It’s been six months since we launched Money Talks.

You probably didn’t know what I was doing or what to expect when our first post published on the final day of January. But we hope you are enjoying our journey and finding value in the content we’re creating.

A sincere thank you to everyone who has read, listened, subscribed, shared, clicked, commented, congratulated, pledged support or offered kind words.

We appreciate all of you!

I wrote in my introductory column that in my pursuit of wealth I stumbled into a higher purpose of wellness and healthy living. That’s a big reason why Money Talks tackles money in so many ways. I’ve written about discipline and education, walking and weight loss, reducing both alcohol and dining out. Some topics you’ve related to more than others.

But I also told you in the about section on the website and in the Substack app that we want to hear from you. And through these first six months, the response we’ve received has been moving.

This feels like a good time to share some of the feedback we’ve gotten and to encourage others to connect with us as well.

If you have been impacted by our journey or found value in Money Talks, don’t hesitate to drop us a note. The goal is to become stronger together. And we can all learn from each other.

As my Oklahoma City pastor, Herbert Cooper, says every Sunday, it’s all about more changed lives.

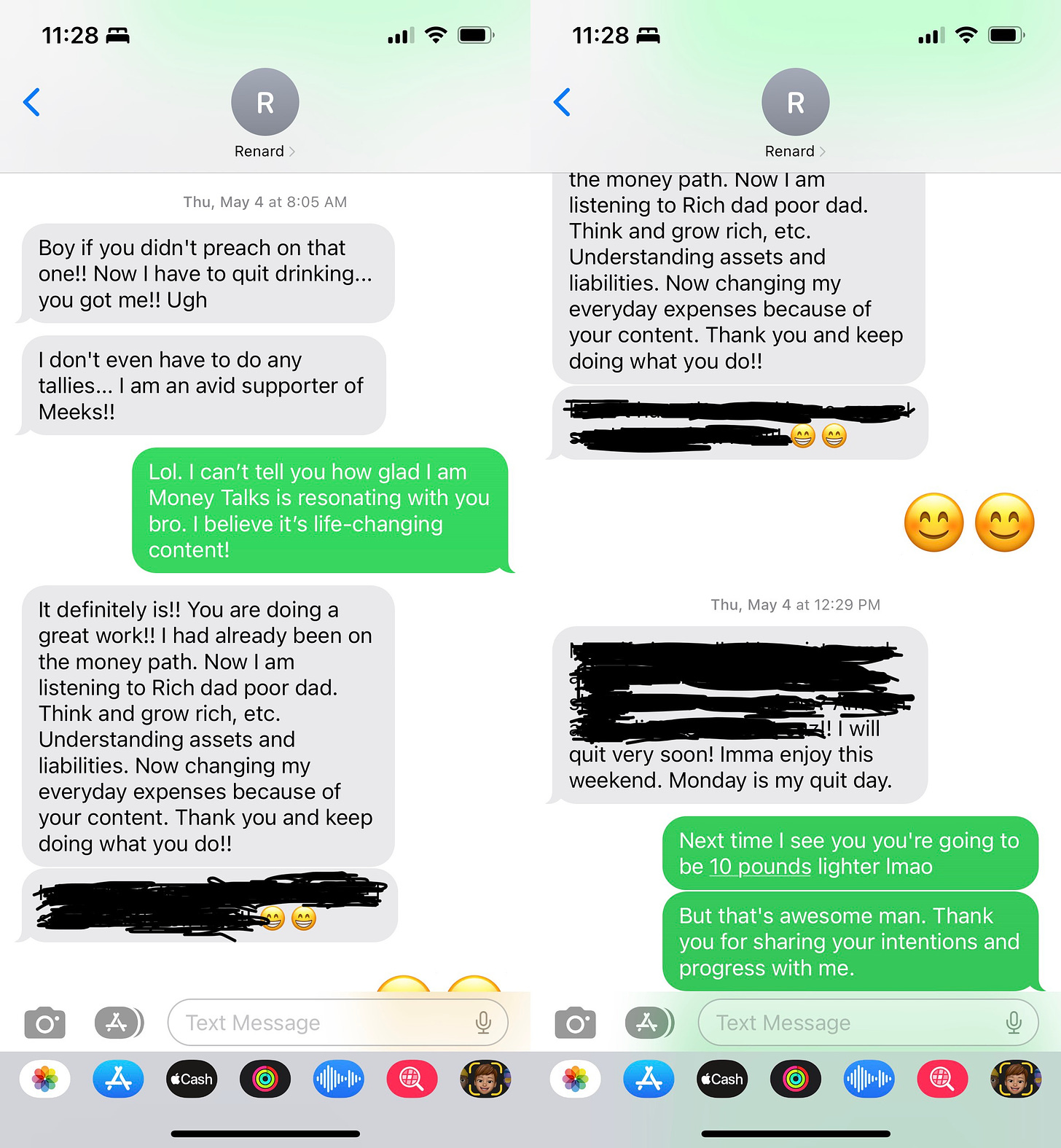

Renard wants to quit drinking

My take: This one meant a lot. Renard is a cousin. He’s long been a loyal reader of mine, going back to my days writing about basketball in Oklahoma City. Our bond has grown stronger through reshaping our mindsets with money.

Two weeks before my column that prompted Renard’s feedback, Am I an alcoholic?, his brother, Stefan, texted me, ‘Why is my brother preaching to me about changing how we look at money? You have a convert! Keep up the good work cuz!”

When Renard’s text landed, it showed me the power of sharing my story. As far as I know, it was the first time my writing moved someone to take a life-changing step.

Continued luck, Renard!

Brian wants his daughter to get a Roth IRA

I just wanted to say that the Money Talks column that Darnell Mayberry writes is awesome and I look forward to it every week. Being an accountant and long-term investor, I really can relate to and especially appreciate the message he shares about helping his daughter and others understand saving and retirement planning. I just encouraged my 18-year-old daughter to open a Roth IRA.

Thanks for the great addition to the PD. — Brian

My take: As much as I love hearing someone change their life for the better, it’s even sweeter to hear we’ve inspired others to take steps for their children.

