My plan to boost Parker’s credit almost backfired last month.

I had a $2,108.73 credit card balance due on April 15.

On April 8, my checking account held just $529.08.

Work expenses had driven up my bill. But my procrastination in submitting paperwork for reimbursement almost caused me to pay interest to my credit card company for the first time since October 2022.

It would have been my first time owing interest since adding my daughter as an authorized user.

Frankly, I don’t know how bad of a burden I would have put on my 10-year-old daughter. I never want to find out. And she shouldn’t have to.

My payment wouldn’t have been late, which would have been a double whammy. But not paying my credit card balance in full, as I’ve done for the past 18 months, would be a part of her credit history.

And I almost put her in jeopardy because I decided to dilly-dally with reclaiming what my company owed me.

It was an important lesson, which is to watch out for work expenses.

If you ever work a job where certain expenses are eligible to be reimbursed, don’t delay. Do your due diligence and make sure you’re getting back every dime from your company — in a timely manner.

I traveled to Salt Lake City, San Francisco, Los Angeles and Indianapolis for work trips in early March. But I didn’t file my expenses until the first week of April.

Luckily, my company has a speedy reimbursement process. After submitting my expense report on April 6, I was reimbursed $1,051.37 on April 12. My paycheck landed the same day, allowing me to cover my remaining balance.

Now here’s how fast I learn and adapt.

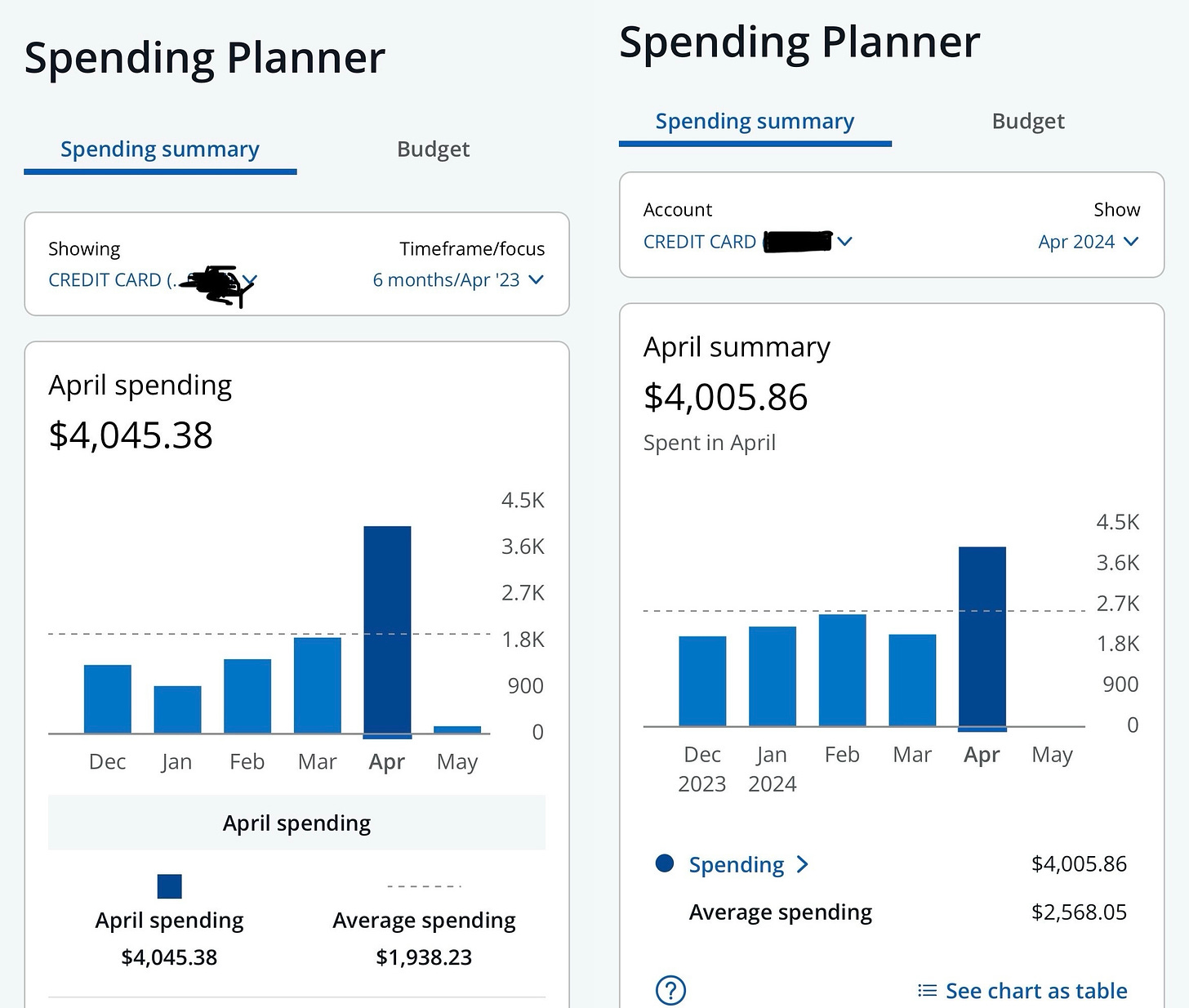

From April 11-30, I traveled to Detroit, Washington, New York, Miami, Oklahoma City and New Orleans for work trips. Those six trips put $2,970.77 on my personal credit card, which explains my annual spike in spending in April.

This time, I didn’t waste time filing my expenses. I submitted it last Thursday. A day later, my expenses were approved. I anticipate receiving my nearly $3,000 reimbursement this week.

Parker’s credit remains protected, well ahead of my next due date.

Before my Money Talks mindset, I allowed so many work expenses to slip through the cracks over the years I probably gave back hundreds to the same companies paying my salary. I’m done being negligent, and I never want you to be, Parker.

Always reclaim what’s yours.

What blows my mind is how my April 2024 credit card spending is only $39.52 more than my April 2023 credit card spending. I couldn’t come that close to a consistent month one year apart if I tried. But it happened unintentionally.

Subtract my work expenses from my balance and I charged only $1,035.09 to my credit card last month. Add another $136.77 for marijuana, and my personal spending in April was only $1,171.86, excluding fixed expenditures such as rent that I pay through my checking account.

Above all, it shows I’ve regained complete control of my personal balance sheet.

Best money move: Golden Chick

While traveling to Oklahoma City for work last month, I got to spend a few days with my mother, who lives nearby. I surprised her on my first visit, showing up with dinner in hand: shrimp, fish, coleslaw (one of her favorite dishes) and delectable hot yeast rolls from Golden Chick. My efforts made my mother’s night. It cost $27.76. And I was reimbursed for the purchase.

Worst money move: TurboTax

Tax season kills me. Every year, I have to pay just to pay the government. I need a better way. Yet once again, I filed my taxes through a popular online tax preparer. This year, on April 7, I paid $210.37 for the service. This is the annoyance I’m talking about, Parker, whenever I refer to Uncle Sam.

Loved the surprise visit- “Go Thunder” and Thank you for the “Best Money Move Dinner!”

From reimbursements to rebates, I want ALL my just just dues and come up-ins! It could be a dollar, if it’s mine, I want it. No company would leave money on the floor, so why should we?