The letter, from The Oklahoman Media Company, is dated March 26, 2018.

It still sits on the floor under my nightstand, right on top of my Bible. For nearly five years, I foolishly watched both collect dust.

I wish I had that time back. I’d pick up the Good Book more, and I’d get a mulligan on one of the worst money moves I’ve ever made.

“This letter is to notify you that the segregation of your OPUBCO 401(k) has been started following the instruction of the approved QDRO,” the letter read.

At the time, I didn’t know what that meant. And I didn’t care. I had bigger concerns. I was newly divorced. Paperwork from the long, litigious fight had just been signed to make it official only three weeks earlier.

A vivid memory from my divorce proceedings happened inside the courthouse during a side conversation between opposing attorneys. The other side sought all they could get in a settlement. My attorney objected after a certain point, saying I simply didn’t have the funds to pay.

“Well tell him to take it out of his retirement,” the opposing attorney shot back, with no regard that I wasn’t standing right there.

I also didn’t fully grasp what that meant. But I knew it wasn’t a pleasant option and would only inflict additional pain. It never came to that, although the settlement still forced me to fork over $32,000 from my 401(k).

I was 35. That was as much thought as I had given to my retirement account — one insulting comment and one costly payout. It took almost another five years for me to start paying attention.

Back in May, I told you about the plan for Parker’s Roth IRA. I haven’t shared with you the story of mine.

I allowed that letter to sit, mostly untouched, from March 2018 through the fall of 2022. I had no idea what I was missing. After I finally grew dedicated to fixing my financial picture, I looked into the letter and looked up the meaning of QDRO. It stands for qualified domestic relations order, and it essentially allowed me to receive my 401(k) assets — or what was left — as a payout or rollover to a new account.

The whole time, I had $45,959 sitting under my nightstand.

It wasn’t compounding or collecting interest. It wasn’t drawing dividends or stabilizing my future. It was just…sitting.

The trust company that my former employer funneled my funds to tried contacting me. I still have their follow-up notice that puts my inexplicable inaction on blast.

“We have previously reached out to you but did not receive a response,” it reads.

Thankfully, the company made the rollover process a breeze. I simply logged into their website, created an online profile and validated my information. After that, I was free to choose how I would manage my investment. I spent two months reading, researching and learning before jumping into a world I still was discovering.

But my foolishness had stopped, and the fun began.

Suddenly, I had nearly $46,000 to invest.

On Oct. 22, 2022, I opened a brokerage account to house my retirement funds. Three weeks later, on Nov. 14, I printed the paperwork for the transfer. On Dec. 8, I signed.

