My young fella Joel called me in a frenzy.

He stood in the middle of Best Buy, but he was lost.

His heart was set on a pair of headphones. They cost $500. He didn’t have the money, but the store offered an attractive line of credit. And I’m the guy he decided to dial to ask for financial advice.

It was the final Friday afternoon of April. I answered Joel’s call as I drove down the expressway en route to retrieve Parker from school.

He was the last person I anticipated ringing me to have a money talk.

Joel is just like I was three days before my 25th birthday. A free spirit but focused. Beyond his years in some ways but still learning some of life’s basics in others.

I can’t help but to see pieces of my younger self in him. Our similarities run deep. He craves career success. He’s passionate about pursuing his goals. And as he courageously shared with me, Joel still paces a Best Buy floor eager to pounce on a deal he knows he can live without.

Electronics were my thing at that age too, and Best Buy was my favorite store.

I wish I had an “O.G.” — which is what Joel calls me — come along and school me to stock market investing at the start of my career as I’ve attempted to do with Joel. He has the opportunity I squandered, a 17-year head start to heed words of someone who has walked in his shoes.

Before that final Friday in April, I had no reason to believe a single word I’d shared with Joel about money management had gotten through.

But when he called about a high-dollar purchase, I knew he’d been listening. Our seven-minute chat then changed my outlook, and I approached the conversation like a test.

I already knew better than to try to talk Joel out of the headphones. There really was no point after he explained this was an item he’d waited on for years. This wasn’t some impulse buy.

I also didn’t want to repulse an already reluctant protégé and risk undoing whatever progress we’d made. The old me would have screamed “Read Money Talks!”, before commanding him to depart the store and go put that $500 into a Roth IRA.

But I’ve learned through first-hand experience over the past 15 months that people will receive what’s for them when it’s for them, not when I want them to.

So instead of insisting on anything, I simply sought to shed light.

