Money Talks has changed my life

Another car repair bill arrives nine months after the last one. This time, I was ready.

While celebrating our company’s first milestone achievement, I suffered a major financial setback last week.

I incurred another mammoth bill for vehicle repairs.

Loyal readers of Money Talks know car trouble is what set me on this path of pursuing financial freedom. I’m only nine months removed from that money nightmare. But I’m proud to report that in that short time, my finances have improved immensely. More than that, my life has changed for the better. I’m a new man, armed with a new mentality and a fresh outlook.

I credit Money Talks.

At the end of August of last year, I decided to start being diligent with my money. I dedicated hours to diving into financial literacy. I sacrificed sleep, staying up late and waking early to take in as much information as I could.

I’m now feeling the payoff in so many ways.

I’ve committed to charitable giving. I’ve learned to track my spending. I’ve basically quit drinking alcohol. I’m close to quitting marijuana. And I’ve probably lost 20 pounds.

By implementing the principles I’ve committed to sharing publicly, my biggest money problem of the year came and went without worry. My peace was uninterrupted. My anxiety never rose.

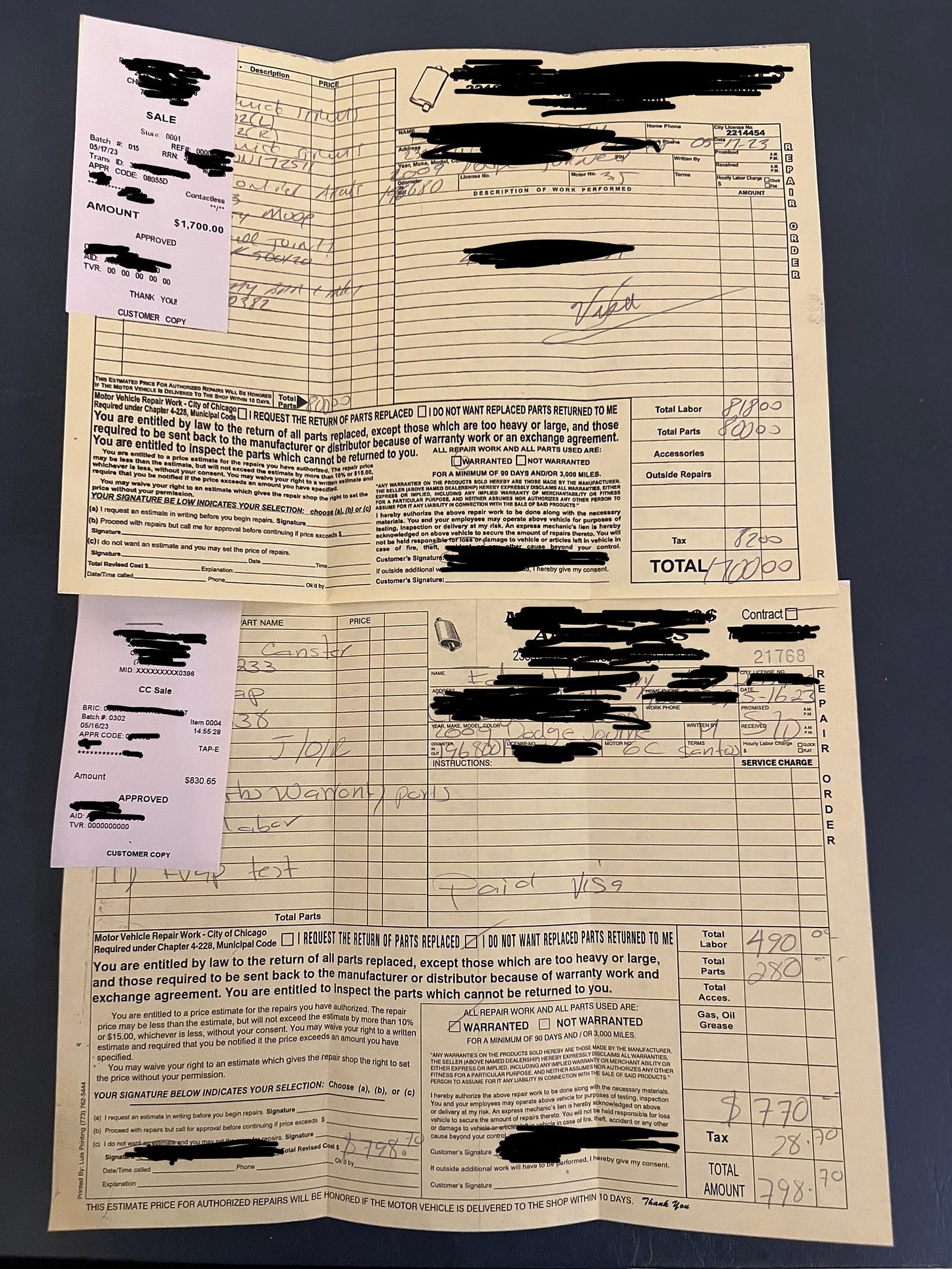

The damage: $2,530.06.

I smiled. I said, “It’s all good. I got it.”

Because I began directing $334 each month into my emergency fund at the start of the year, I had $3,444.74 saved, including additional contributions, for the day such an expense arrived. And much like last August, I no longer could ignore my vehicle’s warning signs.

We’re hitting the road next month, making a 12-hour drive to Oklahoma to spend time with family. It’s Parker’s one trip per year to her native state, the place most of her extended family resides. It would have taken a miracle to get her there safely in my death trap.

My struts were shot. My EVAP system was defective. I even needed a new gas cap.

Within two white envelopes are a pair of yellow receipts detailing the latest lengths I’ve gone to repair my 2009 Dodge Journey, all in the name of avoiding a monthly car payment.

I knew I needed struts. The shop that rebuilt my transmission last fall informed me, as if insanely loud rattling with each bump didn’t make it clear. The point of contact suggested I replace them before winter. But who was he kidding? His repairs cost me north of $3,700. A necessary brake job six weeks later put me out an additional $941. And so I waited.

Of course, by the time I took my vehicle to the shop the damage had grown more severe. The shop that serviced my brakes last year is the one I chose for my struts. A quick look under the vehicle as it was raised in the bay revealed my struts had been leaking so long fluid marks were stained on the parts.

My vehicle required all new struts, a new control arm and new ball joints. Because I was a repeat customer, or perhaps because he felt pity for me given the extent of my repairs, the owner gave me a discount. He lowered the price from $2,000 to $1,700. I immediately shook his hand but just as easily could have thrown my arms around him.

I was less enthusiastic about the 4 percent surcharge the second shop charged me for paying for the EVAP repair with my credit card. It tacked on $31.95 to my bill, bumping it to $830.65. I ate the fee solely for reward points.

Because ample money sat in my emergency fund, I was able to make a quick transfer and pay the balance for both bills. The setback sent my emergency fund spiraling to less than $1,000. And now, my goal of building $5,000 before the end of the year will be difficult.

But it’s all good. I’ve got this.

I’ve developed another healthy habit. I’m purposefully tucking away money to properly prepare for the inevitable. Now, I know the process works. Five months was all it took to strengthen my foundation and be able to face my first major financial hurdle of the year head-on. For the first time in my life, money trouble didn’t shake me. I felt secure rather than scared, comfort rather than uncertain.

Of all my early money moves, this was by far my biggest victory yet.

I think it’s time to get an EV 😅