I thought I’d conquered my FOMO.

Nope. As it turns out, I just don’t like losing money.

It’s gotten pretty easy for me to not chase every hot stock. I’ve built restraint, proving to myself that I can see or hear of a tasty trade yet resist the temptation to jump on the trend.

But I was put to a different type of test two weeks ago. It forced me to examine who I am with money.

In real time, I had to come to grips with my greed.

The options contract on Expand Energy (formerly Chesapeake Energy) that I told you I entered into last month unexpectedly presented me with a different form of FOMO, or a “fear of missing out.”

My position popped.

As my potential profit piled, I grew paralyzed. I had no idea what to do. At one point, my options position showed a 160% unrealized gain. And my contract didn’t expire until April.

I wanted to hold and keep riding my contract higher for longer. Initially, I would have been content with a 20% gain. But suddenly, I sought a 200% profit. Then, I told myself, I’d sell and not look back.

I was being greedy.

But I couldn’t ignore the words of my lady friend Triest, my brother Clifton and the Wallstreet Trapper. I knew that if I went against three people I trust implicitly then I’d deserve whatever I got. Clifton reminded me that includes the possibility of Expand Energy’s stock price continuing to rise and supplying me with more cash.

I shared Wallstreet Trappers words in a three-minute video clip on Monday. His advice was as indispensable as it was indisputable.

“For me, I would get my 100%,” Trap said. “If I just started. I got that one. That’s what I came for. But it also depends on how much time you’ve got left. But, man, I’d take my one.

“There’s nothing wrong with taking profit. That’s money that you didn’t have to go crazy for. That’s money that the market gave you, man.”

It felt like Trap was talking to me.

“Make it a habit not to be greedy,” Trap continued. “Make it a habit not to be, (like), ‘I just wanna get a little bit more.’ No, no, no. Make it a habit not saying that.

“Our goal is to get that 100%. You got your 100%, man, go about your business. Don’t even think twice about that. Don’t get into that because when you start squeezing you’re going to start making that a habit of squeezing.”

That episode of “Trappin’ Tuesday’s” aired on Oct. 1.

Two days later, I sold my Expand Energy options contract.

I netted a 140% profit, a $663.66 gain. I owned the contract for only one month.

One week later, Expand Energy’s stock price climbed another $3.25 above my exit level. I could have made another couple of hundred bucks. It’s still hard to not look back on what could have been.

But profit is profit. And we should never feel bad for a winning trade. It’s better than looking back on a loser.

This week, I did it again. This time, my position turned against me.

