“The stock market is a machine that prints money, and I am more than capable of operating this machine.” — Wallstreet Trapper

I made my first profitable options trade on Oct. 24.

You couldn’t imagine the joy I felt for a $4.68 gain that took 67 days to make. And technically, it took longer than that.

I’ve studied options trading for the past year. It’s a skill I’ve been determined to learn since I stumbled into stock market investing. It’s a way to use the stock market to multiply our money and put my family on the fast track to financial freedom.

I intend to make options trading a prominent part of my wealth-building strategy, alongside my day job, stock investing, real estate, Money Talks and more.

It’s one of the riskier ways to use the stock market so I’ve proceeded with caution. But with the right technique and temperament, you can make a killing. And I believe I can develop both.

I know some of you are well-acquainted with options, perhaps even profitable traders, while others have no idea what I’m talking about.

For those unaware, options trading is an alternative form of stock trading that offers the potential for a much larger — and much faster — return on invested capital compared to purchasing a stock directly.

As an example, Wallstreet Trapper, who I introduced you to in August, disclosed a $57,000 profit in one of his options accounts this week. And that was just from Tuesday.

Of course, it’ll take time for me to get to that point. But I’m a patient man and a willing learner.

Before jumping in, I spent more than six months doing everything I could to educate myself about options and how to mitigate my risk. I downloaded explanatory literature, binged YouTube videos and listened to podcasts. In late June, I finally fired up Investopedia’s stock market simulator. It gives you $100,000 in dummy cash to test your investing theories in real time.

I ran a simulated version of trial and error for another month before I began using real cash. And I quickly learned I wasn’t ready.

I lost $45 in my first options trade on July 28, a “put” on ticker symbol SPY. A put option gains value as the stock price decreases. My position showed a paltry profit — or “in the money,” — for a bit. But I held too long, hoping for a greater gain before the end of the day. Then the position turned and never recovered. It tried to reach my required level just before market close, but failed. My first options contract expired worthless.

I could have quit. I don’t like losing money. And this was the opposite of my first taste of stocks, when I happily watched our money grow in real time.

