A buddy of mine just entered the beginning stages of a divorce.

My heart goes out to the family.

Children are involved. A home will be shattered. Lives will be changed.

There is no hope for the parents to reconcile. Acrimony already has set in. Resentment grows stronger each week. The nature of divorce court, with all its haggling and headaches, is sure to make hard feelings swell. The fight is in the first round, yet both parties can’t wait to retreat to separate corners.

Their marriage will soon be legally dissolved. But because of the children, the parents will remain connected forever.

Neither side will truly receive the split they might believe is coming.

Parenting time must be split. School functions and extracurricular activities require their presence, support and transportation. Medical appointments might get awkward. Religious services could be rocky. And some level of effective communication is needed to navigate all of it.

The situation is tragic.

From the outside looking in, the couple appeared to have it all: high-paying and respected careers, homeownership, children, a future.

Now, everything they worked to achieve must be deferred and divided, hopefully fairly and equitably.

And nothing can prepare you for the money pit we call divorce. It’s why you must be extremely careful who you marry. Select the wrong partner and it could cost a fortune.

Long before a mountain of debt piles, a divorce will suck you of time and energy, effort and emotion. Pain and shame, guilt and regret, immediately follow.

After paying a sum that can easily surpass $20,000 in attorney fees alone, co-parents still must co-exist.

I wish I could effectively warn singles, engaged couples and newlyweds about the enormous cost of divorce. It’s next to impossible without sounding like a pessimist at best and a jerk at worst. Expressing anything but joy for a happy couple comes off as “hating.”

A woman I dated at the beginning stages of my divorce once tried warning me. She was about a dozen years older and foreshadowed more divorces coming for my friends. I was entering the stage, she told me.

I thought she was hating. But she was right.

I’ve watched several of my peers go through divorces. I know more married couples who are holding on with all their might. I want to warn them most.

I’d tell them to look at me.

I’m still stuck in the never-ending spiral of divorce.

I sunk another $1,500 into attorney fees in May. Mind you, my divorce was finalized six years ago. But through our daughter Parker, I’m still connected to my co-parent. We don’t have a good relationship so it occasionally leads to a hefty bill.

The latest charge was worth every penny even though it resulted in a spike in my monthly spending for the second straight month.

