I resubscribed to Audible two Saturdays ago.

The popular audiobook and podcast service ran a promotion offering three free months.

I’ve waited to jump on an Audible free trial since the company caught me slipping and surprisingly auto-renewed my account last July. My forgetfulness cost me $14.95 and forced me to be more diligent about canceling costly subscriptions.

But audiobooks have become vital for me. They’ve removed obstacles I’ve long faced whenever trying to plow through a book the old-fashioned way. They’ve made consuming a book convenient. I’m now comfortable listening while walking or driving, cleaning or exercising.

Thanks to technology, I can devour information I previously would have skipped.

That’s why I couldn’t pass on three free audiobooks over the next 90 days. It’s a chance to add to my digital library and continue my commitment to learning. This journey toward financial independence demands that I do.

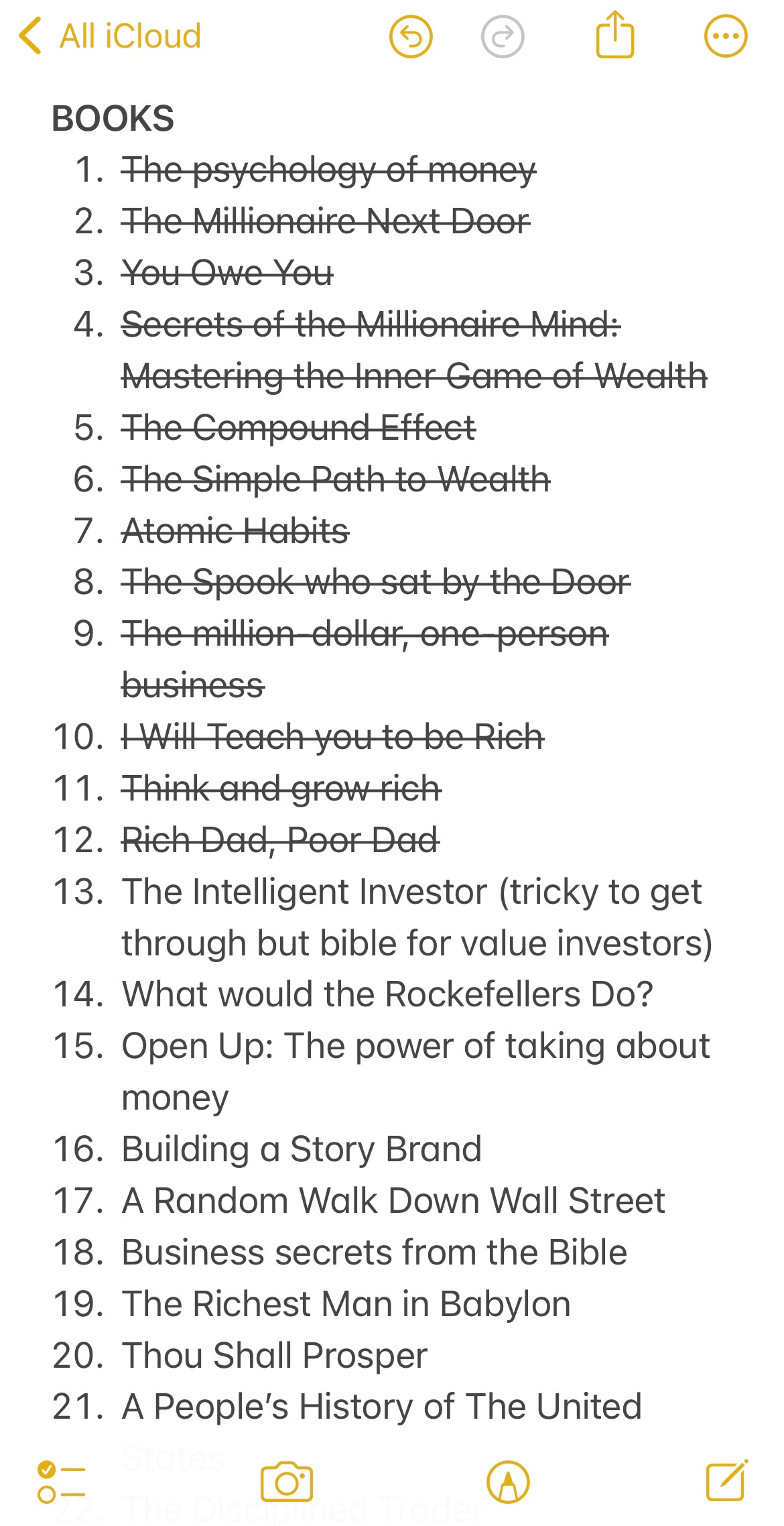

I have a list of 71 books typed in the notes app on my phone. It’s a list I’ve compiled since starting my financial literacy journey late in 2022.

I’ve made it through only a dozen. The majority are money books.

I binged on personal finance books every second I could in the beginning. I felt like each page of each book was helping me to crack the wealth code.

But my reading slowed substantially over the past seven months. Not because I canceled Audible. I still have a backlog of books within the app I haven’t read. Instead, I scaled back on books because those first 12 gave me a good blueprint for how to better manage my money and live my life.

I reached a stage where experimentation was needed more than additional research. I’m happy to say the results are positive. My net worth is growing. My financial outlook is better than ever.

My transformation, however, started when I found the right information.

Here are six books that shifted my thinking and showed me how I can lead my family to financial freedom.

The Psychology of Money: Author Morgan Housel offers a fantastic exploration into our relationship with money. Housel drives home the point that doing well with money has little to do with how smart you are and a lot to do with how you behave. And behavior, he writes, is hard to teach, even to really smart people. By the time I finished this book, I instantly had a new mindset with money.

