Spend check: Making room for loved ones in May

Setbacks in consecutive months have tested my resolve.

Suddenly, I feel broke.

After suffering substantial financial setbacks in consecutive months, I couldn’t wait to get out of May and into June. Between a hefty tax bill in April and major car repairs in May, I forked over more than $5,000 in just the past six weeks.

Eleven days ago, I was worry-free. Money was tight, but I had it. Everything was taken care of.

That all changed when my second and final check arrived for May. Before I could enjoy the thrill of payday, the realization hit that nearly all my income for the pay period would be wiped out.

First, I paid my tithe. Then there was my routine $334 to my emergency fund. I paid rent, and my monthly life insurance premium and weekly Roth IRA contributions were automatically withdrawn.

Just like that, I was waiting for the next check to arrive in June.

My reality worsened after sharing my dismay with Parker. She turned and looked at me quizzically.

“I thought you didn’t live paycheck to paycheck,” she said.

Nope. I still do. But I’m working on it, sweetie.

The difference is my asset base has grown tremendously over the past seven months. The problem is my foundation still isn’t solid enough to avoid tapping into my assets — mostly stocks and retirement accounts — if ever I’m in a bind.

I thought I graduated from here. I thought I progressed to new problems. But progress doesn’t always feel pleasant. I do believe I’m feeling the pain that precedes freedom.

Two things tripped me up in May, however, and provided valuable reminders. The first centered on my obligation to others. The second was none other than me.

I spent more than $500 combined in May celebrating a loved one’s birthday, sending a graduation gift to a nephew and spending quality time with Parker. I don’t regret any of the purchases. If I can’t spend on loved ones, what’s the point of any of this?

I took Parker bowling. We attended a carnival. And I treated her to a taco dinner at one of her favorite local restaurants. I don’t have as many opportunities for fun during my busy season with work. Making it up to Parker when I have downtime is important to me.

Concert tickets for July and August cost me a couple hundred bucks, and I spent $165.07 at restaurants in May. It’s the most I’ve spent in a month eating out all year.

But where I hurt myself most was not on frivolous spending but on stocks. I didn’t even realize it until sitting to write this column.

I deposited $700 into my long-term brokerage account last month. My credit card statement won’t reflect that since the funds were transferred from my bank. But that leaves me with less money to pay my credit card balance.

That’s partly why I’m feeling heat like I’m inside a pressure cooker. After altering my lifestyle and becoming smarter and more disciplined with money, one overzealous month of investing shut off my breathing room.

I got carried away. Now I must be meticulous in June.

The lesson here is to avoid splurging on stocks if it will leave you strapped for cash.

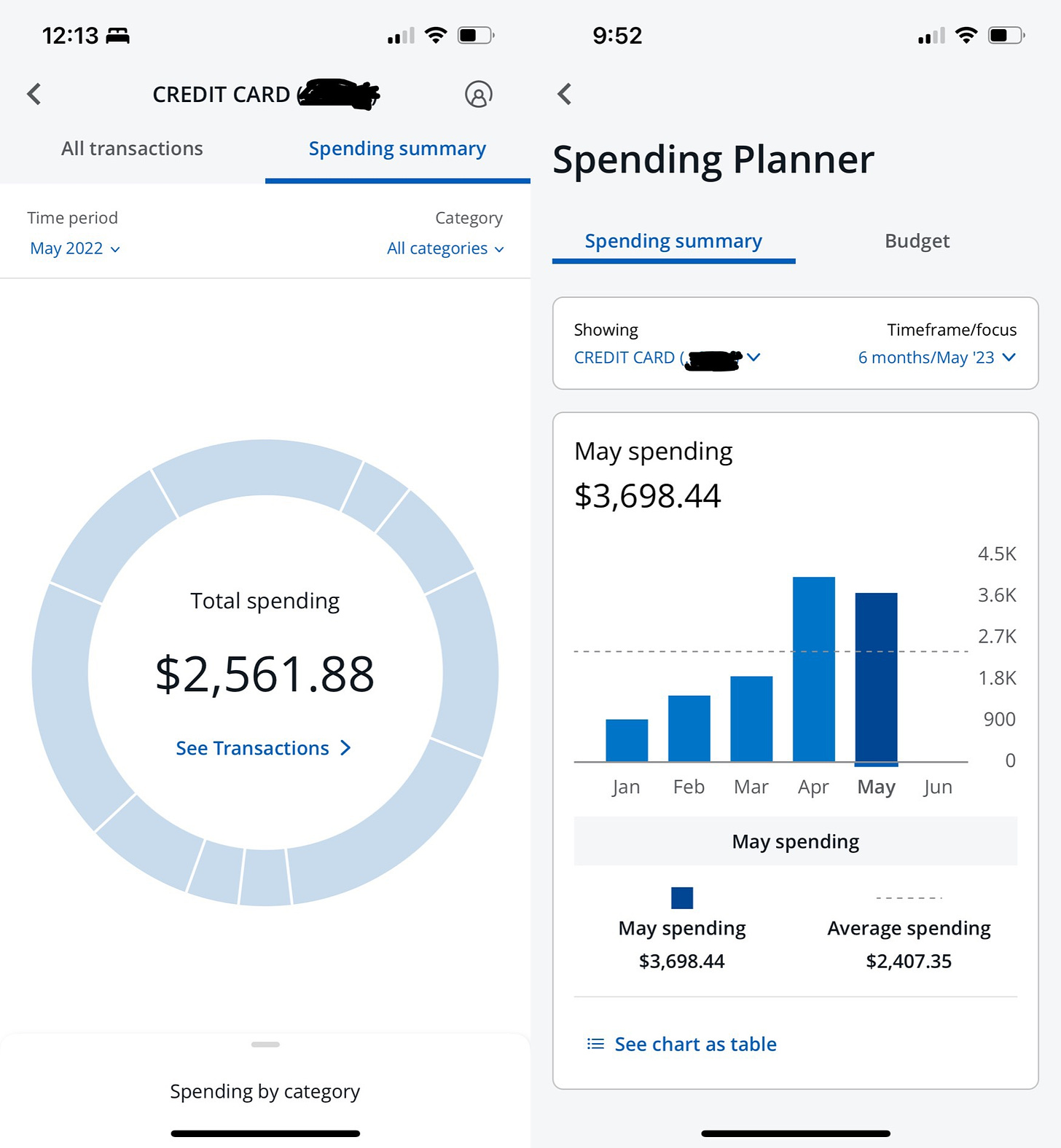

Using just my credit card statement, I spent $1,136.56 more in May 2023 than I did in 2022. There’s no caveat or justification this time. It’s the first month in which my spending topped last year’s for the same month.

The streak ends at four months.

Best money move: Nuggets

Parker’s elementary school permits parents to sign up for “lunch with my learner.” It’s something we discussed since early in the school year. On Tuesday, May 2, with four weeks before the final day of school, I made it happen. I bought a 12-piece nuggets meal from Chick-fil-A, with waffle fries and an apple juice. We split the nuggets in what has to be the loudest cafeteria I’ve ever experienced. I met a few of Parker’s friends. We played on the playground and saw a family of baby bunnies. I couldn’t have scripted a better start to May. Total: $12.75.

Worst money move: Canva

I’ve now allowed my subscription to this graphic design platform to renew for four straight months at $12.99 a month. I thought I needed this subscription to do one thing to enhance the Money Talks logo. I’ve been unable to do it. My futile efforts have cost me $51.96. I’ve cancelled Canva. I’ll figure out another way. If you or someone you know is a graphic designer, please help!

Check out Ant's work!