Allow me to be transparent here more than I typically am.

I have no idea how to command your attention for this column.

Five years ago, I certainly wouldn’t have stopped to read about a health savings account (HSA). Ten years ago, I barely knew what an HSA was. And I had no desire to learn the details.

I could be wrong, but I feel like many of our subscribers might easily check out on this one. I get it. It’s not the most riveting subject. Besides, most reading this either have owned an HSA for years or, at the other end of the spectrum, don’t know the first thing about them — and don’t care to.

I hope I’m wrong. Because depending on your situation, an HSA could be one of the best money moves you can make. And because I’m now a money nerd, I’m excited to finally have established mine.

I told you at the start of the year that my money has gone missing. My take-home pay is almost $500 less in each pay period this year compared to 2023.

It’s a significant change that forces me to be more diligent about my spending. Only miniscule room remains in my budget. Any reckless stretch of splurging will push my finances to the limit. But I’m OK with it. I’m learning to cope.

A big reason why is because I see long-term benefits.

I view my HSA as being akin to my freedom fund. Funneling $204 from each paycheck to my HSA will provide me with a nest egg for medical expenses. That alone would be worth socking away money.

But we can invest the money sitting in our HSA, which really is what commanded my attention.

I sat through a 45-minute training session on Feb. 22 to learn the process. I’d never committed to the method before. The training informed me that my HSA balance must reach at least $2,000 before contributions can be invested.

No problem.

Because I carry my daughter Parker on my insurance every year, I enrolled in the family plan. Its contribution limit is $8,300 for 2024 rather than $4,150 for an individual plan.

My company contributed $1,600 to my chosen plan, which nearly pushed me to the required threshold on Jan. 1. Contributions from my first two checks in the New Year then made me eligible.

On Feb. 28, I made my first transfer of $212.01 to the financial institution managing my HSA investment. Then I turned on the auto-transfer function. On March 4, another $200 settled.

I’ve already earned $3.04 on my investment, which automatically reinvests into my account and has bumped my invested balance to $415.05.

The money I contribute is all pre-tax income. It will now grow inside my HSA tax-free. And in time, I’ll be eligible to withdraw the money tax-free. That’s the “triple-tax advantage” financial gurus rave about with the HSA.

To me, it’s simply a sound investing strategy.

I’m invested in a plan that features 90% stocks and 10% bonds via various exchange-traded funds (ETFs). It forms a globally diverse portfolio with broad market exposure. In other words, it’s a plan I’m comfortable with.

Because I don’t incur many medical expenses, I’m good with the possibility of having to someday pay a high deductible. I also am fortunate to be able to pay for most routine expenses out of pocket. That allows me to be aggressive investing all money beyond the account’s required $2,000 minimum balance.

By year’s end, I will have invested $5,100 through my HSA (I’m anticipating receiving 25 paychecks in 2024 after the first one arrived on Jan. 18). An additional $53.69 each check would max out my contribution for the year.

But as I’ve explained, I’m broke, baby!

