I’m suddenly questioning my gift-giving abilities, and I can’t help but blame my daughter Parker.

For each of Parker’s past two birthdays, she’s seemed grossly underwhelmed with my choices.

Last year, she delivered a subdued reaction to receiving a 10th Generation iPad. Retail price: $700. This year, she still hasn’t worn the Crocs I got her. It’s been 3 1/2 weeks since her birthday. The only time she wears them is immediately before and after taking a shower. If it weren’t for the puddles she leaves outside the shower, I’d have no way of knowing she has a use for them at all.

But I’m proud of remaining sensible in my spending on her special day. With a little thought and some creativity, I managed to stretch my money pretty far while making sure Parker had a joyous 11th birthday.

And she’s not the only person I happily spent money on last month.

When I review my December spending, I see a healthy amount of kindness that I shared in this season of giving.

Parker’s birthday, less than two weeks before Christmas, is always my priority in December. But the better I am with managing my money, the more excess cash I have to be a blessing to others.

This holiday season, I surprised myself with how well I did.

I make the majority of my purchases with a credit card so I can accrue airline points to fly for free. A few mainstays are excluded, such as rent, gas for my apartment and vehicle, my electricity bill and my $10 monthly gym membership. With the lion’s share of my expenses going on my credit card, it’s the best place to monitor my monthly spending, and each month I share my progress, for better and worse.

Last month, however, most of my spending wasn’t on myself — which makes me smile.

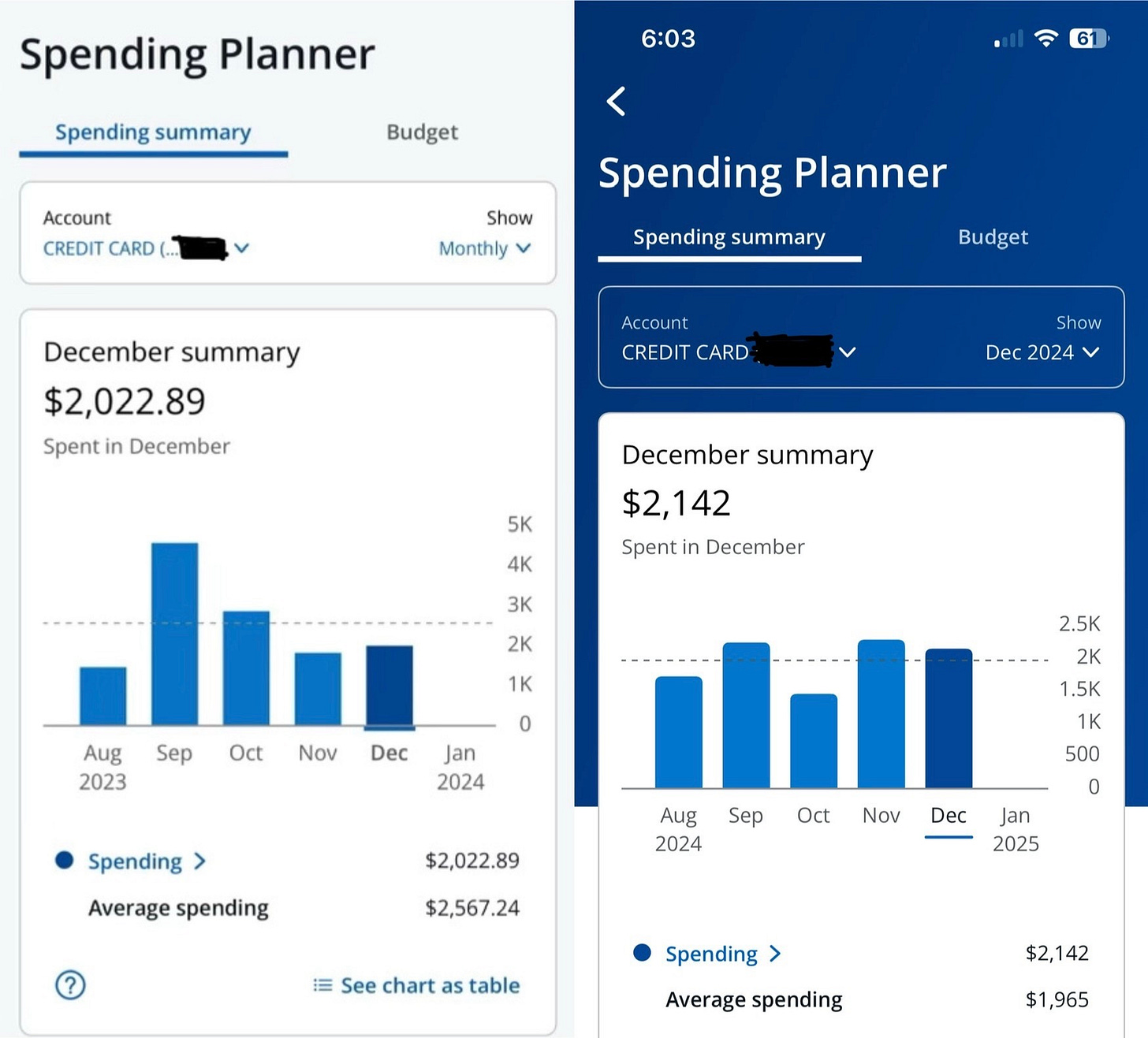

My credit card statement shows only a $119.11 surplus in my spending in December 2024 compared to December 2023. My year-over-year consistency used to amaze me. Now, it’s become my norm. It’s the life-changing habit that will lead us to where I believe we’re going.

I paid $640 in legal fees and professional services, as well as $316 on groceries. Those charges made up 45% of my December spending. I don’t mind my grocery bill increasing. There are four of us in the home now, and my grocery bill is a sign that we’re eating at home rather than dining out.

In fact, I spent only $139.37 in the food and drink category. Of that, $121.82 was spent on alcohol. That’s not terrible, but I never feel great looking back on the money I spent on booze. Between the financial cost and harming my health — which can get really expensive in time — I’ve learned to live without alcohol. I rarely even drink beer anymore.

I’m less proud of paying $44.49 for smoking papers in December. The routine cost has me considering reverting to a pipe. I also gave in to an impulse purchase — $53.41 on YouTube TV and NFL Sunday Ticket just to watch my Minnesota Vikings win at Seattle. I canceled my free trial for YouTube TV immediately after the game, but I had to eat the Sunday Ticket expense. It was worth it.

The rest of my spending was other-centered.

I paid for Parker’s Crocs using an Amazon credit I earned through my employer. I spent another $67.94 for Parker and her friend Tiffany to jump and play at a trampoline park for two hours on the eve of Parker’s birthday. We bought decorations, inexpensive cupcakes and celebrated at home.

I gifted an ebook to my niece Tatum, who recently enlisted in the U.S. Navy. The book is from one of my favorite podcast hosts, Xavier Miller of The Millionaire Mindsets. He wrote a step-by-step booklet on how to use military benefits to become a millionaire. It was a small price to pay for a resource that has the power to change my niece’s life for the better.

I also supported my friend Michael’s small business by buying merchandise. I told you about Michael last year. He wrote a fantastic article about my mission with Money Talks and our journey to financial independence. It’s only right to support the people who support you.

Lastly, I gifted my lady friend Triest and her daughter Tiffany a few practical items that will assist them on their personal development journeys.

I don’t need much.

For me, December truly was more about giving than receiving.