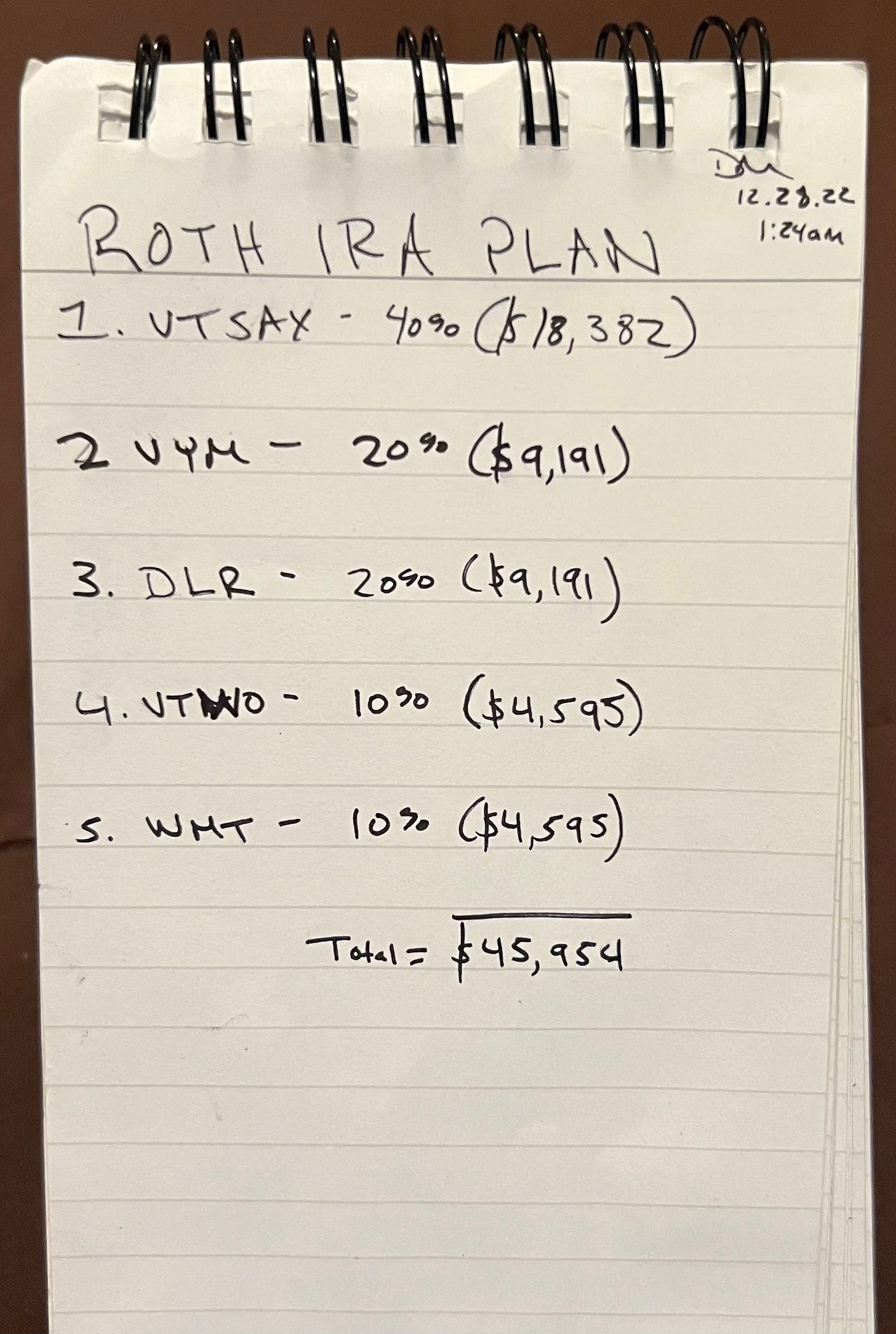

And on Dec. 27, 2022, $45,955.17 was transferred into my rollover Roth IRA. A day later, I got to work investing exactly how I settled on dispersing the funds. I wrote my plan in a notebook during one of my many sleepless nights spent studying and strategizing last winter.

I earmarked 40 percent, about $18,000, for the Vanguard Total Stock Market Index Fund, ticker symbol VTSAX. It’s a mutual fund that seeks to track the performance of the overall stock market. J.L. Collins’ book “The Simple Path to Wealth” hammers home how easy investing can be by sticking to this fund as your primary vehicle. He helped turn me into a believer in index fund investing.

I put 20 percent, a little more than $9,000, on the Vanguard High Dividend Yield ETF, ticker symbol VYM. It’s the same stock I entrusted with Parker’s first stock investment. If I trust it to build wealth for my daughter, I figured I ought to park a portion of my money there as well.

I dedicated another 20 percent to Digital Realty Trust, ticker symbol DLR. It’s a company that operates in data centers, which could continue to increase in value with the rise of A.I and so much other technology.

I split the final 20 percent, about $4,500 each, between Walmart and the Vanguard Russell 2000 Index Fund, a diversified index primarily made up of small U.S. companies.

Before, I couldn’t be bothered. Now I love checking in on my retirement account. As of Wednesday night, my Roth IRA was up 14.41 percent, or $7,773.52.

Seeing a nearly $8,000 gain over only eight months, I can’t help but to think about all the money I missed by squandering nearly five years.

It probably was a $25,000 mistake.

But my retirement investing is now on autopilot. I’m contributing to my current employer’s 401(k) and taking advantage of the company match. I’m also committed to maxing out my Roth IRA forever. Each Friday since the start of the year, $125 has automatically deposited into that fund to hit the $6,500 annual limit.

I can’t wait to see how my money compounds. And it will.

Because I never plan on prematurely taking it out of my retirement.

Disclaimer: The information contained on Money Talks is not intended as, and should not be understood or construed as, financial advice. I am not an attorney, accountant or financial advisor. These are my personal experiences, and neither this website, newsletter nor podcast is a substitute for advice from a qualified professional.

Better late than never! You still have many decades ahead of you.

Glad you got the money to work! That's the hardest part. If you're interested in getting exposure to small companies, I'd recommend tracking a different index. The Russell 2000 has historically had issues with people front running the index as companies are moved in and out. They've made steps to correct, but I'd rather not put money there. The S&P 600 index doesn't have this issue, and they also apply a quality screen to weed out any junk companies. We use the fund SLYV which is an SP 600 value index, SLY is their small blend version.

I know JL Collins doesn't endorse it, but I'd consider investing in some international companies as well since you have a long time horizon. The bulk of our money is in VT (Vanguard Total World ETF), which buys a bit of every publicly traded company in the world at the market cap. I think it would be worthwhile to look into the research on the "value" of high dividend paying stocks. Larry Swedroe has done good stuff on that and his books on investing are great.

I've been reading William Bernstein's update of the Four Pillars of Investing. It's dense, but it's probably my favorite book on investing and the original version me started on a great path. Covers about everything you could need to know. Would definitely recommend it.