The Millionaire Next Door: This one is extremely stat-heavy, but authors Thomas J. Stanley and William D. Danko rely on data to paint a vivid picture of how America’s millionaires think and live. It’s not how many of us non-millionaires were led to believe. Rather than lavish lifestyles, common traits among millionaires include principles such as frugality, bargain shopping and living within your means.

Rich Dad Poor Dad: I was late to reading this classic by author Robert T. Kiyosaki. But I appreciated it much more after finishing it last summer than I probably would have earlier in life. This book helped to reprogram my brain about entrepreneurship, the importance of amassing assets and learning to tackle taxes.

The Simple Path to Wealth: Author J.L. Collins started this book as a series of letters to his daughter about money and investing. You know this one is near and dear to my heart. The book hits on several financial subjects, but its premise preaches a slow and steady path to wealth using mutual funds or stock market index funds as the primary vehicle. My initial investment allocation was chaotic. Collins helped me see the benefits of simplifying my portfolio.

The Compound Effect: A relatively quick read by author Darren Hardy, “The Compound Effect” does a great job of showing how our everyday decisions propel us to the life we desire or lead to our detriment. It’s all about the power of time plus consistency and the outsized returns that inevitably come from that mix. I sped through this book shortly after becoming fascinated by compounding.

Atomic Habits: This book isn’t about money. But before you can become good with money, you must have good habits. Author James Clear helps you to break non-productive habits, while building and sustaining more productive habits. After reading this book, I challenged myself to commit to small things: making my bed each morning, taking a daily walk, going to the gym five days a week and drinking more water to name a few. The book’s tagline, “tiny changes, remarkable results,” is now my reality.

Can’t get enough Money Talks?

Nice work. Give Audible a call about your account. They have been generous to me in the past with refunds and putting my account on hold to maintain credits.

An excellent reading list! A few I would add is the Bogleheads Guide to Investing, Just Keep Buying by Nick Maguilli, and the Four Pillars of Investing by William Bernstein.

After reading those and a Random Walk Down Wall Street you'll know everything you really need to know about investing and can spend the rest of your time focusing on saving and enjoying your life.