I made my best money move in January last Monday night.

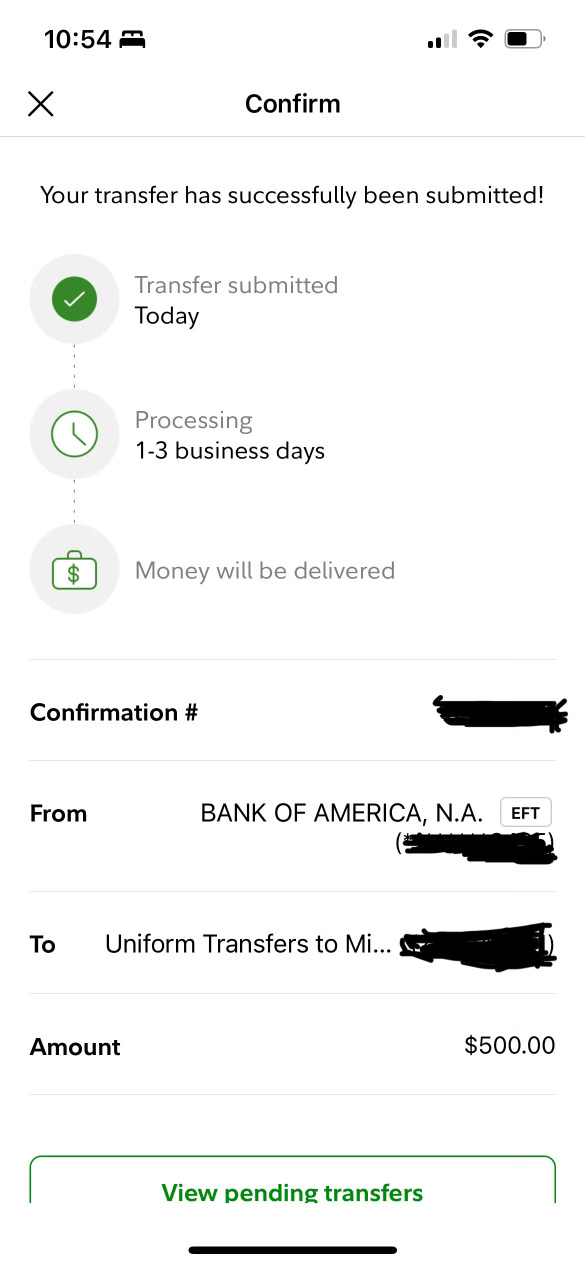

At 10:54 p.m., I transferred $500 from my checking account into my daughter Parker’s brokerage account.

It was her Christmas bonus, which I’m now issuing annually in lieu of presents. It’s my way of teaching Parker early to amass appreciable assets instead of material stuff.

But I told you last week that I was late in paying Parker. The headline on that column sat as a painful reminder. For 12 days, it stung. Each time I read it, “I’m in debt to my daughter,” it gnawed at me. Score another one for the power of journaling.

And so I didn’t want another day to pass. It was time I made things right.

The reason for my debt is relatable — insufficient funds.

You must understand that my money is spoken for. Nearly every dollar I bring in now has a purpose. I’ve maxed out my elections. I’m tithing. I’m investing for myself and for Parker. I’m paying down a new car note. I’m tucking away cash to purchase a multi-family property.

That’s all by choice, decisions I deem as smart money moves for me and Parker’s future. Still, they’re cumbersome additions to my everyday expenses.

So when it came to a $500 cash gift, I wasn’t sure where the money would come from. I didn’t have to give that much. The amount was arbitrary. But I never want to shortchange Parker. My obligation to her also forced me to operate differently.

Every frivolous purchase I so much as thought about making elicited guilt. I knew I couldn’t. Not as long as Parker hadn’t received her Christmas bonus.

And remember sweetie, a man always keeps his word.

I could have scaled back on my gift or canceled it altogether, chalking it up to hard times. Parker would have understood either way. She’s a sweet child, and she never cared about a Christmas bonus. She’s not hyper-focused on money.

But I’ve realized how much investing for Parker now will do for her later. And I’m hooked on helping her.

