I wanted to go into the New Year debt-free.

So much for that.

Setback after setback has sacked me like a relentless blitz, knocking me flat every time I think I’m about to take flight. And just like Lawrence Taylor hounding an opposing quarterback, my money problems don’t stop coming.

No matter how carefully I plan, something always pops up to throw me off course. A surprise bill here, an unexpected car repair there, and suddenly the progress I’ve made feels like it’s wiped out in an instant.

But it’s not just about the money. The real problem is the mental and emotional toll.

Financial stress doesn’t just sit in your bank statement; it invades your mind, drains your energy and messes with your sense of control. Over time, money problems start to feel like a constant hum in the background, always there, always noticeable.

It’s the compounding nature of money woes that turns manageable challenges into an unrelenting weight. You don’t just face the next bill. You start stressing over what will come next, and it’s exhausting.

Every time you think you’re on track, it seems like the finish line moves further away. You begin questioning your choices, second-guessing your financial strategy and wondering if you’ll ever truly get ahead. That uncertainty can chip away at you, no matter how hard you fight to pull yourself up.

Emotionally, it chips away at your sense of security. Money problems don’t just affect your wallet — they affect your peace of mind. The non-stop worry becomes a big, invisible bully that influences everything from how you sleep to how you interact with others. You find yourself holding your breath when you check the mail or dread checking your bank account, afraid that there’s another setback waiting for you at every turn.

That’s been the hardest part to shake along my financial journey: the never-ending feeling of being on edge, never really sure if I’m truly stable or simply holding things together by sheer will.

Closing out 2024 debt-free was my goal, my benchmark. Falling short has the potential to conjure up all those dreaded feelings.

Because just when I thought I was on track, I learned I must pay more than $4,000 in vehicle repairs and legal fees. The costs have threatened to financially wreck my holiday season.

Even though I’d planned for this — with an emergency savings account set aside specifically for such unexpected expenses — it never feels good to tap into your reserves when you feel like you’re just throwing money away. Now, I will almost certainly carry debt into 2025.

What stings even more is that I did everything right to tidy up my finances before January. I curbed my spending, paid back every penny to anyone I owed a dime and scaled back on my stock purchases.

I spent the past six months getting in position to buy a home. And here came a major, four-figure headache in the final two months, trying to hijack my foundation.

