A quick escape, a lasting financial shift

How a one-day getaway inspired better money management

Do you remember that magical trip to Minneapolis I told you about last month?

That spontaneous but splendid one-night getaway I paid $1,000 for to create a family memory?

Well that trip, as wonderful as it was, left me paralyzed with my spending throughout October. When I look back on my credit card statement, it shows my frugality bordered on fear. My balance reflects my reluctance to fork over a dime more than I needed to last month.

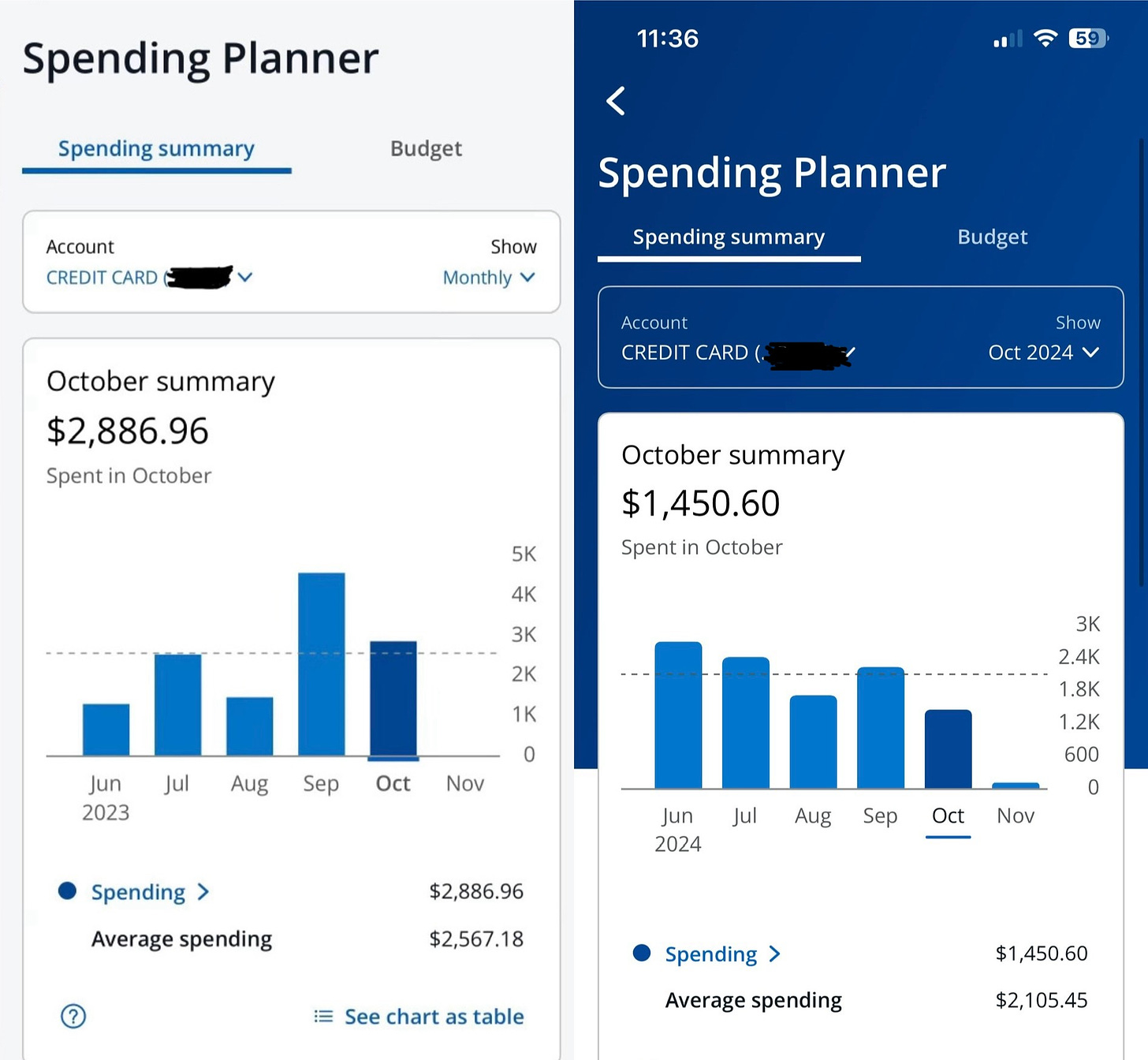

October turned out to be my lowest month of spending since June 2023 — and I wasn’t even trying to be a tightwad. Paying my previous month’s balance in full, as well as the one after, became my priority. Nothing mattered more than preserving enough capital to keep my interest-free streak alive.

And so I was forced to scale back. But I still found a few ways to treat myself.

I make the majority of my purchases with a credit card so I can accrue airline points to fly for free. A few mainstays are excluded, such as rent, gas for my apartment and vehicle, my electricity bill and my $10 monthly gym membership. With the lion’s share of my expenses going on my credit card, it’s the best place to monitor my monthly spending, and each month I will share my progress, for better and worse.

My best purchase was $150.31 spent for one dozen Money Talks T-shirts of different colors and styles. Never mind the weather turning. I’m not late. I’m wardrobe-ready six months before warmth returns. We’ll go with that.

I made two, rare liquor runs that totaled $65.32. And similar to my old drinking days, I don’t remember much good coming from either purchase, certainly no long-term benefits.

On the other hand, I paid $65 for three books from last month’s All Black National Convention. We’re already reading and learning from them. But I gave into a craving, rekindling another old habit last month. I ordered a large spinach deep dish pizza from Giordano’s. It cost $44.72 — roughly the price of heating our home each month.

Fortunately, there were no major blemishes in my spending last month.

Not shown on my credit card balance, however, is $938.83 worth of stock shares I couldn’t resist buying. I spent $512.18 on Nike, because I’m an addict. And I threw $426.65 on The Hershey Company rather than blowing the budget on Halloween candy. Both companies are experiencing dips similar to those that I recently profited from with Starbucks, Google, Shake Shack and Expand Energy (formerly Chesapeake Energy) among others.

But those funds came from gains from stock sales that I’ll tell you more about next week. I didn’t have to transfer money I needed for bills from my checking account or pull from a regular stream of income. The funds were already in my brokerage account.

A smarter decision would have been to use that $938 to eliminate a few anticipated expenses. And longtime readers of Money Talks know I’ve flirted with splurging too heavily on stocks before. You would think I would have learned my lesson last year. But when Nike and Hershey’s stock prices rise again, I’ll be glad I found another way to cover those bills.

Being back in the swing of things at work also means travel expenses occasionally will appear on my balance. But I took just one trip in October, which totaled $151.52 and will be reimbursed when I stop procrastinating and file my expenses.

Two other factors led to my lowest month of spending since last summer. The first, I believe, is now living with my lady friend Triest. I told you last month that I anticipated our move would reduce my financial pressure, and it has. Let’s just say it helps having a partner who can assist with buying groceries.

But the second factor is I’m preparing to buy a house. And every dollar I spend prior to securing a multi-family home is a suboptimal investment. I’ve decided, and I’m determined. My mind is made up. My funds are committed. My feelings won’t change.

This last quarter of 2024 is about tightening the strings and tying loose ends, tucking away a little more cash and avoiding financial calamity.

Because the runway is clear. And this family is ready to take flight.