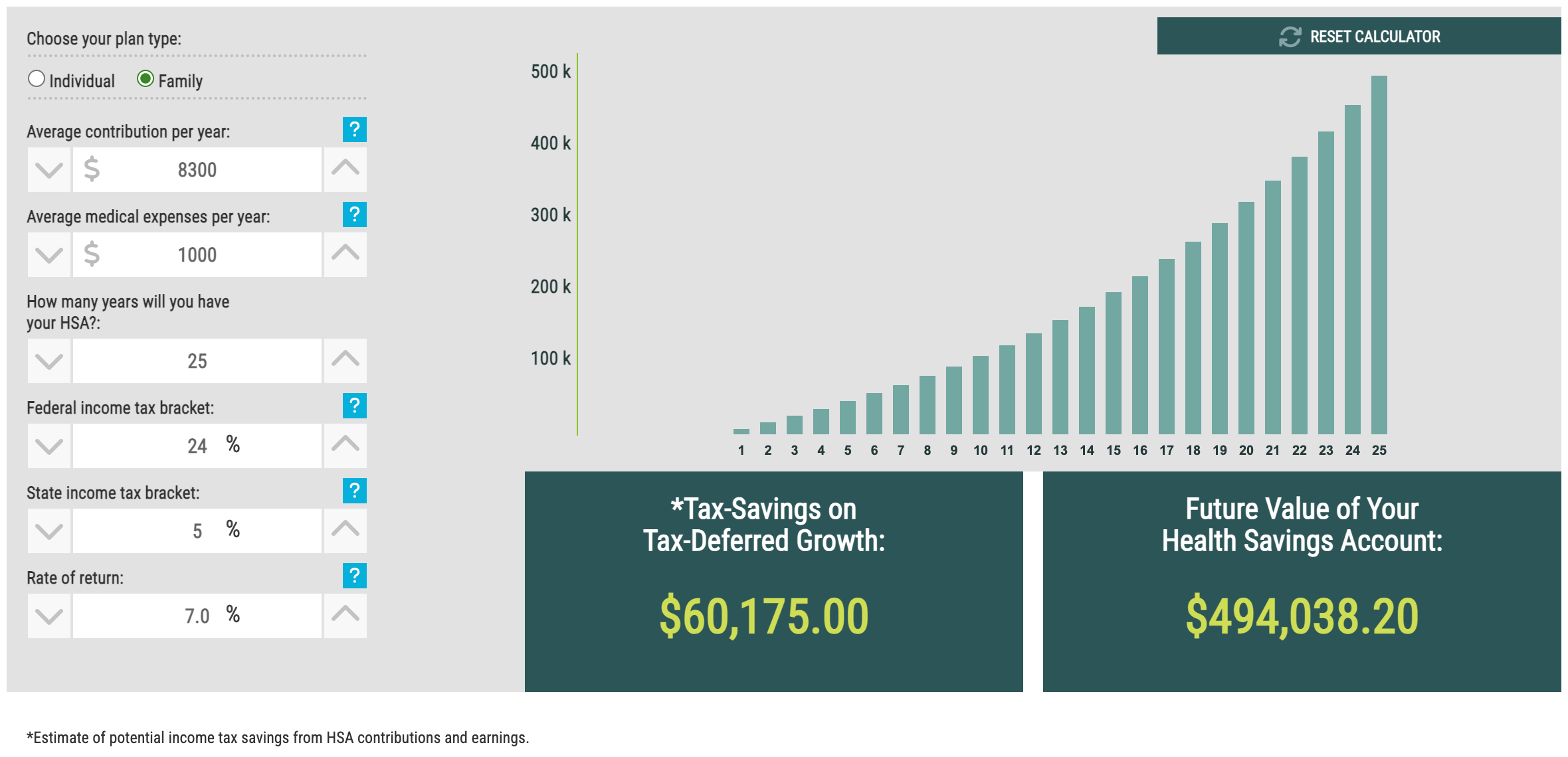

I hope to be able to max out my HSA next year and every year after that.

If I can achieve that for the next 25 years, I could be armed with almost $500,000 just in my HSA. That’s assuming a conservative 7% annual rate of return, with a generous $1,000 annually going to medical expenses. I would have contributed just more than $200,000.

Nothing about that math bores this converted money nerd.

Can’t get enough Money Talks?

Disclaimer: The information contained on Money Talks is not intended as, and should not be understood or construed as, financial advice. I am not an attorney, accountant or financial advisor. These are my personal experiences, and this website is not a substitute for advice from a qualified professional.

The HSA and the triple-tax advantage was something I learned about exclusively from my co-workers. Just another way I benefited from being around financially savvy mentors who had already done the leg-work, and pushed the company to switch to a high-deductible plan to my eventual benefit. And it wasn't until hearing them describe the HSA to new employees last year that the triple-tax advantage really hit home. Now I try to pay my medical expenses with my liquid funds and leave the HSA balance to grow tax-free as much as possible. I didn't do this for the first 5+ years.

I'm glad you've found out about it too and are spreading the knowledge, Darnell.

Triple Tax Advantage. 99% of financial people say to max out your HSA just after making sure you get any employer match (free money).

Sounds like a winning plan to me.