I employed the worst logic in stock market history during my first month investing.

Had I known better, I could have saved myself a little money and a lot of time. But I was convinced I had a foolproof plan.

Whenever my stocks dropped below my average purchase price, I sold my shares and repurchased my stake for slightly less. If the stock price dipped more, I’d do it again.

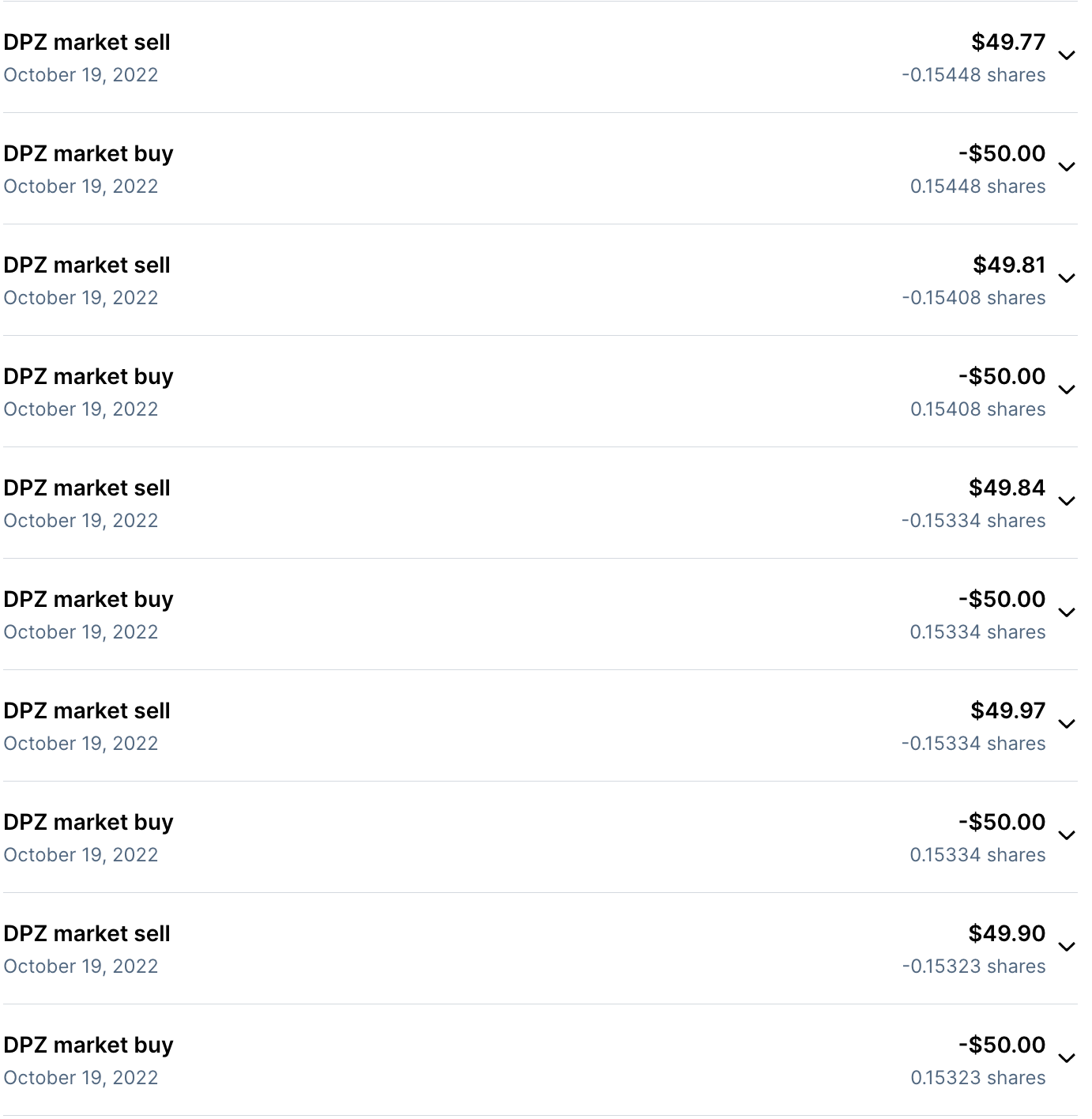

The best example of my simpleminded initial strategy is Domino’s. I bought and sold the pizza restaurant company 13 times between 9:22 a.m. and 1:46 p.m. on Oct. 19, 2022. Each transaction totaled $50 or less. But I was determined to get in at the “best” price.

I lost 79 cents buying and selling Domino’s that day. Six days later, I sold my Domino’s stake for good, which tells you how weak my investing “strategy” was. I made $1.23, giving me a 44 cents profit.

Still, I tried the same formula on every company from Amazon to Ulta Beauty. I had a horrible habit of trying to find the bottom. The finance industry refers to it timing the market, which no one can consistently do (legally).

I had to learn for myself in those first few weeks. I’ve always been the type who must touch the stove to see first-hand if it’s hot. I’m teaching my daughter Parker to not pick up that trait from me. We’ll see if I’m successful. She’s extremely curious and a bit of a daredevil.

But I’ve grown to believe index funds should be our primary focus over individual stock picking. Adopting and sticking with that simple investing approach was half of my battle in becoming a more sensible investor.

Learning about capital gains taxes aided me in my transition.

