just spent $57.61 at Pete’s Market, a local grocer.

I wanted to make tacos.

And while I love Walmart for a lot of reasons, its meat section isn’t one of them.

When I really want to make tacos, I need inner-skirt steak, trimmed. At least two pounds. Authentic Mexican corn tortillas, a white onion and cilantro are the only other items I typically need. But on Jan. 5, I had a taste for chips and guacamole. And Pete’s has some pretty good, premade guac.

It ran up my bill and made me break my allegiance to Walmart. But it beat eating out.

I made dinner for four. Had breakfast tacos for three the next morning. And I ate off those tacos again two more times.

Seventeen days later, I was back at Pete’s, hungry for more tacos.

On my second trip, I spent $31.41.

That’s $89.02 I spent in January with a competitor of the big-box store I’m invested in. It feels strange now to step foot inside Pete’s.

But I don’t have to be so rigid. I know three people who will vouch for the deliciousness of my tacos. It was money well spent, the runner-up to my best money move of the month.

January was filled with similar joys.

I got to meet up with my guy Justice during a work trip to Cleveland, Ohio. I treated him to Shake Shack, one of the few individual companies in my buy-and-hold stock portfolio. Justice showed up wearing a limited edition Money Talks shirt, which made my day and our $29.22 lunch well worth paying.

Other shrewd and satisfying purchases last month included a $6.36 charge for pizza at Casey’s, a midwestern chain of gas stations and convenience stores. I paid $12 for my first car wash since buying a new vehicle in September. I bought a new vape pen for $15.14 and a bottle of my favorite, ready-to-drink old fashioned for $23.08. Guilty pleasures, you could say.

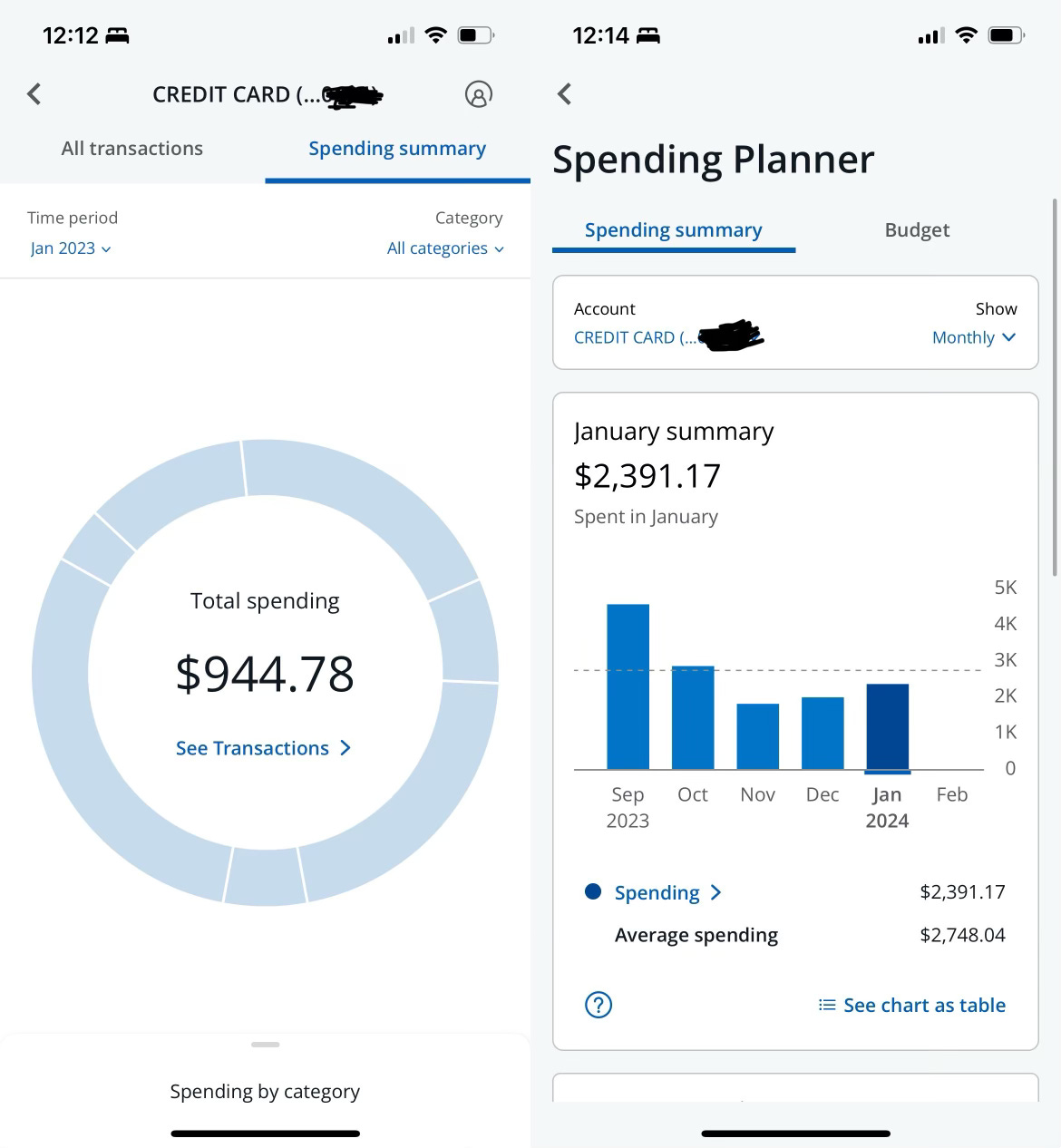

Three work trips are what swelled my credit card statement nearly $1,500 higher last month compared to January 2023. Subtract my expenses from those trips, and I spent only $299.45 more in January 2024 than January 2023.

I’m hoping the Illinois Department of Transportation does the right thing and reimburses me $67.98 I spent for a tire thanks to a sinkhole playing chicken with cars in the middle of the expressway. My guy James came in hot in my text messages on the Thursday morning that column published, telling me about Federal Tort Claims. Basically, I can file a claim, and I might get reimbursed.

If so, it’ll wash away my worst money move of the month.

Can’t get enough Money Talks?

I love the experience of eating out tooo much and the break it gives us from cooking. Maybe if I had a personal chef I’d feel differently? I guess it comes down to the values thing like you mentioned. My husband and I have talked about how since we do love eating out, we could cut back on getting drinks since 2 drinks often equates to the price of one of our dishes. That has helped some!