A colleague and loyal Money Talks reader stopped me during my work trip to Las Vegas last month.

He couldn’t help but to convey his shock the second he saw me.

“I can’t believe you stopped drinking,” the man said.

Who, me?

It took a second for me to process what the man was referring to or if he was talking to the right person. I’ve never claimed to be a teetotaler.

In fact, I had booze waiting back in my hotel room. Whether Las Vegas or any other destination, alcohol consumption is always much cheaper that way. I’ve learned that lesson at least.

I’m beyond bar tabs. I’ve not only outgrown them. They now disgust me. Each time I pay for liquor I’m actively lining the pockets of other families. And I’m subtracting from my own family’s wealth — while also harming my health.

When acquaintances aren’t reminding me of what matters most, my precious daughter Parker does.

Just eyeing beer in the cooler at a corner store on the first day of August prompted Parker to admonish me.

“Daddy, you said you’d stop,” she said.

False.

But that doesn’t mean Parker is wrong. Quitting isn’t a bad idea.

I’m not going to…yet.

But when I looked at my July spending, the amount of alcohol purchases on my credit card statement made me cringe.

Sure, I spent six, sun-drenched days in Las Vegas. But my bill shows an imbalanced basics-to-booze ratio.

I searched high and low for holes in my spending last month. I didn’t find many. Drinking was the biggest.

Last year, I learned that these summer months are a bit of my weakness. All the healthy habits I’ve formed over the past two years can come crashing down if I’m not careful. When the weather turns pleasant, my temptations blossom into full-blown distractions.

And when you’re in a rough patch, alcohol can feel like the perfect elixir.

It’s not.

Thankfully, I track my spending each month. By diligently minding my purchases, I have an accurate pulse on my behaviors. It shows me the good, the bad and everything in between.

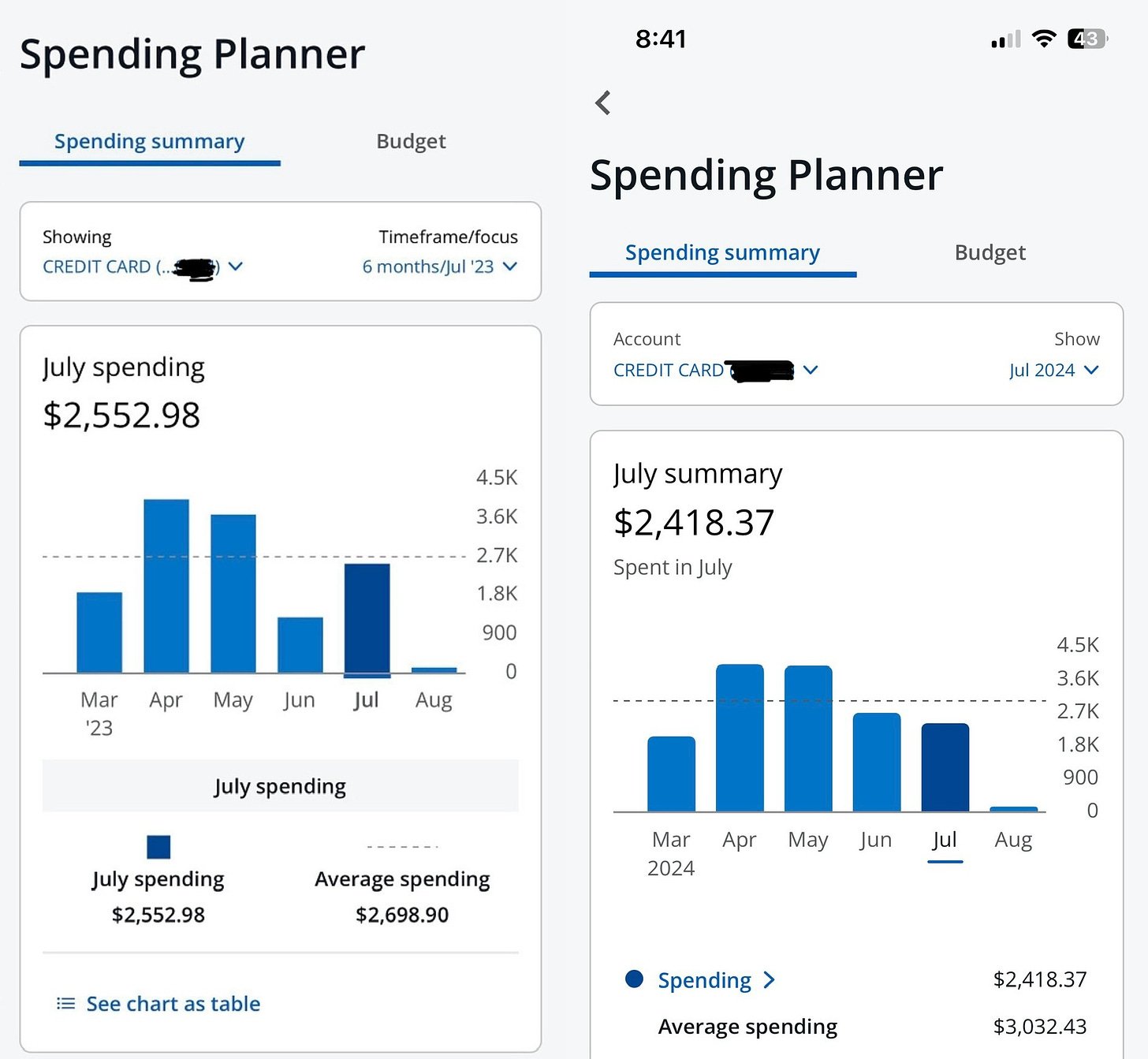

Discipline and determination has enabled me to keep my monthly spending within a healthy range. After almost two years of practice, my spending no longer fluctuates wildly. When I review my financial statements now, I see more stability than ever.

And that’s what makes the blemishes jump out.

On paper, my July credit card statement shows I spent $2,418.37. My July 2023 statement showed an additional $134.61.

But my work trip to Las Vegas charged $964.77 on my personal credit card. I received reimbursement on Aug. 2 and immediately put the money toward my balance. I don’t need anymore drama.

Deduct another $415.16 for a flight that I floated money to my lady friend Triest for an upcoming trip and my balance looks even better.

The tally is $1,038.44.

But that makes the $232.36 I spent on alcohol in July really stand out.

Regardless of the circumstance, booze should never make up almost a quarter of my monthly spending. In my defense, though, one drink in Las Vegas cost $30. And I’m happily paying for two these days.

Still, my behavioral spillage showed in my shopping.

Instead of remaining faithful to Walmart with the location that sat blocks away from me now shuttered, I visited five other grocers to buy booze and food.

A few hundred bucks isn’t the biggest financial burden. But it’s the most I’ve spent on alcohol in any month this year.

It was the only snag in my July spending.

It was enough to make me think about becoming a teetotaler.