I couldn’t afford to pay my rent this month.

My lease was renewed at a $60 rate hike. But inflation was only the beginning of my problems.

I held insufficient funds.

For the second time in four months, my checking account dipped below my danger zone. I narrowly avoided paying credit card interest in April. I started July by snapping my nine-month streak of prompt rent payments on the first of the month.

Negligence was my nemesis in both instances.

And both instances were great reminders that it’s OK to scale back on investments. Maximizing every penny isn’t worth the anxiety that arrives when bills are due and there’s no longer enough money available.

With my checking account showing a balance of $1,096.65 on July 1, there was no way I could send my customary electronic payment to my landlord. My raised rent is now $1,180.

At first, I didn’t understand.

I knew that my aggressive investing this year required me to be diligent with my money in all other areas. But days earlier, I logged in to find a robust account. It was flush with almost $3,000. With other obligations covered, I figured I had room. It was more than I needed, which meant I wasn’t maximizing my money.

That’s where I went wrong.

Rather than riding it out for just another week with what appeared to be a little extra cash, I had the bright idea to make an additional credit card payment.

I put $528.85 on my bill, reducing the balance to an even $1,000. I smiled inside, feeling victorious. The transaction would lessen my burden at the next due date, in theory giving me more breathing room in my next paycheck.

Must have been boy math.

With a five-day window to pay, my rent wasn’t technically late. But in my pursuit of financial independence, I’m growing paralyzed by the impossible goal of perfection.

Paying my rent on the first of each month has become a badge of honor. It’s one small sign that I’m effectively managing my money. It also sends a strong message.

Despite our cultural differences, I’ve felt my landlord’s respect for me as a tenant grow. On the final day of May, he agreed to a truncated four-month lease. Remember, we’re tired of paying rent. When I walked out to my beloved stoop and past my landlord sitting in the back of his Sprinter van, with the sliding backdoor ajar, he almost jumped out and stood at attention after seeing me.

That was July 1, the day before I paid my rent.

My paycheck was scheduled to arrive July 3, and it typically comes the night before. But that was too late. It didn’t calm my worry. My streak was ruined.

That day, I made a pair of transfers into my checking account from two separate accounts. The transactions totaled $2,800. I never want to unnecessarily feel the stress of insufficient funds.

My second oversight in four months revealed a simple but important financial strategy.

That is to leave enough money in my checking account.