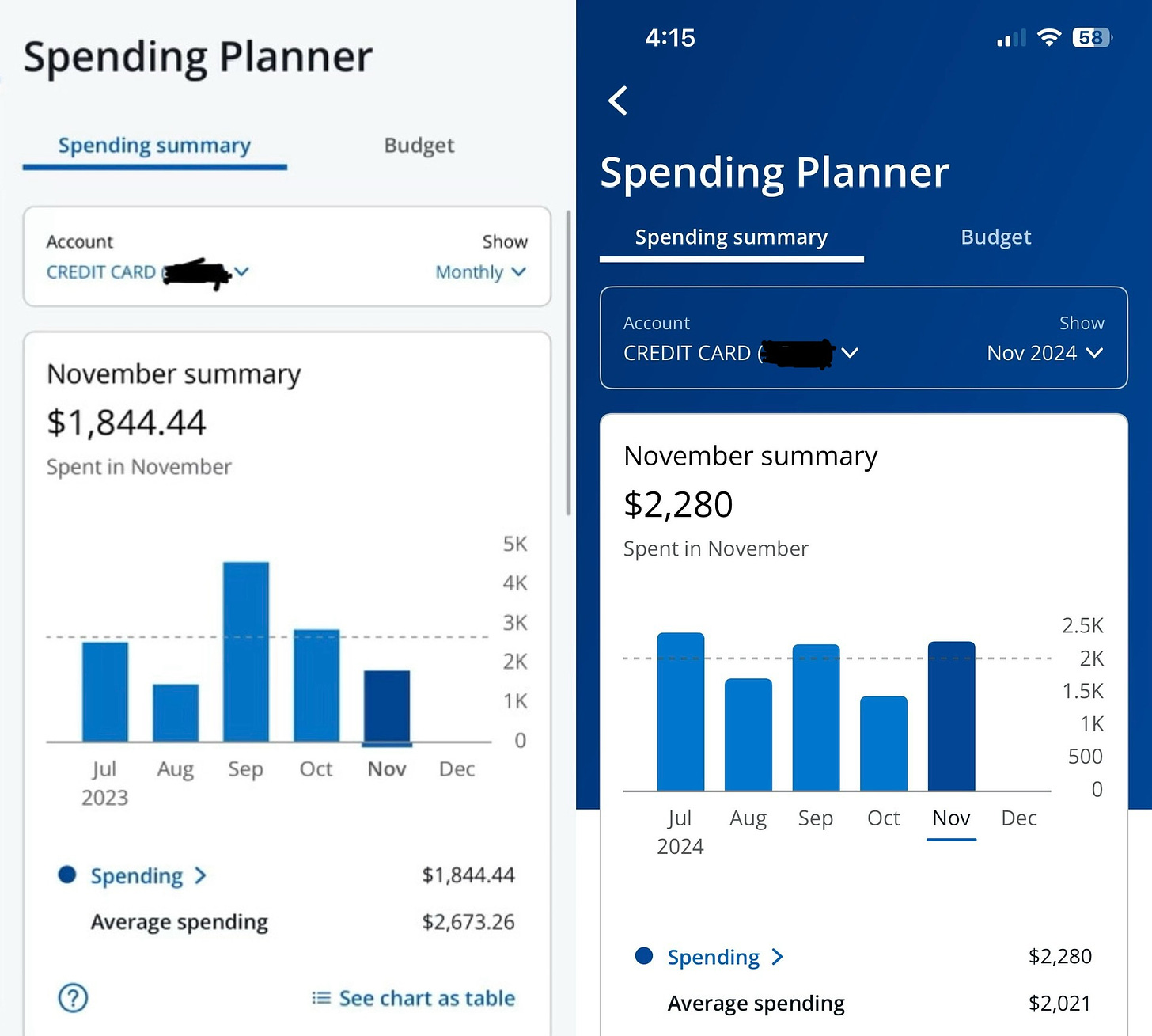

Subtract the initial $1,000 in legal fees and my credit card statement would show I spent only $1,280 in November. Deduct another $200 for reimbursable travel expenses for work and the number shrinks more.

My consistency not just in November but since the summer is a reflection of my desire to be done renting. Rather than paying it, we want to start collecting.

With every setback, that chief goal grows more challenging.

But regardless of how many times life’s hiccups throw me off balance, I’ll keep showing up. I’ll adjust my strategy, cut costs, find new income streams — whatever it takes.

Setbacks don’t define me. They never have and never will.

And I won’t let money problems define you.

Financial struggles can feel isolating, but you don’t have to carry the burden alone. Reach out to a financial advisor, a counselor or a trusted friend to get advice and support.

Sometimes, just talking through your worries can lift some weight off your shoulders. And when things feel overwhelming, take a moment to pause and breathe.

Remember, you don’t have to solve everything all at once. Break things down into manageable pieces, and tackle one thing at a time.

Don’t allow financial pressure to blind you to the progress you’re already making.

This journey isn’t about getting everything perfect. It’s about persistence — showing up, adjusting and pushing forward, even when the path gets tough.

This is one of those “keep on reading” columns!! And I’m glad that I did not stop midway and start the lecture that was in my head and headed to my tongue!

Your doom and gloom and what I feared was defeatism is real, because of course,I’ve lived it. Many of your fellow Americans are living it at levels far worse than yours! Yet and still— We feel you!!

But we know you and we know the young woman (women) of resilience and resourcefulness and fortitude and high achievement that you are raising.

Today’s column is so relevant to life in total! Doing everything “right” with plans for next level success, and here comes Cancer, termination, divorce, death of a loved one or a friend— all checks that cause us to have a “negative balance!” I so often wonder how people survive , recoup, start over from a house fire!! Even the best insurance cannot bring back the memories and the moments. They will always have a negative balance in that category!!

But we know that for ourselves and for those around us , for those depending on us, we must pick up the pieces of our lives, wealth, health, emotions, and did I say money/finances — and move ever so steadily forward. Leaning and relying on family, friends, powers greater than ourselves and the strength within us!!!

Thank you for this whole column!