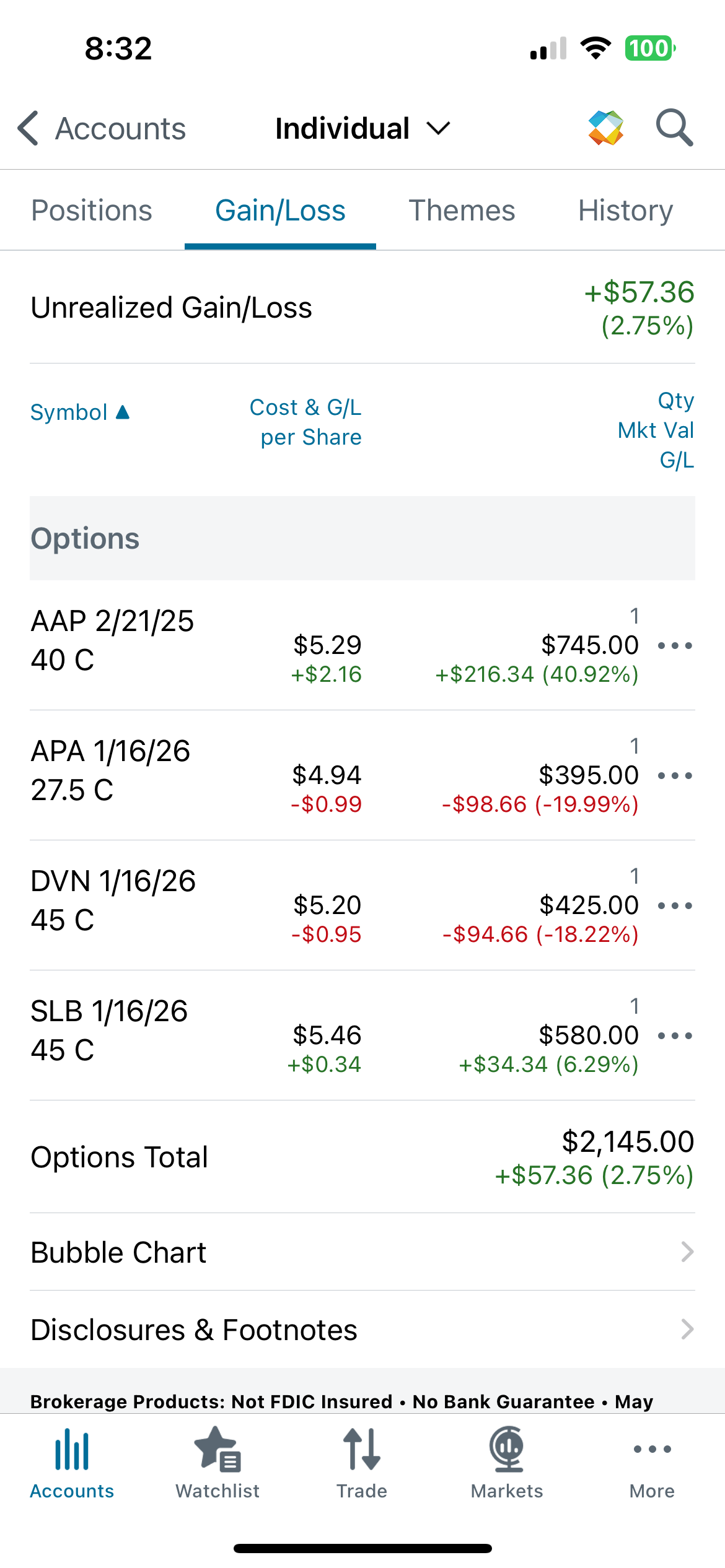

On Tuesday morning, my Advance Auto Parts (AAP) option play showed a nearly 41% unrealized gain, or a $216.34 profit. I should have sold. Instead, I waited to see how much more AAP would run. Less than an hour later, I paid dearly. The stock began plummeting.

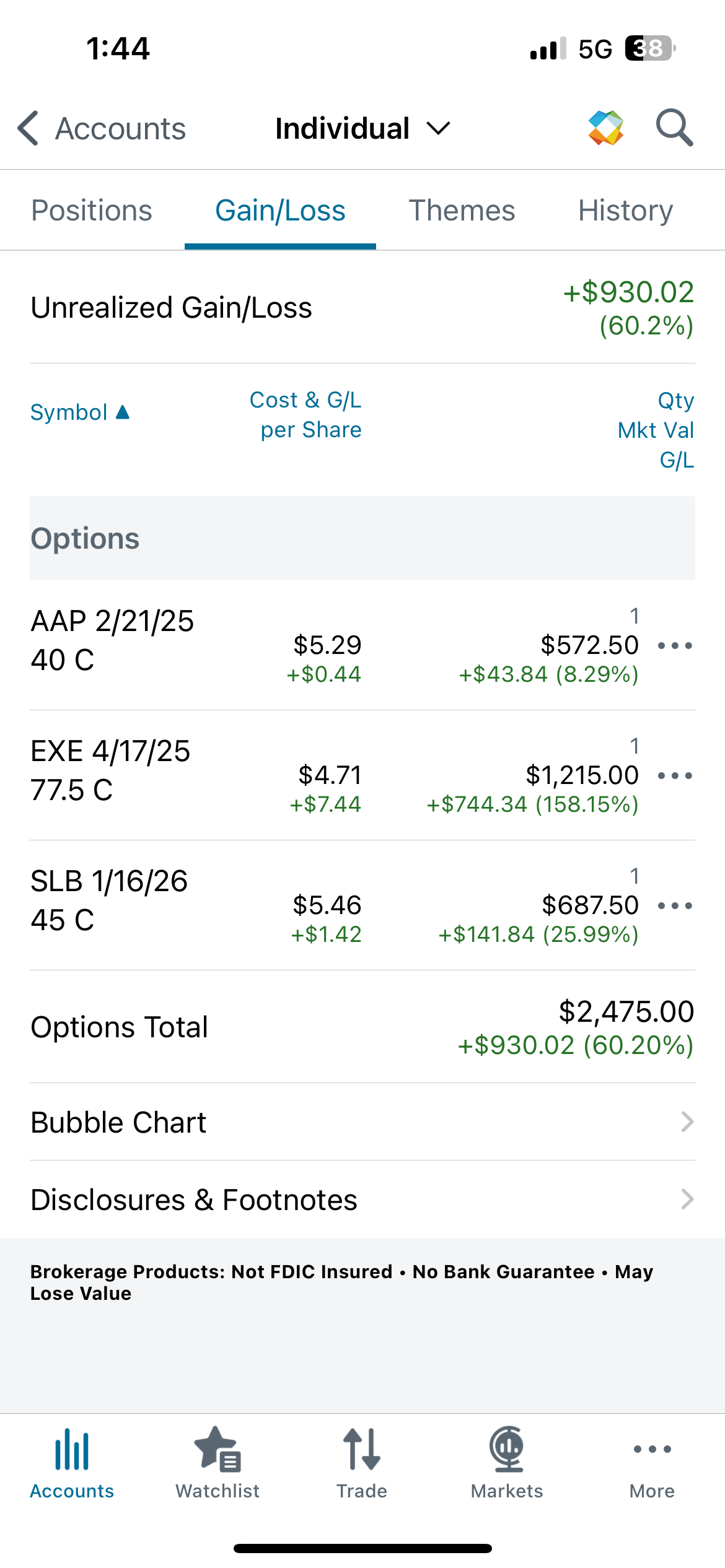

At the market close on Wednesday, my AAP position was down to an 8.29% unrealized gain, or a $43.84 profit. That contract doesn’t expire until February, however. I can only hope the bleeding doesn’t get worse.

I’m also battling similar uncertainty with Coinbase.

I’ve held a small stake in the company for almost two years, but it’s time to sell my remaining seven shares. My unrealized gain: 479%, or $1,212.72.

It makes no sense for me to continue holding. I got what I came for more than four times over.

Now, against my better judgment, I’m just being greedy.