I was in the middle of making breakfast recently when I spotted something that made me stop and snap a picture.

My kitchen counter was packed with Walmart products.

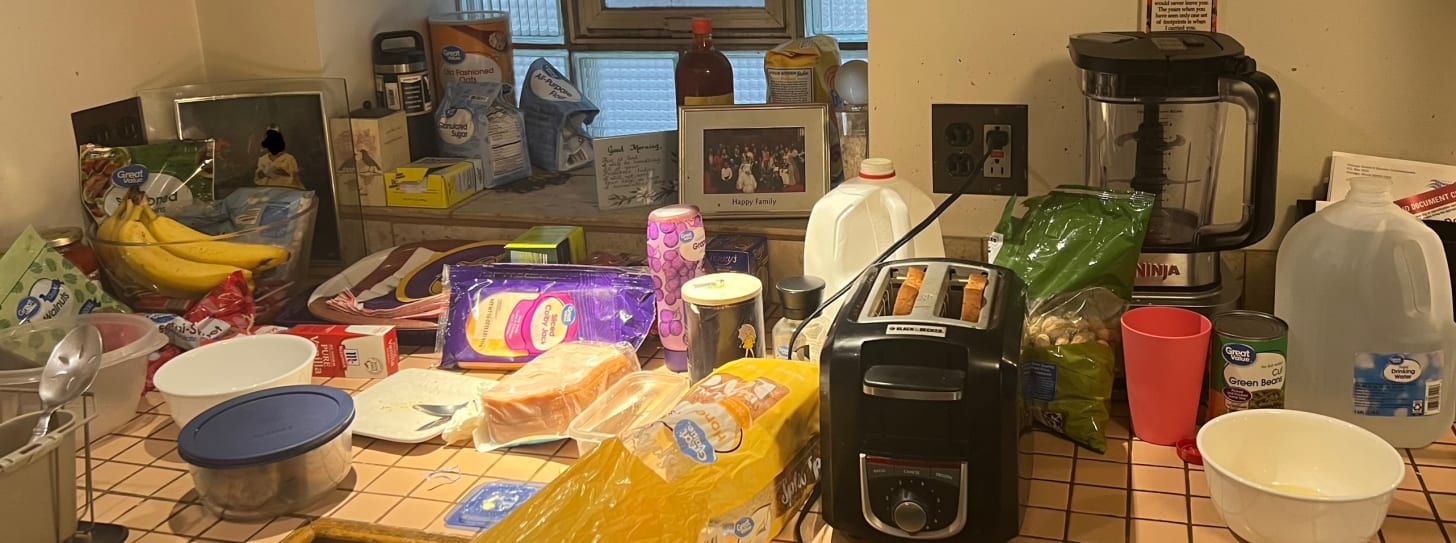

From sugar to shelled peanuts, semi-sweet chocolate chips to sliced Colby Jack cheese, my countertop was filled with the chain’s Great Value brand. It’s by design. Still, I couldn’t believe my eyes. I had no idea how deep my commitment had grown.

When I view the photo now, I count 16 Great Value products. There’s milk and mini marshmallows, walnuts and honey wheat bread, black pepper, grape jelly, green beans and more.

The image tells you all you need to know about where I shop and what brand I prefer. Now let me tell you why I’m loyal to America’s low-price leader and how I got here.

When I fell in love with dividends last fall, I began a lifestyle of purchasing products only from companies I owned as a shareholder. Everyday household items we all use are under companies like Procter & Gamble, Kimberly-Clark and Johnson & Johnson. When I needed toothpaste or mouthwash, soap or deodorant, dishwashing liquid or laundry detergent, I searched for brands under those companies.

But then common sense and my frugal mentality kicked in.

I was spreading my money around with multiple companies, most of which sold more expensive products. I quickly realized Walmart, and its store brand, could meet most of my basic needs.

Before I streamlined my shopping with Walmart, my grocery store trips were chaotic, a mystery from one day to the next day. I frequented Target, Pete’s, Mariano’s, Jewel Osco, Fairplay and Aldi with no rhyme or reason. If I needed dinner that night, I pulled over and figured it out on the fly. When I knew I needed groceries, I generally went wherever had the best supply of what I wanted.

I would get fresh fruit from Pete’s and ransack the bakery at Mariano’s. I’d take advantage of buy-one-get-one deals at Jewel and make quick alcohol grabs at Fairplay.

But as inflation rose and talk of recession spread at the end of 2022 and into 2023, I became more cost-conscious. The price of eggs, milk and more skyrocketed. Basic necessities were breaking the bank. I felt financial pressure despite earning a good salary.

I remember feeling paralyzed as I sat in my car in a Walmart parking lot one afternoon, afraid to get out and pay the rising prices. I had just paid for a new transmission, and an 18-pack of eggs had just nearly doubled in price to six bucks. My old habits no longer were sustainable.

Between its low prices and nationwide presence, Walmart became my preferred retailer. I also benefited from proximity before the company closed four Chicago locations in April. A Walmart Neighborhood Market sat within a 10-minute walk from my apartment before closing. I had every reason to roll with Walmart.

I also became a Walmart investor. The company is a leader in its industry and always will have a robust market for low-priced goods. When I opened an individual retirement account late last year, I dedicated 10 percent of my portfolio to Walmart stock. To help fuel my long-term investment, I now reach for Walmart’s store brand almost exclusively for household items.

The change has helped declutter my decision-making and brought greater clarity between my wants and needs. By streamlining my shopping and sticking to one store, I’ve also taken back control of my spending.

My credit card statement shows I spent $3,894.11 on groceries last year, or $324.51 a month. Through the first 6 1/2 months of 2023, I’ve spent $1,340.58 on groceries, or $206.24.

At my current rate, my annual savings on groceries this year would be $1,419.24, although that has as much to do with making smarter choices like reducing alcohol and red meat as it does simply switching to Walmart. The figure also might be inexact based on how my financial institution categorizes my purchases.

But it provides a ballpark estimate for how my shopping habits have saved me money.

I used to despise generic brands. Now I see enormous value in Great Value.

I think you should read The Simple Path to Wealth by JL Collins and get into index investing. Your financial reforms in your life are laudable, but picking individual stocks is a fool errand, and dividend investing has been largely debunked. By simplifying your investments you'll gain more free time as well as better performance.