Brian wrote this letter to the editor of the Cleveland Plain Dealer, a publication we partnered with in May. Our partnership with Advance Ohio, parent company of the Cleveland Plain Dealer, allows us to reach a wider audience. I believe our content has no bounds and can benefit all. Inspiring someone two states over to suggest a tax-advantaged account for their teenage daughter is proof.

To top it off, this message was originally sent, and shared with me, on Father’s Day of all days. It helped make my day.

Natalie opens custodial account for her granddaughter

I’m moving Brinley’s account over to a custodial account as well! — Natalie

My take: Every child deserves a custodial account. I opened Parker’s in April, and after reading our experience my big cousin Natalie decided to follow suit for her granddaughter.

Great job, Natalie. Brinley’s going to be balling!

Sandra feels regret with money, hopeful for others

Examining my spending patterns and habits became a necessity when my total yearly income went from $70k to less than $16k. Granted, there were serious health issues and other life events associated with this drastic decrease, but mismanagement of money played a crucial part as well. A painful reality (and regret) at this stage in my life is that I wish I would have paid more attention to this type of information 50 years ago!

I have no problem budgeting and being careful with my finances now because its born out of sheer necessity! And even with penny-pinching, at times, I still must rely upon the kindness of friends and family, just to “stay above water!” It’s mentally depressing to reflect on the “great career” I experienced, only to conclude that I literally have nothing to show for it. I try not to dwell on it, but instead, enjoy my life such that it is. I hope and pray that the advice offered here isn’t falling on deaf ears. Take it serious, and put yourselves in position to reap a much better outcome later!

Thank you Darnell Mayberry — Sandra

My take: Sandra left this gem in the comments section back in March. I’d like to thank her again for sharing such a personal story.

To me, this speaks to the power of vision. No, everything won’t always go your way. But it’s up to us to do our best to plan and prepare for our futures. If we don’t, we could become reliant on government assistance and the generosity of others.

The better choice is to be mindful and methodical early so you can enjoy life to the fullest without financial worry later.

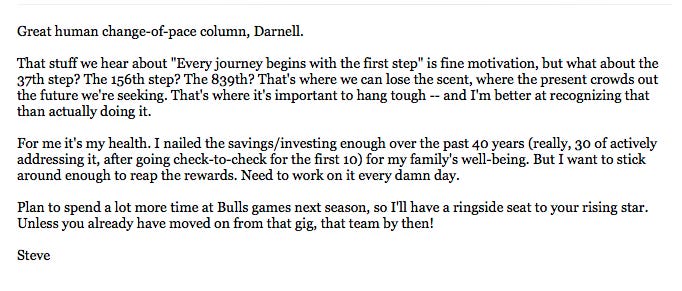

Steve offers encouragement for the journey

My take: Steve e-mailed this note following my June 12 column, “How to escape a funk.” They were much-needed words, particularly from someone much farther along in this financial game than me. I truly appreciate the words of encouragement.

