I shaved $3,000 from my yearly spending in 2023.

The moment I realized it, I said to myself, “That’s it?”

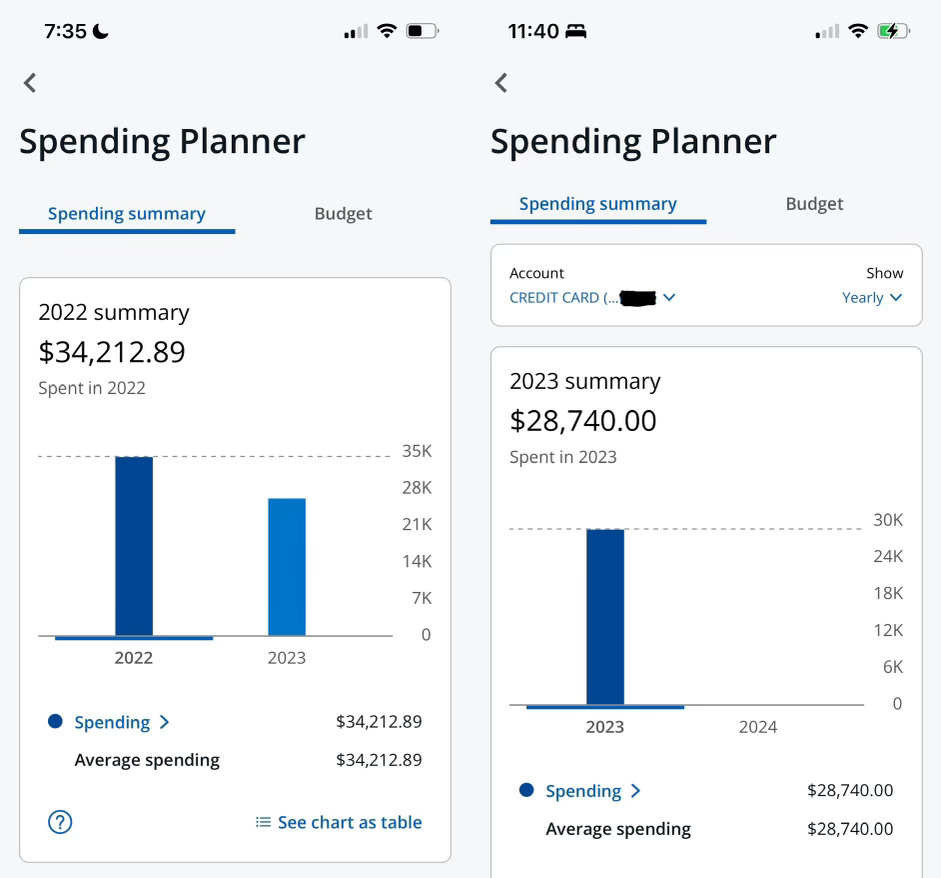

I grew disappointed after I calculated the math last week. Frustration soon followed. I anticipated the money saved between my 2022 and 2023 spending would be substantially higher.

I sacrificed so much throughout 2023. I changed my habits. I altered my lifestyle. I committed to a new money mindset and a wholly different approach. When it came to my spending, I was as intentional as ever. Discipline and consistency supplanted my lifelong patterns of spontaneity and splurging. So why didn’t I save more?

It’s because my money now has a greater purpose. It’s because I didn’t simply stop spending, but instead I evolved into a smarter consumer.

Take the food and drink category, for example. In 2022, it made up a shocking 24% of my credit card spending. Last year, the category accounted for only 8%. Talk about the joy of cooking — and the importance of scaling back on booze.

By making wiser money decisions, I created room in my budget for things that truly matter. First and foremost, it allowed me to afford my monthly tithe. Committing to giving God the first 10 percent of my salary added structure. It forced me to be sensible with my spending each month. It made me a better steward of every dollar I receive.

Healthier habits flowed from there. I shifted my focus. I let go of liabilities and learned how to start stockpiling assets. I funneled money to my freedom fund to bolster my foundation and to my daughter Parker’s brokerage account to set up her future.

I redirected funds to my stock portfolios as well, maxing out my Roth IRA for the first time for the tax year 2022, and jumping on market corrections in my long-term brokerage account. I’m dedicated to dumping as much money into the market as possible. Because I crave steady future income and a comfortable retirement.

Gobs of money that previously went to things like pizza began going to personal development. I spent more than $2,000 on business conferences in 2023, attending three in-person and one virtually. That’s four more than I’ve attended — and paid for — in probably the past decade. I grew wiser and more confident after each conference. My circle of like-minded individuals seemed to increase after each session.

Many other business expenses appeared on my statement for the first time. I ordered a wardrobe’s worth of Money Talks apparel: T-shirts and hats, sweatshirts and hoodies. Everything from business cards to a business address got added to my balance in 2023.

I got hit with a hefty tax bill, which I put on my credit card but paid off immediately. I paid another four figures for my old vehicle’s repairs before finally calling it a clunker and throwing $3,000 more on a down payment for my new car. Those charges alone represent almost one-quarter of my yearly spending. I don’t anticipate seeing those bumps return in 2024.

For 2023, my total credit card spending was $28,740. After accounting for gasoline, which I paid for exclusively with my Shell credit card instead of my everyday credit card, the difference between my 2022 and 2023 spending was only $2,994.60.

Not even $3,000 less in 2023.

Initially, I expected more. My mind ran back the past 16 months of sacrifices I’ve made. The memories didn’t mesh with the math. It’s because I was using an old strategy.

At that moment, I had reverted to a saver’s mentality. And that’s not at all what this journey is about.

I’m now an investor.

And that means that even when it doesn’t feel like it, I know my money is busy working for me.

Can’t get enough Money Talks?

This was a good one. I tithe too. Started 3 years ago and its the only money that goes out that im happy about each month bc i know my blessings will multiple. Which credit cards u use? Any ones have the best rewards?

If you don’t mind sharing, what was your total investment allocation amount for 2023? And how does it compare to your 2022?