I could have spent $1,000 less in September.

But I’d be sitting here with regret if I did.

Instead of being cheap, I happily pulled out the wallet to help provide my family with a lifetime memory, to buy our girls a few meaningful gifts and to secure more slick Money Talks T-shirts.

I won’t miss the money.

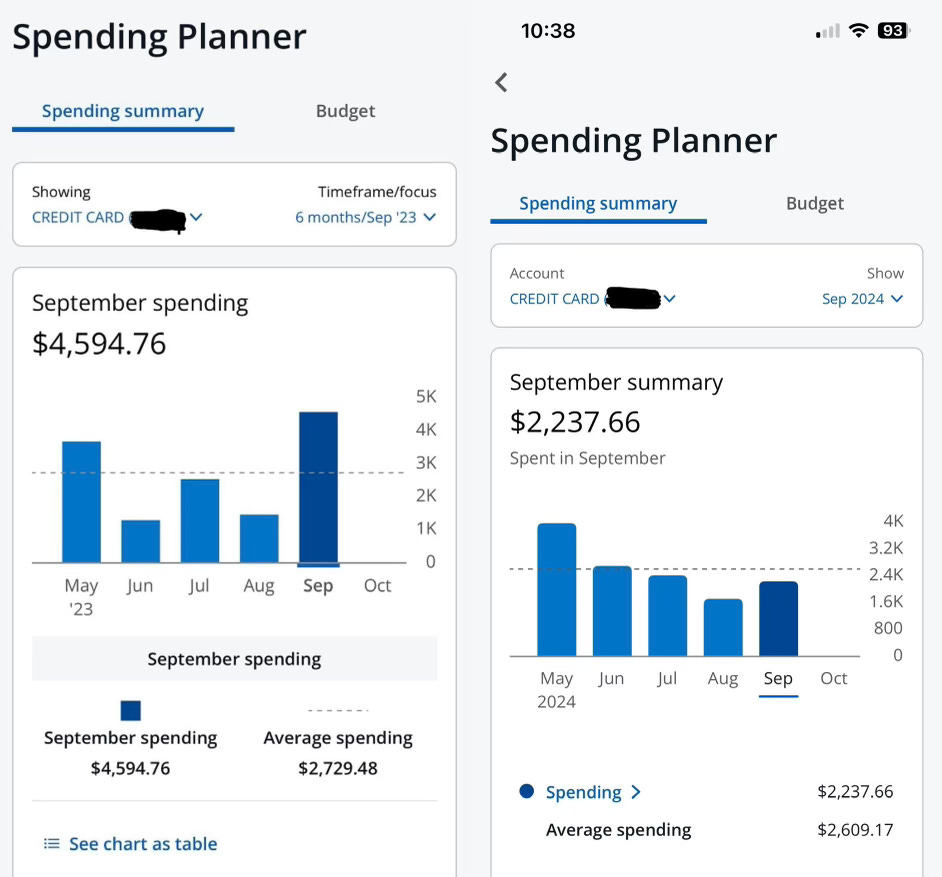

But the spike in my discretionary spending from last month definitely was noticeable.

I spent a little more than $800 on our spontaneous, overnight road trip to Minnesota. That included two tickets to the Vikings’ home opener, fun and games for Parker and Tiffany at the Mall of America, food, gas, a pair of Vikings shirts as souvenirs and a $20 tip for face painting.

I’ve become so set in my ways that getting gas at a Kwik Trip because I couldn’t find a Shell in Wisconsin annoyed me more than anything else I paid for. The frustration of that expense was followed closely by having to fork over $40.83 at McDonald’s on the way home for necessary grub. There are 40 million other places I’d rather eat and spend my money.

On Sept. 16, I paid $105.77 for six Money Talks T-shirts. I’ve gone through trial and error for more than a year, but this batch aced the trial run. I’m a happy customer, and now have another contact I trust for my printing.

Tiffany celebrated her 11th birthday a week later. Me and Parker gifted her earrings from Claire’s, and I stuffed $11 into a birthday card. I also bought her one share of the Vanguard Total World Stock ETF, ticker symbol VT. I’m sold on gifting stock rather than material stuff.

But I kept my word and purchased Parker a Beautiful Curly Me doll. I was impressed with how the company CEO, a 12-year-old Black girl named Zoe Oli, landed her product in Target stores. I couldn’t help but to support. Hopefully it reminds Parker of the power and possibilities of entrepreneurship — even at a young age.

I also had some annoyances last month.

A mandatory online messaging service renewed for two years at $205. I had to pay for a new Chicago city sticker, which cost $127.17. My car’s check engine light came on out of nowhere, and a subsequent EVAP test put me out another $124.80, including a 3.5% credit card fee.

And I slipped up and allowed my Audible free trial to expire and renew at $14.95.

Oh yeah, my monthly car insurance and cell phone bills increased too.

Other than those nuisances, September was a solid month for spending.

I could have saved money had I chosen to not indulge in an unplanned trip to Minnesota or not treated myself and our girls to a few meaningful items.

My credit card statement for September would have shown $1,150.66. It would have easily been the lowest amount I’ve spent in a month since November 2022. That was my second full month into my new Money Talks mindset, when I was terrified to spend.

My savings would have looked great on a screen and made me feel good about my discipline.

But I would have deprived myself and my crew. And for what?

I won’t miss the money.