Steve’s message also reminds of the importance of health. Without it, wealth is meaningless. Exercising and eating healthily is critical. I encourage everyone to develop a sensible daily routine.

Thank you, Steve.

Mark sees the bigger picture of Money Talks

The cool thing about this entire project you're on is you'll be able to look back on these writings and podcasts with your daughter as a time capsule to always come back to. Revisiting these conversations down the road will carry so much intrinsic value and meaning, in addition to all the teachings you're passing onto Parker. — Mark

My take: This is absolutely correct and the reason I started Money Talks.

My first idea was to write all this stuff down and stick it in a blue accordion folder. Someday, Parker could rummage through it. I still have the folder. I’m glad I ditched the idea.

Mark shared this feedback in the comments section under my first letter to Parker. I hope Parker someday shares the start of our journey with her children.

Iain sees his past in the pages of Money Talks

I appreciate your Bulls coverage and hearing you talk about your Substack on Bernstein & Holmes and The Full Go. In my adulthood I’ve been fortunate enough to have financial security beyond what I’m used to and comfortable with. This Substack helps me reconnect with the decisions my late father made for my sake and make sure I don’t lose the instincts that were essential to my development. — Iain

My take: How cool is that?

I don’t know how our story will end, but Iain is living proof of the possibilities thanks to his father’s vision. Iain left this comment while making a pledge of support to Money Talks.

Thank you for your support, Iain.

Sandra has one more month to get in shape

I’ve struggled for years with being disciplined enough to combat my weight problem! However, over the past three years, my efforts have improved dramatically, and the results are being noticed. I’m certainly not “on top of my game”, but articles like this one continue to motivate me to keep trying! Summer will dawn in a few hours, so I feel that this is a good time to start an early morning and late evening walking routine. Let’s see what I look and feel like by the end of August! #BabySteps Thanks Mr. Mayberry — Sandra

My take: This comment was posted on “The untold weight of weight loss” on May 11. Sandra left the comment in mid-June. It’s now the final day of July.

Only Sandra knows if she’s stayed true to herself and made strides toward her goal. How we use our time is totally up to us. The days will pass regardless. Might as well make the most of them.

Here’s hoping you make the most of August and continue moving closer to your goals, Sandra.

Vinay has learned to track his spending

Thanks for writing this Darnell. As somebody who at times struggles month to month staying current on everything while taking care of kids, when I started adding up the numbers today it was pretty crazy to see how much I was spending. — Vinay

My take: More feedback from my column on my former drinking habits. But unlike Renard, Vinay isn’t trying to cut out alcohol, only cut back.

Vinay’s desire to track his spending is laudable, and I’m glad opening up about my story helped him become more aware. Tracking your money is half the battle. Habits form from there.

You got this, Vinay.