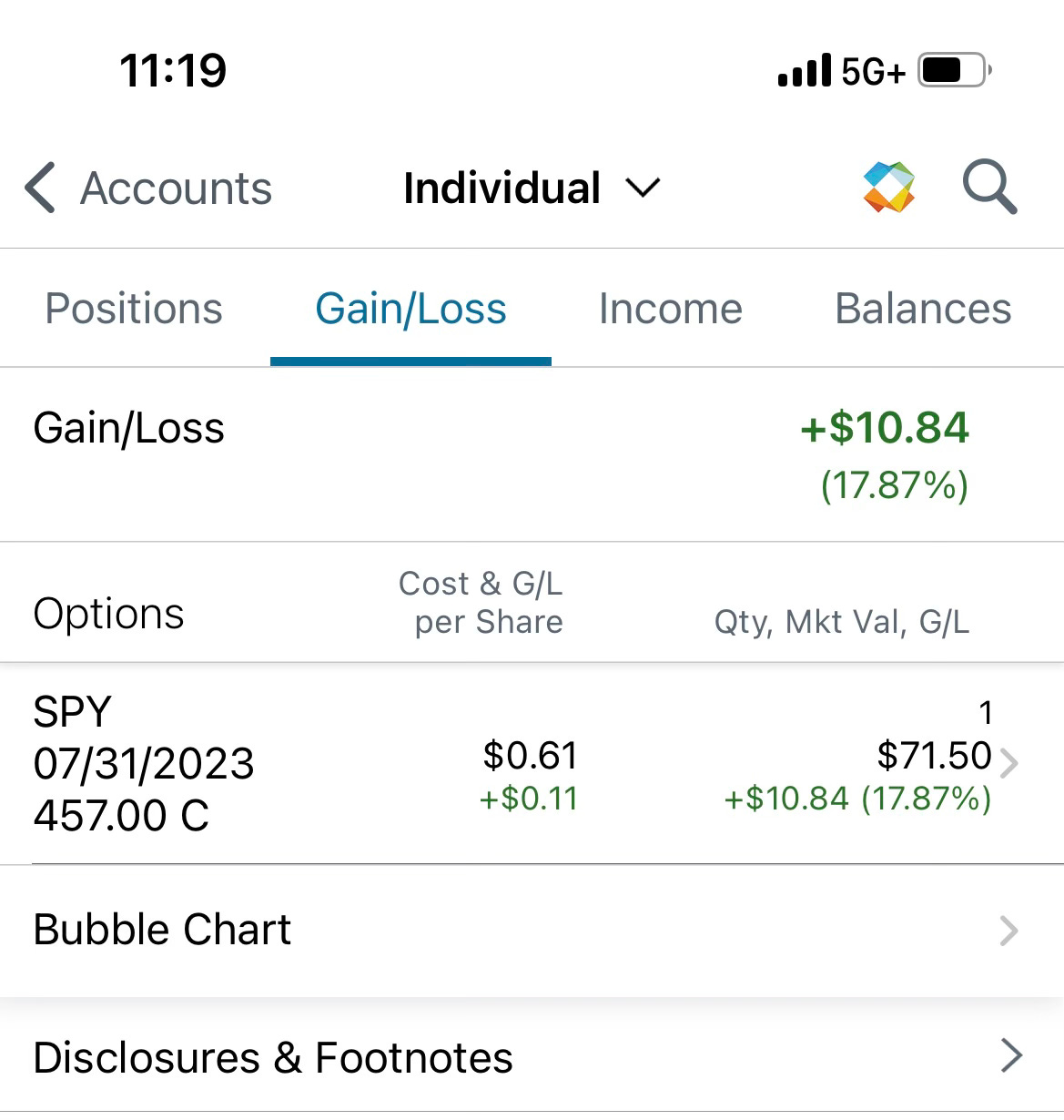

It was a Friday. But I got right back into my second option the following Monday morning. On my second try, I bought a “call” option on the SPY, which means I anticipated the market would go up. And it did.

I watched my position increase 17.87%, a cool $10.84.

But then the market turned. My position flipped from green to red. I sold to stop the bleeding, only to watch the market spike in the closing minutes. It was too late. Total damage: $53.32.

With my losses from my first two trades hovering at $100, I smartened up. I joined a community group in August to help teach me how to trade. I mentioned it in September in my August spending column. It’s $10 monthly. I figure it’s better than going at it alone and hemorrhaging money.

But I still have a lot more to learn. I’m nowhere near comfortable trading consistently and certainly not pulling in a profit. I’m still easing my way in. But enough time has passed. I can only study so much. This is a game I must learn by playing.

My first successful options trade was a put option on Mullen Automotive, ticker symbol MULN. I had become familiar with the price movement on the electric vehicle maker’s stock since adding the company to my portfolio in October of last year. I’ve made $235.94 swing trading Mullen over the past year, essentially buying low and selling higher a short time later.

Once I realized the stock is trash and stuck in a never-ending spiral, it seemed obvious to me to try buying a put option.

I’m glad it worked. It was good practice. Because I’m not stopping.

This mechanism, when operated properly, is a money multiplier. It’s not manual labor. It doesn’t require hard days and long nights. It won’t pull me away from loved ones on weekends and holidays. I don’t have to be anywhere or take instruction from anyone. I just have to pay attention and push a few buttons.

That’s a trade I like.

Disclaimer: The information contained on Money Talks is not intended as, and should not be understood or construed as, financial advice. I am not an attorney, accountant or financial advisor. These are my personal experiences, and neither this website, newsletter nor podcast is a substitute for advice from a qualified professional.

It seems like you've done your due diligence on this, but I can't say it's a path I would recommend. I personally prefer to throw everything into a few lost cost index funds and let the pros do the work for me. The odds are too stacked against you in the options market, and I've got no interest in doing battle with the likes of JP Morgan and Blackrock.

I don't want to spend any time worrying about the market or whether one particular stock is up or down on a day to day basis, since I've still got another 20-30 years before I retire. The plan is just to let time in the market do its thing.