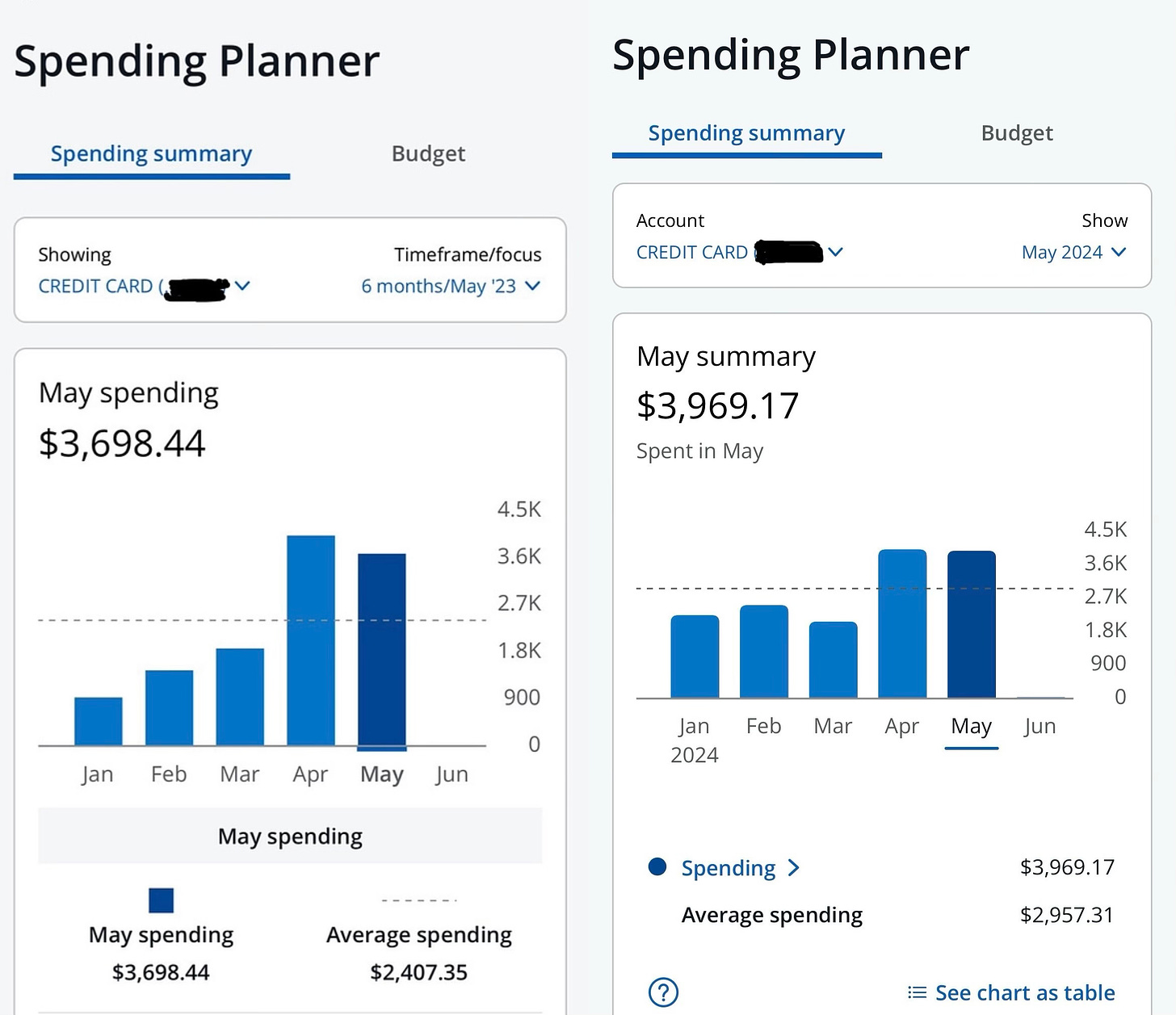

Thanks to tracking, I can see that my spending in April and May of this year ballooned to nearly identical levels as April and May of 2023. The difference between the past two Aprils: $39.52.

The difference in the past two Mays: $270.73.

I continue to be amazed at my consistency because it’s not planned. I’m nearly matching my numbers naturally. It’s like I instinctively know when to not pull out my credit card now.

But I splurged last month.

It was my lady friend’s birthday month, and I did everything I could to make Triest feel special. I’ll save the details, but I’m pretty sure I succeeded.

I did treat her to brunch as part of her day (and night!), and that contributed to the $289.33 in my personal spending on restaurants in May. That’s slightly more than I spent on restaurants from January through April.

I also spent $122.12 on T-shirts, polos and hoodies. I’m anticipating the next line of Money Talks apparel returning from the printer next week.

It never gets old pulling our logo over my head and wearing it proudly across my chest.

Best money move: Fiverr

I used this online freelancing service to find a graphic designer who could quickly format our logo for screen printing. It was my first time using Fiverr, and I was pleased with my experience. Rather than spending five months figuring out formatting, as I did last year, I decided it’s easier to just pay a pro. I forked over $62.76 for logo formatting. My files were returned promptly. And now I have a very talented graphic designer in my contacts whenever I have another need.

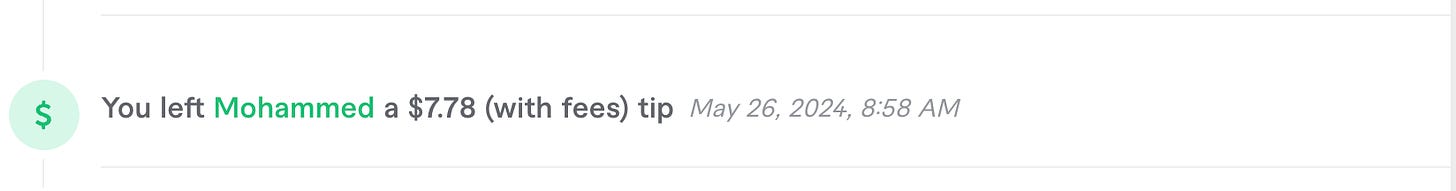

Worst money move: Tipping

I told you this awful practice should be abolished. How much longer must we as consumers be taken advantage of? Until we take a stand, companies like Fiverr can continue to exploit the little guy. For two logo orders, I paid $23.60 each after tax. But because I’m a nice guy, I left a $5 tip for each transaction. Both times, my credit card was charged $7.78 for my tip. A quick Reddit search informed me Fiverr has a surcharge on tips! While it might be partly to prevent sellers from gaming the system, it also puts money intended for the artist back in the company’s pockets. How is that OK?

I too, was warned about the “Divorce Zone” part of life. I took two things from that convo:

1. Think of divorce as you would schooling or a long term career, you were really good at marriage for however many years and now you’ve just graduated on to the next part of your life. So be proud of your efforts and appreciate the growth.

2. Statistically, I avoided my first divorce and the sometimes endless, annoyances that come with it. Mentally AND financially, I’m pretty ok with that.

Now about that birthday, you transcended success and were able to express your love and care for me in one day/night, in a way most couldn’t do in a lifetime.

I have NEVER heard of adding a fee to a tip! When will the money bullying stop?!