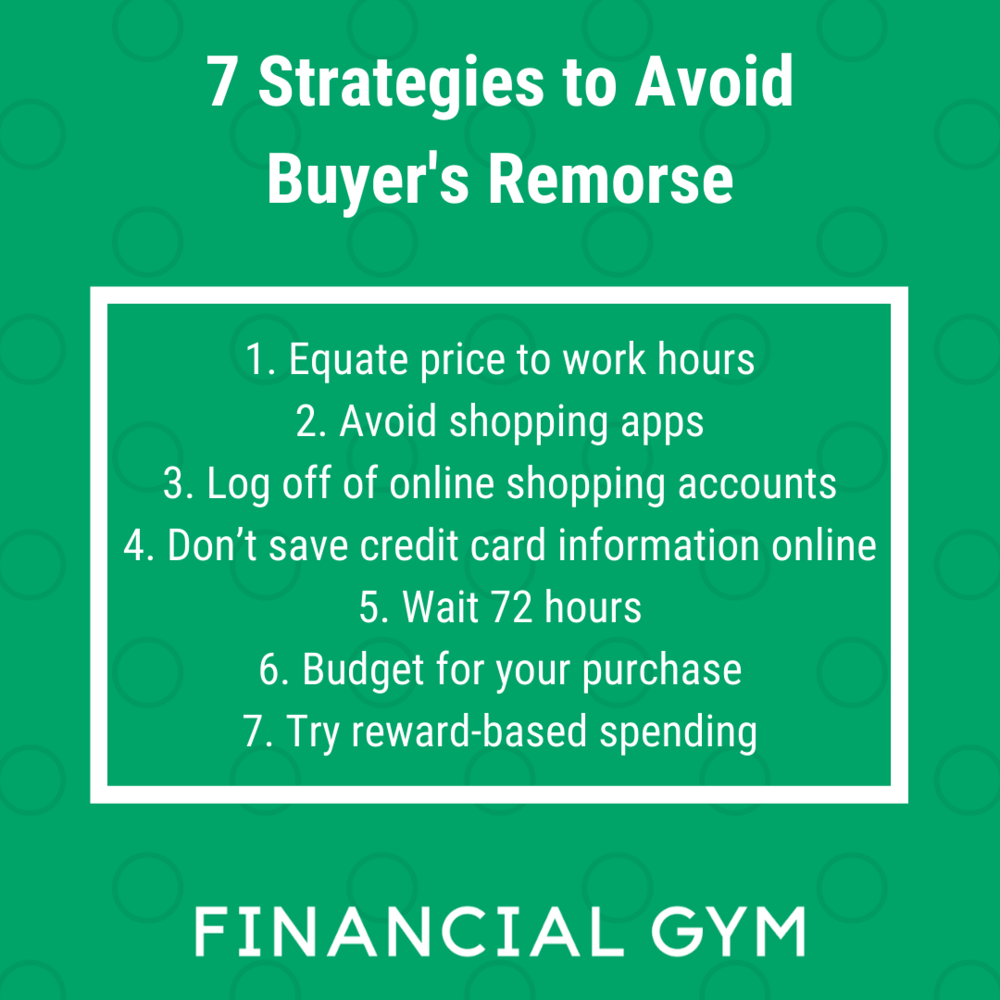

I needed Joel to picture the possible outcomes of putting $500 headphones on a credit card, even with the first 12 months offered at 0% interest. He needed to look beyond the immediate purchase and consider his entire financial picture.

Joel admitted he didn’t have the cash to pay for the item out of pocket. A few questions told me much of his financial foundation is waiting on a kickstart he doesn’t know he needs. But that’s to be expected from an early career professional who never was schooled about money.

He said he felt comfortable paying a few dollars, essentially the minimum payment, toward the would-be balance each month.

I countered by telling him that’s a solid plan until, say, something happens to his car. I informed him that headphones money would quickly become fix-my-car money and that life always requires unexpected spending.

He remained resolute, expressing confidence he’d pay the headphones off over the next 12 months.

I then broke down the perils of compound interest, undoubtedly at a sky-high rate, eating him alive if he doesn’t. I made brief mentions of consumerism and lifestyle creep just to put the topics on his radar and plant a seed in him that it’s critical to limit both.

I sensed Joel’s appreciation through the phone as I strolled down the expressway.

But he still bought the headphones.

Last Thursday afternoon, Joel texted me. I was driving again.

“Well, the AirPod maxes are officially my first dumb purchase of that magnitude,” he wrote.

He didn’t like a slew of features from the size and look of his once-coveted headphones to certain connectivity and utility issues. He had buyer’s remorse.

Not only did Joel no longer care for the headphones, he also told me he’s run into car problems since purchasing them. A few days after opening the line of credit and taking the headphones home, Joel’s car got towed. It cost him $250.

Then he shared that his vehicle’s air conditioner needs work, which he’d been putting off. With summer approaching, Joel will either suffer from the heat or have to find a way to scrounge up some cash — or be forced to sink into debt.

He hadn’t even made his first payment.

My advice was to return the headphones. To file an AppleCare claim citing connectivity issues, reverse course and get refunded. Then put that money on his air conditioner.

Our second chat lasted 12 minutes, five minutes longer than when he paced the Best Buy floor, itching to spend money he didn’t have on something he didn’t need and ultimately didn’t like.

I heard his remorse. I felt his regret. I know a light went on in Joel’s mind.

But he’s in his busy season with work, and I’ve been there.

I hope it doesn’t take Joel another 15 years like it did for me to see it.

Sooo good!

Assuming I'm correct on which Joel you're talking about...he's a heck of a writer! His writing all season has been great, but he's really stepped it up for the playoffs Those bigger checks will be coming soon.

Sounds like he learned a good lesson. I'm a gear head myself and have gone through a lot of headphones and other tech. The one thing I do to avoid regret is always trying to get stuff used at a good enough price that I'll only take a small loss (if any) if I end up not liking the item and sell it.

I love the hustle of buying and selling used gear. You save money, save the planet's resources, and are usually taking something someone doesn't want and giving it a second life.