I learned that we’re taxed at a lower rate upon selling our stocks when we’ve owned them for at least one year. It was my introduction to long-term capital gains and short-term capital gains, which are taxed at the typical federal income tax rates.

The revelation helped me to embrace a more sound buy-and-hold strategy.

I had been spending significant time staring at the ticker, to chase paltry profits, only to face the highest tax hit when I cashed out a short time later.

That made me shift to a minimum 365-day timeline. It forced me to invest my money only into companies I was sure I wanted to hold in my portfolio. The number was a fraction of what I initially figured it to be.

Soon, I started strategically selling my positions in individual companies and folding that money into my chosen total stock market index fund. It’s the place I feel most comfortable riding out stock market fluctuations.

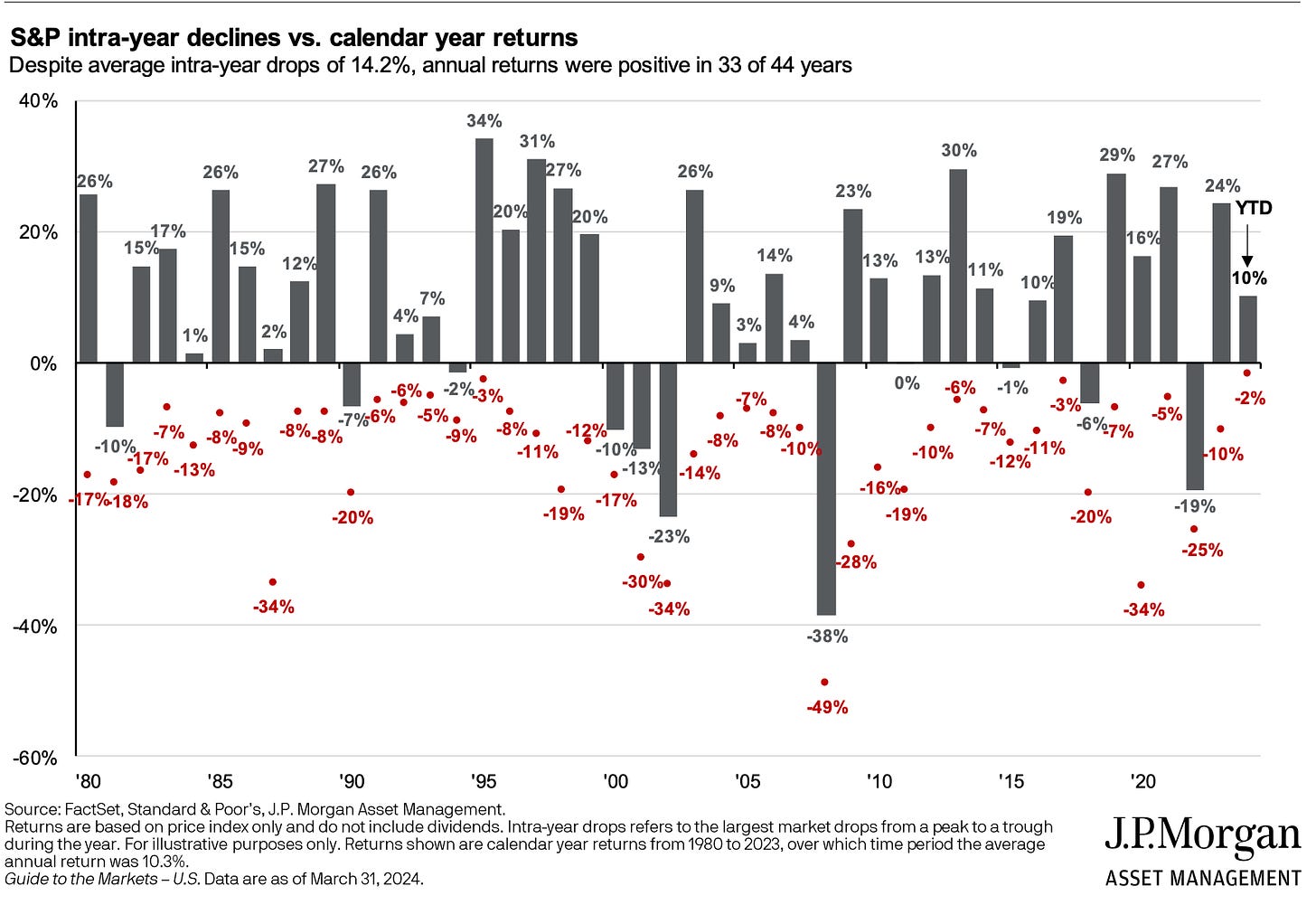

Then I started learning how longer investment horizons translate to higher rates of success and how the stock market goes up approximately 75% of the time.

I grew a new outlook. I realized there was no reason for me to sell.

Rather than trying to time the market with every company, I took the long view. I began buying more when share prices ticked below my average purchase price. When the stock rises again, I will have accumulated more equity at a cheaper price — without resetting my holding time.

My first stock market lesson to Parker was buy low and sell high. Before she could grow comfortable navigating such a volatile industry, I knew she’d have to avoid panicking during down periods.

But it took a month of daily trading for me to implement that foundational principle into my strategy.

I was busy doing the opposite. But I was learning.

I touched the stove so hopefully Parker won’t have to.