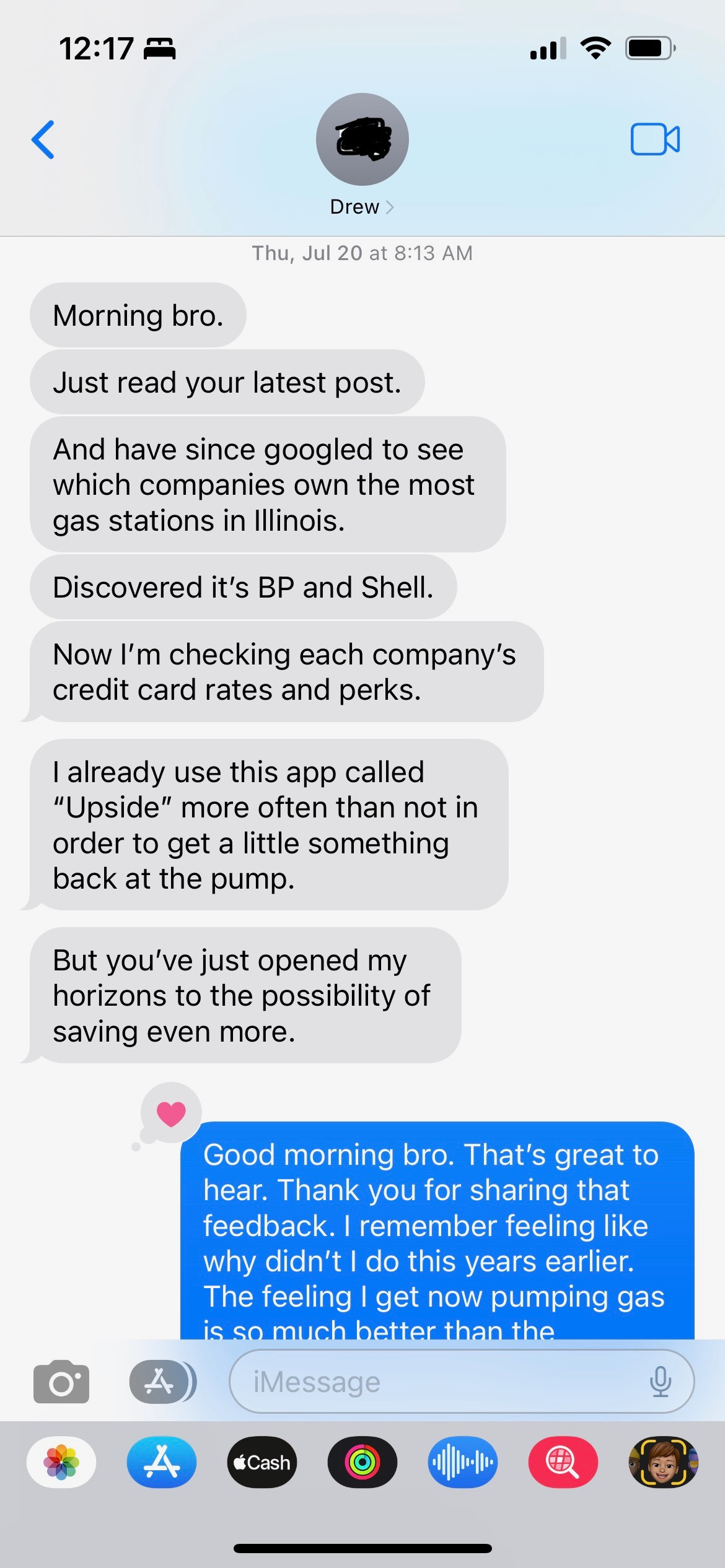

Drew wants to save money on gas too

My take: With my money-saving method for buying gas, I’m creeping closer to my first $100 saved with Shell. I’m now sitting at $91.99 in savings.

I understand Drew wanting to join the fun. It’s amazing how we allow everyday purchases to pile up without much of a plan for taking back control of how we spend and what our hard-earned dollars are getting. I didn’t commit to my gas hack until October. I’m so glad I did.

Sandra sees the light — and value in a water filter

My weight journey from 326 pounds in 2022 to 286 pounds at present, is definitely attributable to an increase of my water. I typically buy 3-4 cases of water weekly, and never think twice about the amount of money I’m spending. Thank you for bringing the matter to the forefront! Headed to purchase that filter ASAP! As I inch towards 70 years of age, my aim is to be as healthy as possible for as long as possible. Thank you, Mr. Mayberry, for sharing your story — for my health and my pocketbook! — Sandra

My take: OK, I know what you’re thinking. Yes, this is the same Sandra. She’s my godmother and a pleasant surprise as a prolific commenter. But she has a powerful story worth relaying.

This one speaks to how even our best intentions can be imprudent and that mindless spending can get the best of us. But once we know better, we must do better. That’s how change truly happens.

Mark believes in the Money Talks mission

Darnell Mayberry’s column, “What I was and wasn’t taught about money,” addresses one of the major problems with economics, a topic that, for most people, is poorly demonstrated by governments around the world. Seventy percent of the U.S. gross domestic product comes from the consumption of goods and services, funded by people who do not understand how their view of money was shaped early in their development.

Mayberry is providing the knowledge, skills and abilities for a lesson that is generally only provided at the adult level in work training or college, with courses on business law and other business classes.

Stephen R. Covey’s book on “The 7 Habits of Highly Effective People” lists as Habit 1 to “be proactive” in taking responsibility. Private victories before public victories start in the home. — Mark

My take: Another letter to the editor of the Cleveland Plain Dealer and more proof that what we’re doing means something to people near and far.

It’s been a wonderful first six months for Money Talks. I’m excited for the next six.

Our lives are improving substantially.

We hope yours is as well.

All I can say is “Thank you, Darnell”. The teacher is now learning from her student! And what a great teacher is he!👏🏽👏🏽👏🏽