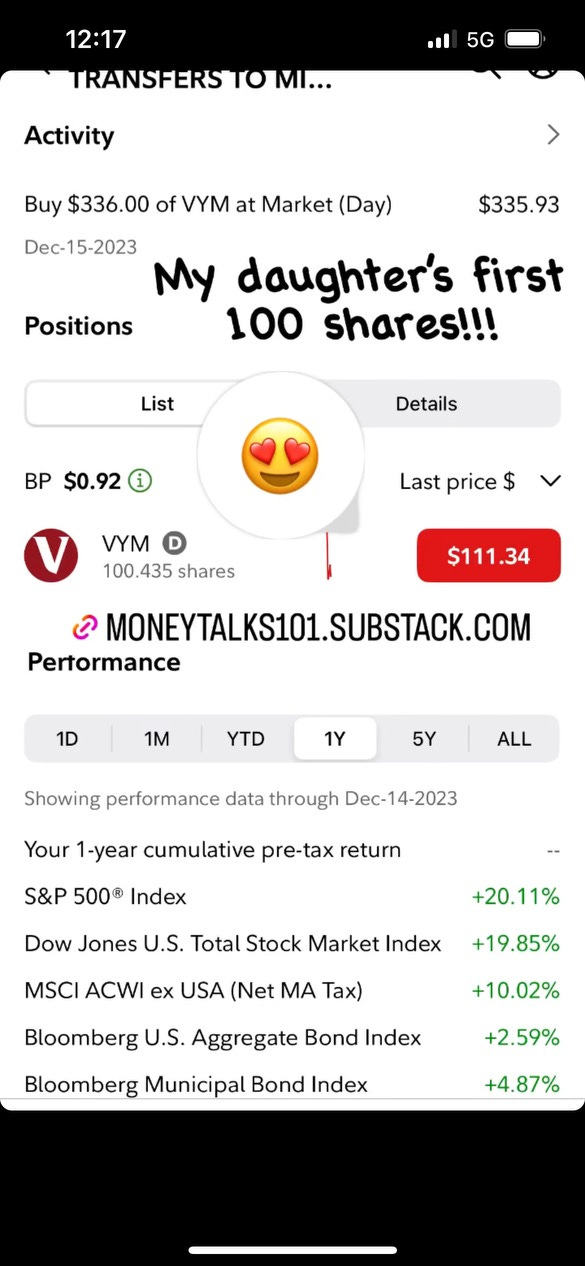

When I made my monthly contribution to Parker’s brokerage account in mid-December, the deposit and subsequent investment pushed her past 100 shares of the VYM.

After my January and February contributions, and after we invest her Christmas bonus and birthday money, Parker will surpass 110 shares.

By drawing dividends that we have automatically reinvesting into the same position, Parker’s money is working for her and compounding.

On Dec. 21, she earned a $110.43 dividend payout. With the VYM’s stock price at $112.99 (at market close on Friday, Jan. 27), Parker’s quarterly payout is nearly securing her another share.

I’m committed to dumping as much money into this account as possible until Parker turns 21 and assumes ownership. I’ve got 11 more years.

I’m still working on the snag with her Roth IRA. But keeping my word to Parker and fulfilling my obligation for her Christmas bonus was an important first step.

Not only will the bonus help accelerate Parker along the simple path to wealth. But the bump also was a valuable reminder of a pivotal lesson in this financial game — paying yourself first.

No matter my other obligations, I needed to adhere to that philosophy. I’m adopting it late. It’s pivotal that Parker learns it early.

I didn’t concern myself as much with how I would recoup my $500 cash gift. Instead, I believed that I would find a way. I still believe that, even though it’s not quite necessary.

Three hours before I made the transfer, my mother told me she owed me money: $500. A repaid debt she’s returning to me is trickling in. Snags on her end have interrupted her planned installments. It resulted in a $500 shortfall this month.

I didn’t know. I wasn’t keeping track. I never planned on my mother’s money. But it arrived at the perfect time.

My account was credited with that money last Tuesday, the same day Parker’s bonus was debited.

It helped me to comfortably absorb the most critical catch-up contribution there is.

Can’t get enough Money Talks?

Paying your Daughter; Paying my Son! Do what is right and God will do the rest!!

Taking notes. This year, my family will have this big meeting about what to do with Grandma's inheritance. I miss her dearly. While I would trade in the money to have her here on earth, knowing that she tried to do right in her life for her family brings me comfort. Investing is number one on the list for all of us so I'm glad to see that more families are adopting this practice of how to make money together