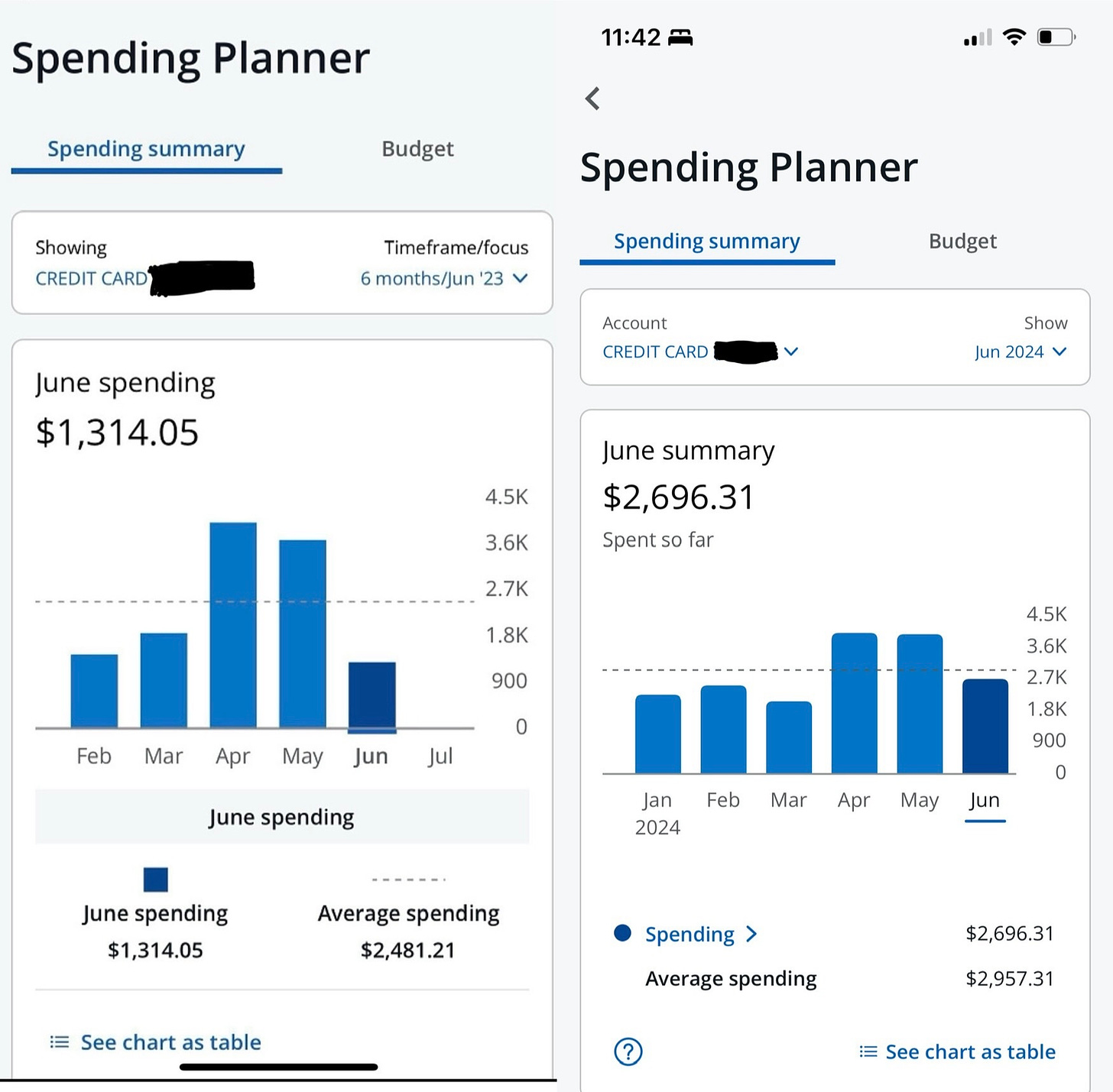

Other takeaways from June start with me being on track for almost $35,000 in credit card spending through the first half of the year. It’s approximately $3,700 more than 2023 and more in line with my 2022 spending.

My credit card balance carries the majority of my purchases so I can accrue airline points to fly for free. A few mainstays are excluded, such as rent, gas for my apartment and vehicle, my electricity bill and my $10 monthly gym membership. With the lion’s share of my expenses going on my credit card, it’s the best place to monitor my monthly spending.

My June statement included a $1,300 car repair bill. Along with it, an unexpected $1,500 attorney bill from a few weeks earlier has accelerated my spending. Subtract those nuisances and I’d currently be at only $918 more than last year’s pace.

What’s worse is that my car repair bill last month was more than my June 2023 credit card balance. But I benefited from a week in Oklahoma for our annual Father’s Day weekend trip. I’m thankful for family and friends who welcomed us and treated us to various meals, gifts and outings. It saved me a lot of money in June.

Still, I spent $178.20 on dining out last month. I also forked over a little more than $150 on alcohol.

Both were signs that I leaned a little too much into my typical June temptations.

Best money move: Books

I purchased two physical books. That tells you all you need to know about how eager I am to educate myself through them. I rarely finish books and almost never pay for them. But on June 21, I bought “10 Commandments of Black Economic Power” by Dr. Boyce Watkins for $30.96 and paid another $37.87 for “PowerNomics: The National Plan to Empower Black America” by Dr. Claud Anderson. I also snagged another Audible trial on June 29. It gave me a three-month subscription for 99 cents. My summer reading is set.

Worst money move: Speeding ticket

I had dinner with my friend Will on May 20. I scratched my rear bumper against a really high curb while parking upon arrival. A street camera busted me speeding on the way home. I paid the price, a $35 ticket, on June 26. It was my sixth speeding violation since 2021. Each was for going between 6-10 miles over the limit. A street camera was the source of each. That’s $210 in 3 1/2 years. It pays to slow down and be a defensive driver.

Ouch! Hate a surprise bill like that. It sounds like you were doing what I had mentioned in a comment earlier this year about keeping at least 1,000 in your checking as a buffer.

As always, the trick with personal finance is that it's personal. The better rule should probably be to keep an amount in checking equal to at least the largest bill you regularly pay. For my family, our mortgage is sub $400 (thank you low cost of living area), which means our 1,000 buffer is more than enough. In your situation, since your rent payment is much larger, it probably makes sense to keep at least 1,500-2000 to give yourself a bit more buffer.

Another thing I do is pay the credit card bills as they come. It's silly, but I don't like to see the bill amount going up and cash sitting in checking. I'd rather just have it paid off once a handful of transactions clear. I still have it set to autopay the previous statement balance so we don't get hit with late fees, but I'd rather smooth out the payments over the course of a month rather than one big bill. Makes things easier to keep track of since I don't strictly budget anymore, I just sweep anything leftover from my paychecks into investments or savings at the end of the month.